Market Insights: IBM Gives the Market a Blast from the Past This Week

Milestone Wealth Management Ltd. - Jan 31, 2025

Macroeconomic and Market Developments:

- North American markets were slow this week. In Canada, the S&P/TSX Composite Index rose 0.25%. In the U.S., the Dow Jones Industrial Average grew 0.27% and the S&P 500 Index dropped 1%.

- The Canadian dollar remained dropped marginally this week, closing at 68.8 cents vs 69.7 cents last week.

- Oil prices fell again this week. U.S. West Texas crude closed at US$73.53 vs US$74.56 last week.

- The price of gold continued its steady incline this week, closing at US$2,833.7 vs US$2,779 last week.

- The Canadian government has postponed the increase in the capital gains inclusion rate from June 25, 2024, to January 1, 2026. The change will raise the taxable portion of capital gains above $250,000 for individuals and all capital gains for corporations and trusts from 50% to 66.7%. Key exemptions, including the Principal Residence Exemption, a new $250,000 annual threshold, and an increased $1.25 million Lifetime Capital Gains Exemption, remain in place.

- Labour market conditions remain soft, with unemployment at 6.7% in December.

- Apple's Q1 revenue rose 4%, with strong services revenue ($26.34B) offsetting a slight decline in iPhone sales. Greater China sales fell 11.1%, but investors reacted positively to Apple's forecast for growth in the March quarter, pushing shares up 3%.

- A new Chinese artificial intelligence company, DeepSeek AI, has sent shockwaves through the tech industry and stock markets. The company unveiled a breakthrough AI model that delivers high performance while using significantly fewer resources than industry leaders like OpenAI and Meta, Nvidia’s stock fell, as investors fear reduced demand for its high-end AI chips, while QQQ dropped 4% amid concerns over shifting competition in the AI sector.

- The U.S. economy expanded at a 2.3% annual rate in the fourth quarter of 2024, slightly below the 2.6% consensus forecast. Consumer spending was the primary driver, increasing at a 4.2% rate, while business investment declined by 2.2%. The GDP price index, a key inflation measure, rose 2.2% in the quarter, exceeding the Federal Reserve's 2.0% target.

- The PCE deflator, the Fed’s preferred inflation measure, rose 0.3% in December and 2.6% year-over-year, while core PCE (excluding food and energy) increased 0.2% for the month and 2.8% annually. Real consumer spending grew 0.4%, driven by strong holiday spending and income gains. However, inflation remains stubborn, with the Fed signaling a cautious approach to future rate cuts in 2025.

Weekly Diversion:

Check out this video: Save of the Year?

Charts of the Week:

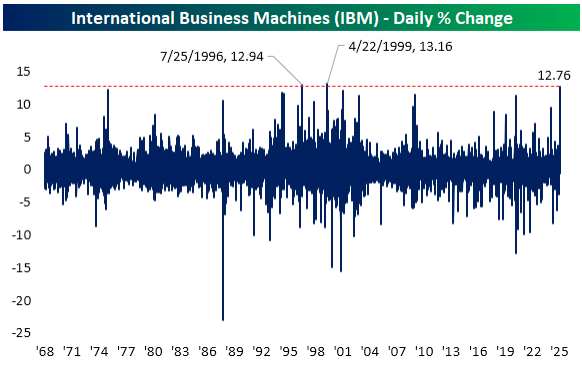

IBM's stock surged nearly 13% yesterday after a strong earnings report, hitting an all-time high and experiencing its third best single-day performances in its history going back 60 almost years! This resurgence is notable because IBM, while a former tech titan, is now only the 40th largest company in the S&P 500, down from 7th largest 25 years ago. However, IBM's comeback mirrors a broader trend so far this year: former market leaders like GE and Walmart have outperformed the current ‘Magnificent Seven or Mag 7’ (today's seven largest companies) in year-to-date 2025 performance.

Source: Bespoke Investment Group

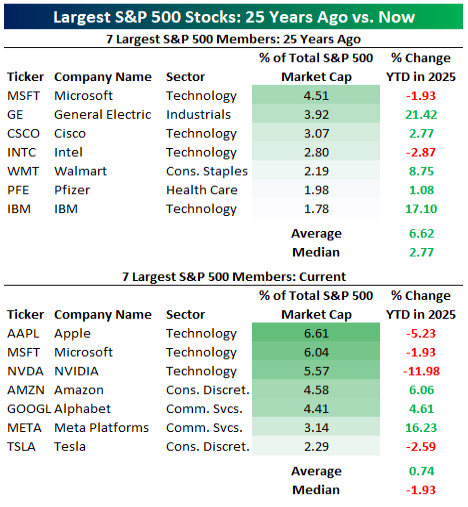

As the next two tables show, while these current seven giants hold a larger share (32%) of the S&P 500's market capitalization than their predecessors did (20%), their performance has been weaker this year, with some, including NVIDIA, experiencing losses. Essentially, older, once-dominant companies are currently showing stronger growth than today's market behemoths.

Source: Bespoke Investment Group

We will see if this is an early indication of what could be a larger rotation out of the Mag 7 and into the rest of the market. As of last week, overall market breadth for the S&P 500 Index had been solid (hitting a new all-time high). Positive breadth can be defined as having more daily advancing stocks than declining ones. In fact, last Wednesday ended a 6-day streak of positive breadth for the index, which is only the seventh time going all the way back to 1990 when there was a streak that long (and only one has lasted seven days way back in 1991). If we continue to see some strength underlying the market, then it could hold up well even if we see some continued weakness from the Mag 7.

Sources: CNBC, yahoo finance, Bloomberg, Thomson Reuters, Canaccord Genuity, Bespoke Investment Group, The Globe and Mail, Government of Canada, First Trust, Hedgeye

©2025 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.