Market Insights: Energy Independence? Why the U.S. Still Relies on Canada

Milestone Wealth Management Ltd. - Feb 14, 2025

Macroeconomic and Market Developments:

- North American markets were positive this week. In Canada, the S&P/TSX Composite Index rose slightly by 0.03%. In the U.S., the Dow Jones Industrial Average was up 0.55% and the S&P 500 Index jumped 1.58%.

- The Canadian dollar continued its rebound this week, closing at 70.6 cents vs 69.9 cents last week.

- Oil prices fell marginally this week. U.S. West Texas crude closed at US$70.72 vs US$70.98 last week.

- The price of gold was up again this week, closing at US$2,896 vs US$2,886 last week.

- TD Bank Group plans to sell its entire 10.1% stake in Charles Schwab through a registered offering and share repurchase agreement, generating approximately C$20 billion in net proceeds and releasing 247 bps of CET1 capital. Despite the divestment, TD will maintain its business relationship with Schwab through its Insured Deposit Account (IDA) Agreement. The transaction is expected to be EPS accretive and will be managed by TD Securities and Goldman Sachs.

- Nissan and Honda end merger talks, and shift to a strategic partnership: Nissan and Honda have called off their merger discussions, opting instead for a strategic collaboration focused on electric and intelligent vehicle development. The talks collapsed after Honda proposed making Nissan a subsidiary, a structure Nissan rejected. The failed merger leaves Nissan in a precarious position as it faces financial struggles, mounting debt, and increased EV competition, prompting speculation about its next potential partner.

- The European Union is prioritizing negotiations over retaliation in response to the U.S. tariffs on steel and aluminum set for March 12. While EU leaders condemned the move, they are talking with U.S. officials to seek a resolution. If discussions fail, retaliatory tariffs on U.S. goods like bourbon and motorcycles remain on the table. Meanwhile, Trump escalated tensions by announcing plans for reciprocal tariffs against countries with higher duties on U.S. goods, shaking currency markets as investors sought safe-haven assets.

- Canada’s population growth may overshoot government targets. Despite a slowdown in non-permanent resident (NPR) arrivals in late 2024, Desjardins warns that population growth is still tracking well above government projections. The proportion of NPRs is estimated at 7.5% of the population, far exceeding the 5% target for 2026. While Ottawa has reduced immigration targets, analysts remain skeptical it will meet them, citing labour market pressures, policy execution challenges, and economic uncertainties tied to trade tensions as complicating factors.

- Inflation heats up in January, delaying rate cut hopes in the US. The Consumer Price Index (CPI) rose 0.5%, exceeding expectations, with headline inflation at 3.0% year-over-year and core inflation at 3.3%. Rising energy (+1.1%) and food (+0.4%) costs contributed, while "supercore" inflation, which excludes food, energy, goods, and housing rents, surged 0.8%—its largest monthly jump in a year. With inflation still above the Fed's 2.0% target, expectations for near-term rate cuts have diminished, keeping markets focused on future data.

Weekly Diversion:

Some of you may recall that Shawn’s puppy went viral over a year ago. Here she is now enjoying the snow

Charts of the Week:

The United States has made significant strides in achieving energy independence; however, this does not mean the U.S. is free from reliance on imports—especially when it comes to its northern neighbor, Canada.

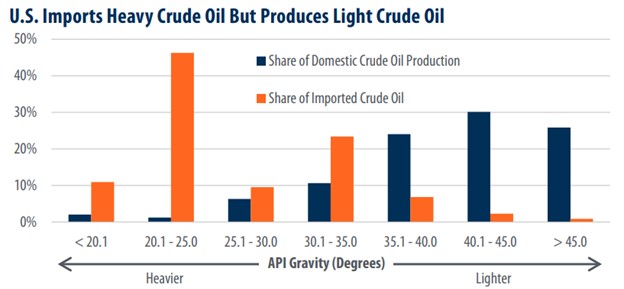

One of the key reasons for this reliance lies in the type of crude oil each country produces. U.S. refineries are designed to process heavy crude oil, a resource Canada supplies in abundance, primarily from Alberta's oil sands. In contrast, the U.S. shale boom has produced light sweet crude oil, which many domestic refineries are not equipped to handle without costly upgrades. In 2023 alone, Canada supplied 24% of U.S. refinery throughput. The chart below, shows the share of imported crude oil vs domestic crude oil production by weight.

Source: Energy Information Administration, First Trust Advisors, API (American Petroleum Institute)

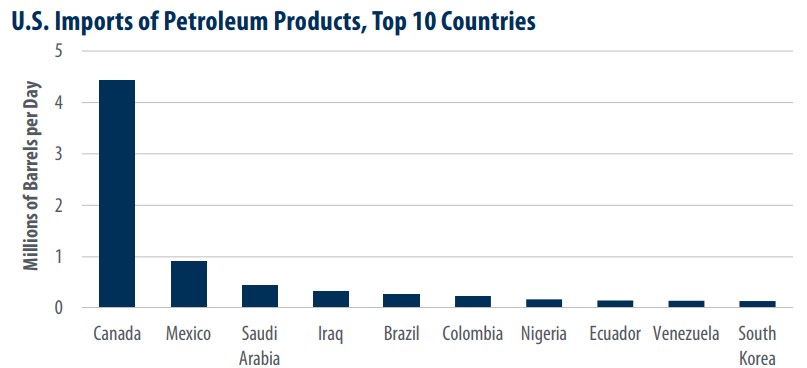

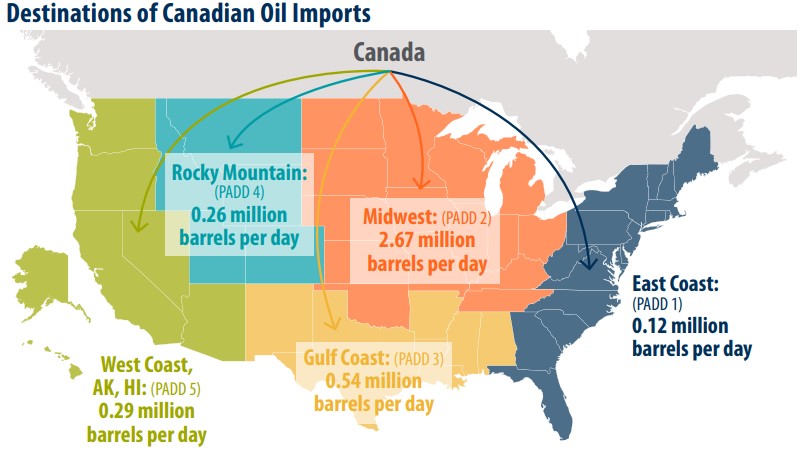

In 2023, the U.S. imported 8.51 million barrels per day (mb/d) of petroleum from 86 countries, with Canada accounting for a staggering 52% (4.42 mb/d), as shown in the first chart below. To put this into perspective, Mexico—the second-largest supplier—provided just 11% (0.91 mb/d). This reliance is further reinforced by geographic proximity and an extensive network of pipelines and rail systems that efficiently transport Canadian crude to U.S. refineries, particularly in inland regions like the Midwest and Rocky Mountains, as shown in the second chart below.

Source: Energy Information Administration, First Trust Advisors

Source: Energy Information Administration, First Trust Advisors, PADD (The Petroleum Administration for Defense Districts)

This energy relationship is mutually beneficial. While the U.S. depends on Canadian heavy crude to meet its refining needs, Canada relies heavily on the U.S. as its primary export market. In 2023, 97% of Canadian crude oil exports went to the U.S., largely due to limited access to coastal ports and challenges in building new pipelines within Canada. The interdependence between these two nations underscores the complexity of achieving true energy independence. Cutting off Canadian imports would not only disrupt U.S. refinery operations but also pose economic challenges for Canada’s oil industry.

Sources: CNBC, yahoo finance, CNN Business, Canaccord Genuity Wealth Management, Richardson Wealth, Energy Information Administration, First Trust Advisors, API, PADD

©2025 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.