Market Insights: The Presidential Stock Market Scorecard: A Tale of Three Administrations

Milestone Wealth Management Ltd. - Jan 24, 2025

Macroeconomic and Market Developments:

- North American markets were up for the second straight week. In Canada, the S&P/TSX Composite Index rose 1.55%. In the U.S., the Dow Jones Industrial Average jumped 2.76% and the S&P 500 Index increased 2.60%.

- The Canadian dollar remained strong this week, despite tariff speculation, closing at 69.7 cents vs 69.1 cents last week.

- Oil prices slipped this week. U.S. West Texas crude closed at US$74.56 vs US$77.42 last week.

- The price of gold continued its steady incline this week, closing at US$2,779 vs US$2,740 last week.

- Tesla announced this week that it is increasing prices for the Model 3 (up to $9,000) and Model Y (up to $4,000) in Canada, effective February 1, 2025. The hike is linked to supply chain concerns and potential U.S. tariffs.

- A turbulent time for airlines, American Airline's first-quarter earnings outlook on Thursday fell short of analysts’ estimates, sending its shares down nearly 9%. Southwest Airlines has paused corporate hiring and promotions to cut costs and improve margins. Airplane manufacturer Boeing predicts a 4-billion-dollar loss in Q4 of 2024 on account of a strike and labor agreements. Positively, United Airlines forecasts earnings to beat analyst estimates in 2025 and Delta Airlines predicts 2025 to be their "best financial year" to this point.

- In his inaugural address on January 20, President Donald Trump outlined plans for sweeping reforms, promising a "revolution of common sense." He criticized the Biden administration’s handling of inflation, energy, and foreign policy, declaring a “national energy emergency” and pledging to boost domestic oil production with his “Drill Baby Drill” initiative. Trump also emphasized a return to "America First" policies.

- Trump has directed federal agencies to review tariff policies and trade relationships with China, Canada, and Mexico, potentially paving the way for new trade duties in the coming weeks or months.

- Amazon’s decision to lay off 1,700 workers in Quebec has prompted the Canadian government to review its agreements with the company. The layoffs, tied to operational restructuring, have raised concerns about the tech giant’s long-term commitments in Canada.

Weekly Diversion:

Check out this video: What I expect an $8 coffee to look like

Charts of the Week:

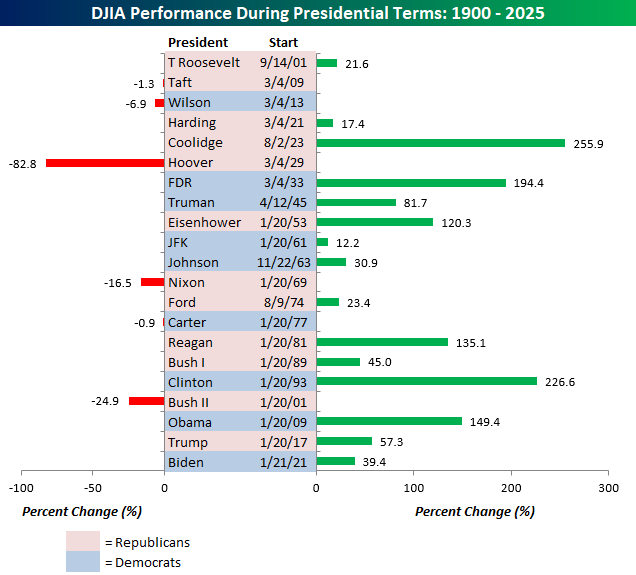

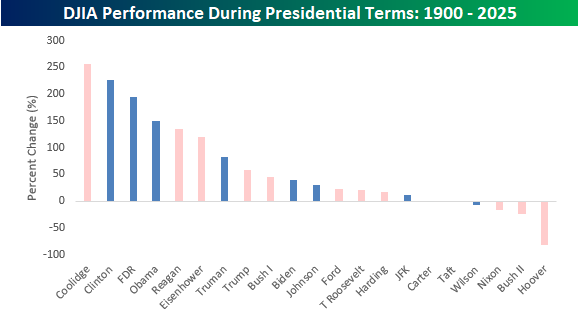

As the Trump administration 2.0 begins its second term on January 20th, 2025, it's an opportune moment to reflect on the stock market performance under recent presidencies. Biden's presidency saw the Dow Jones Industrial Average (DJIA) rally by 39.4%, a respectable figure that nonetheless falls short of the gains seen under Trump's first term and Obama's eight-year administration. This performance, while the weakest among the three most recent presidents, still ranks within the top ten presidential terms since 1900 as shown in the chart below, highlighting the overall strength of the market the last sixteen years.

What makes this period particularly noteworthy is that it marks the third consecutive presidential term with strong gains, defined as an increase of more than 30% in the DJIA. Such a streak has only occurred twice before in the past century: once from 1933 to 1961 (spanning FDR, Truman, and Eisenhower) and again from 1981 to 2001 (under Reagan, Bush I, and Clinton). The current streak is unique in that it includes two one-term presidents (shorter period overall), adding an interesting wrinkle to this historical pattern.

Source: Bespoke Investment Group

This investment performance data highlights the risk of letting political beliefs influence investment decisions. In past instances (Obama's presidency, Trump's presidency, Biden's presidency), there were times when investors panicked and withdrew from the market due to political anxieties. Look no further than in late 2008/early 2009 when many exited due to Obama’s views towards business and the economy, yet the Dow rallied 150% during his tenure; or even late 2016/yearly 2017, when other investors fled due to some chaos caused by Trump, but then again, the markets rallied. These decisions proved costly as the market continued to grow despite political uncertainty. Currently, some investors may be making similar mistakes based on the current political climate. As we have noted for many years, we remain in a long-term secular bull market and this trend is still in place today.

Source: Bespoke Investment Group

As we enter a new presidential term, the lessons drawn from this scorecard remain invaluable: the stock market's performance is influenced by a myriad of factors beyond presidential politics, and successful long-term investing requires looking beyond the partisan fray.

_____________________

Sources: CNBC, yahoo finance, Financial Post, Bloomberg, Thomson Reuters, Canaccord Genuity, Bespoke Investment Group, The Globe and Mail, Bespoke Investment Group

©2025 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed