Market Insights: The First 100

Milestone Wealth Management Ltd. - May 30, 2025

Markets rose this week as Canadian GDP beat expectations and U.S. spending stayed strong. Oil and gold dipped, and Canadian banks posted mixed earnings.

Macroeconomic and Market Developments:

- North American markets were up this week. In Canada, the S&P/TSX Composite Index rose 1.14%. In the U.S., the Dow Jones Industrial Average was up 0.98% and the S&P 500 Index added 1.19%.

- The Canadian dollar was almost flat this week, closing at 72.88 cents vs 72.84 cents USD last week.

- Oil prices dropped slightly with U.S. West Texas crude closing at US$60.92 vs US$61.64 last week.

- The price of gold declined over 1%, closing at US$3,317 vs US$3,359 last week.

- U.S. personal income jumped 0.8% in April, beating expectations, with gains driven largely by government transfers including Social Security-related payments. Private-sector wages rose 0.5%, up 4.5% year-over-year. Personal consumption expenditures increased 0.2% in April, while the Core PCE Price Index, the Fed’s preferred inflation measure, eased to 2.5% YoY — the lowest since early 2021. Real (inflation-adjusted) consumer spending rose 0.1% in April, up 3.2% YoY, pointing to resilient consumer demand despite ongoing policy uncertainty.

- Cheniere Energy signed a 15-year deal to purchase natural gas from Canadian Natural Resources, marking a major cross-border supply agreement. The deal supports Cheniere’s plans to double LNG output to 90 MTPA, contingent on a final investment decision for its Sabine Pass expansion. This comes as U.S. LNG export momentum builds under Trump, who lifted a permitting moratorium earlier this year.

- Strathcona Resources has launched a formal takeover bid for MEG Energy, offering 0.62 Strathcona shares plus $4.10 in cash per MEG share. The bid, backed by an additional $662M equity commitment from Waterous Energy Fund, runs until Sept. 15. MEG’s board is reviewing the offer and advises shareholders to await its recommendation.

- Canada’s Q1 GDP grew an annualized rate of 2.2%, beating the expected rate of 1.7%, but underlying data showed weak domestic demand and tariff-driven export front-running. Economists warn the economy looks “frail,” with some forecasting a trade war-induced recession. Markets now see a split on whether the BoC will cut rates or hold next week.

- Canadian Banks released their earnings this week:

o TD Bank beat earnings expectations as lower-than-forecast credit provisions and the Schwab stake sale drove profit to $11.1B, while job cuts and AML remediation highlight ongoing restructuring.

o Scotiabank missed estimates with earnings down 3% as it ramped up credit loss provisions amid rising domestic risks, though strong performance in international and wealth units helped offset Canadian softness.

o BMO topped forecasts with a 9% revenue increase and solid capital markets performance, despite higher credit provisions tied to unsecured lending and commercial banking risks.

o National Bank delivered a strong beat driven by capital markets, even as loan loss reserves jumped due to the Canadian Western Bank acquisition and broader macro risk.

o CIBC posted a 15% profit surge and exceeded expectations thanks to strong revenue growth and better-than-expected credit performance, with incoming CEO Harry Culham set to take the reins in October.

o RBC reported 11% profit growth but missed forecasts as elevated loan loss provisions and integration costs from the HSBC deal weighed on results, despite solid capital strength and a dividend hike

Weekly Diversion:

Check out this video: This is why I have trust issues

Charts of the Week:

The first 100 trading days of 2025 have been marked by extraordinary volatility, dramatic policy shifts, and a pronounced divergence between U.S. and international asset performance. This period stands as one of the most eventful in recent financial history, shaped by the inauguration of a new U.S. President, the imposition of sweeping tariffs, and a near miss with a bear market.

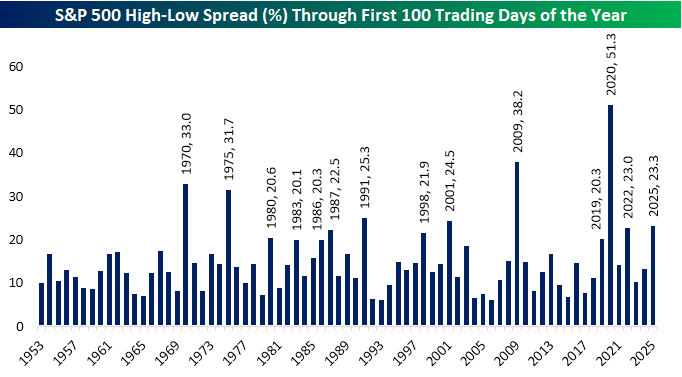

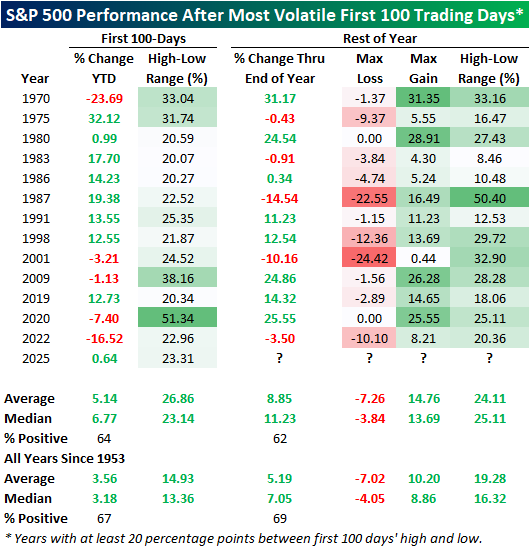

U.S. equities saw significant volatility in the first 100 trading days, with the S&P 500’s high-low range reaching 23.3% — the largest since 2020 and seventh largest since 1953 — yet the index finished the period nearly flat, up less than 1%. As the first chart highlights, high-low spreads of over 20% have only occurred thirteen times since 1953. Historically, when this pattern appears, the remainder of the year tends to deliver stronger than usual average and median gains at 8.85% and 11.23% vs. all years at 5.19% and 7.05% respectively. However, positive returns are slightly less frequent, and trading ranges remain wider with maximum gains notably higher than average, as shown in the second chart.

Source: Bespoke Investment Group

Source: Bespoke Investment Group

In key domestic economic news this week, Canada’s Gross Domestic Product (GDP) grew at an annualized rate of 2.2% in the first quarter of 2025, surpassing economists’ expectations of just 1.6%. This stronger-than-anticipated growth was mainly driven by increased exports, as businesses accelerated inventory purchases ahead of anticipated U.S. tariffs, along with notable gains in business investment in machinery and equipment and a rise in mining, quarrying, and oil and gas extraction. The latest figures indicate that, while growth momentum has moderated compared to earlier quarters, Canada’s economy continues to show underlying resilience in the face of global and domestic uncertainties. The better-than-expected GDP numbers also likely pushes rate cut expectations by the Bank of Canada out to at least July of this year.

Source: Statistics Canada, Yahoo Finance

Sources: Yahoo Finance, The Canadian Press, First Trust, Reuters, Financial Post, The Globe & Mail Bespoke Investment Group, Statistics Canada

©2025 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.