Market Insights: Weaker Canadian Dollar Leaves 'Thumbprints All Over' Inflation Report

Milestone Wealth Management Ltd. - Feb 21, 2025

Macroeconomic and Market Developments:

- North American markets were positive this week. In Canada, the S&P/TSX Composite Index dropped by 2.15%. In the U.S., the Dow Jones Industrial Average was down 2.87% and the S&P 500 Index fell 1.67%.

- The Canadian dollar stayed relatively stable this week, closing at 70.3 cents vs 70.6 cents last week.

- Oil prices fell marginally this week. U.S. West Texas crude closed at US$70.22 vs US$70.72 last week.

- The price of gold was up again this week, closing at US$2,947 vs US$2,896 last week.

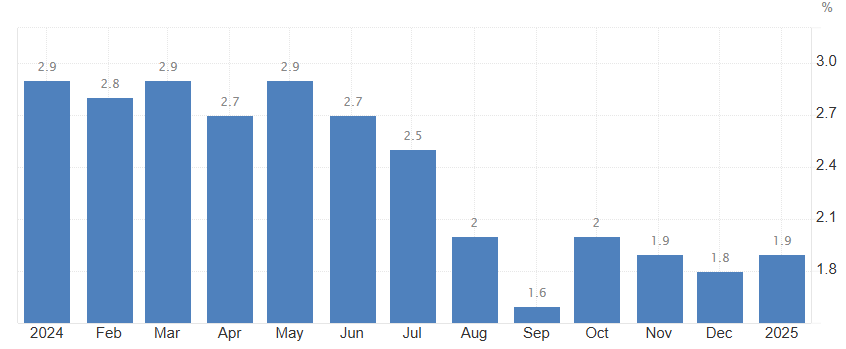

- Canada’s annual inflation rate ticked back up to 1.9% in January. Prices reflected the full month-long effect of the federal government’s tax break; however, an increase in gas prices helped to offset the government’s relief.

- Canada's annual housing starts rose 3% in January, driven by an 8% increase in multi-unit urban starts, particularly in Quebec and B.C. While Montreal and Vancouver saw significant year-over-year growth, Toronto's starts dropped 41% due to lower multi-unit construction.

- GameStop (GME) is looking to sell its Canadian and French operations as it evaluates its international assets. As of early 2024, GameStop had 203 locations in Canada.

- Battery-electric and fuel-cell-electric truck and van maker Nikola Corp (NKLA) voluntarily filed for Chapter 11 bankruptcy this week. The company said it has also filed to pursue an auction and sale process, and to ensure its “limited operations” can continue during the sale process.

- Canadian Tire (CTC.a) announced that it has signed a definitive agreement to sell its Helly Hansen business to Kontoor Brands, Inc. for total gross proceeds of $1.276 billion. Canadian Tire intends to adopt a balanced approach to the allocation of the transaction proceeds, consistent with its past practice.

- Calgary-based Cenovus Energy (CVE) reported lower than expected quarterly adjusted funds flow per share of $0.87/share vs $0.90/share expected but had above forecast production of 816.0 Mboe/d vs 810.1 Mboe/d expected. The company also reported it returned C$706M to shareholders in the quarter through share purchases, common and preferred share dividends and the redemption of Cenovus Series 3 preferred shares.

Weekly Diversion:

Check out this video: The shot heard across Canada

Charts of the Week:

On Tuesday, it was announced that inflation in Canada grew at a rate of 1.9% year-over-year in January, up from 1.8% in December, as shown in the chart below. While much of this increase was attributed to rising energy prices, it is also important to point out that items sensitive to currency fluctuations also saw price increases. Following the release of this latest CPI data, chief economist of Rosenberg Research & Associates, David Rosenberg, noted that “the weak Canadian dollar had its thumbprints all over this report.” For instance, new vehicle prices rose 2.3% year-over-year, and clothing and furniture prices increased on a seasonally adjusted basis. He further noted that, “what makes (these items) different is they have quite a bit of sensitivity to shifts in the Canadian dollar, more than is the case with health and personal care, recreation and education, and home entertainment. Those are, principally, the areas that caught my eye, telling me that the impact of the softer loonie is beginning to percolate through.”

Source: Statistics Canada

The Canadian dollar has been on a downward trend against the U.S. dollar since late September, coinciding with Donald Trump's rising momentum in the U.S. presidential race against Kamala Harris. The loonie, which was trading at 74.5 cents U.S. at that time, has fallen to 70.3 cents USD today.

Source: XE

Trump's presidency has negatively affected the Canadian dollar due to his push towards tariffs, which could potentially harm the Canadian economy. In addition, Canada’s economic growth rate as measured by GDP and inflation rate as measured by CPI, has been much lower than down south which is simply reflective of a weaker economy in general. This situation might force the Bank of Canada to lower interest rates to defend growth. Additionally, global uncertainty driven by Trump's policies could lead investors to seek safety in the U.S. dollar, further weakening the loonie.

Despite these challenges, economists feel the weaker Canadian dollar and lower interest rates could serve as a safeguard against disinflation. It is widely expected that the Bank of Canada will continue cutting rates, possibly even below its current target range, to prevent disinflation from turning into deflation which is generally viewed as the worst-case economic scenario for risk assets.

In conclusion, while a weaker Canadian dollar presents challenges, it may also play a crucial role in maintaining economic stability and preventing deflationary pressures in the Canadian economy.

Sources: CNBC, yahoo finance, CNN Business, Canaccord Genuity Wealth Management, Richardson Wealth, Statistics Canada, XE, Yahoo Finance

©2025 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.