Market Insights: Strong Mays are a Good Sign

Milestone Wealth Management Ltd. - Jun 06, 2025

Macroeconomic and Market Developments:

- North American markets were up this week. In Canada, the S&P/TSX Composite Index rose 0.97%. In the U.S., the Dow Jones Industrial Average increased 1.17% and the S&P 500 Index was up 1.50% to close just over 6,000.

- The Canadian dollar was stagnant again this week, closing at 73.02 cents vs 72.88 cents USD last week.

- Oil prices increased 6% with U.S. West Texas crude closing at US$64.63 vs US$60.92 last week (read more on that below).

- The price of gold was stable this week with a slight increase, closing at US$3,334 vs US$3,317 last week.

- Oil prices rose amid supply concerns, with Iran poised to reject a U.S. nuclear deal, wildfires curbing ~344,000 bpd of Canadian oil sands output, and continued tensions in Russia. Brent climbed to $65.18 USD, while WTI hit $63.11, boosted further by OPEC+ keeping July output hikes steady at 411,000 bpd—less than some feared.

- U.S. nonfarm payrolls rose 139,000 in May, slightly above expectations, but downward revisions to prior months trimmed the net gain to 44,000. Job growth was concentrated in education/health (+87K) and leisure/hospitality (+48K), while manufacturing (-8K) and government (-1K) declined. The unemployment rate held at 4.2%, and wage growth accelerated to +0.4% MoM / +3.9% YoY. Civilian employment fell 696,000 as the labor force shrank. Federal government jobs saw the largest monthly drop in two decades (-16K), reflecting the new administration’s downsizing efforts.

- The U.S. trade deficit narrowed sharply to $61.6B in April, beating expectations ($66B) as exports rose $8.3B and imports plunged $68.4B—led by a $26B drop in pharmaceutical imports. This reversal follows Q1’s tariff-driven import surge and should boost Q2 GDP after net exports shaved ~5 points off Q1 growth. The real goods trade gap shrank $7.2B YoY, and total trade volume is up 5.7%. The U.S. remained a net petroleum exporter for the 38th straight month, while China slipped to third among U.S. import sources behind Mexico and Canada.

- Canada’s unemployment rate rose to 7.0% in May, the highest in 9 years outside the pandemic, as job growth stalled with only 8,800 net new jobs. A gain in full-time (+58K) and private-sector hiring was offset by losses in part-time (-49K) and public sector jobs (-32K), while manufacturing shed another 12.2K positions. Labour market slack is growing, with 1.6M unemployed and job seekers taking longer to find work—averaging 21.8 weeks. Wage growth held steady at 3.4%, but the rising jobless rate could pressure the Bank of Canada to cut rates further.

- PM Mark Carney introduced a bill to fast-track “nation-building” projects like pipelines, ports, and transmission lines, aiming to cut approval times to two years and boost economic resilience amid U.S. tariff pressure. The legislation also targets interprovincial trade barriers and labor mobility, while requiring Indigenous and provincial consultation. The move signals a pro-investment shift as Ottawa seeks to reassert economic autonomy and accelerate strategic infrastructure

Weekly Diversion:

Check out this video: GoPro’s Most Beautiful Underwater Moments

Charts of the Week:

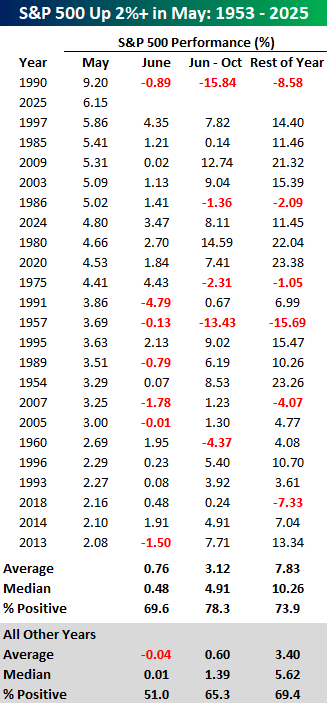

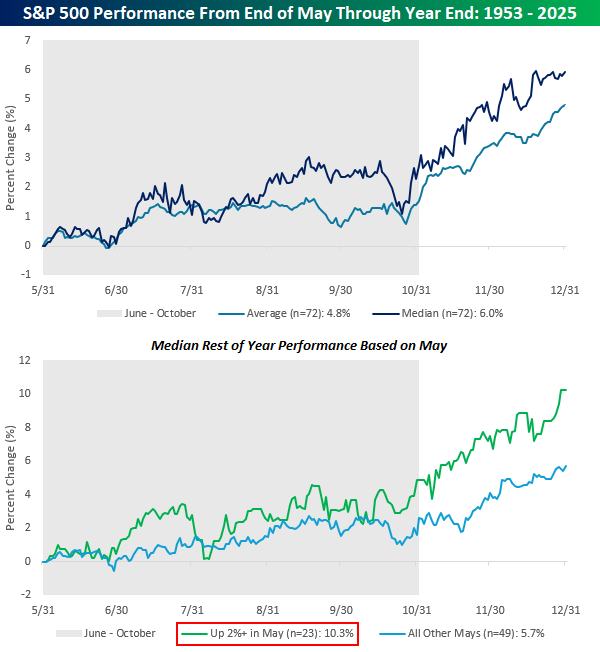

In a bit of a sequel to our recent Weekly Commentary Post on May 9th, contrary to the traditional "Sell in May" adage, which warns of weaker summer and early fall returns, historical data shows that when May has been strong, subsequent months often see well above-average performance. Notably, May 2025 was the S&P 500's second-best May since 1953, surpassed only by 1990. While that year did see a sharp reversal due to economic and geopolitical turmoil, most years with a strong May have not experienced such declines.

As highlighted in the table below, for years when the S&P 500 Index was up more than 2% in May (24th time this year for a good sample size), the median June return was 0.48%, which is substantially higher than the 0.01% median for all other years. This out-performance has tended to extend through the June-to-October period, where the median gain was 4.91%—over three times the 1.39% median gain for all other years. For the remainder of the year after May, the median return was 10.26%, nearly double the 5.62% median for years without a strong May. These figures are visually reinforced in the second chart below, which compares the composites of median performance for "strong May" years versus all others, showing a clear pattern of superior returns following these instances. For reference, the table highlights the performance of the S&P 500 since 1953 showing the average and median returns for both.

Source: Bespoke Investment Group

Source: Bespoke Investment Group

While "Sell in May" is a well-known seasonal strategy, the reality is more nuanced. Strong May performances have historically led to better-than-average returns in the months that follow, as reflected in the median data. The graphs and tables underscore this, and although exceptions like 1957, 1990 and 2018 exist, the median outcomes suggest that investors who remain invested after a strong May are more likely to see positive results through the end of the year.

Sources: Yahoo Finance, Bloomberg, First Trust, The Globe & Mail, Bespoke Investment Group, CBC

©2025 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.