Market Insights: The Bull Market Roars On - 2025 U.S. Economic Outlook

Milestone Wealth Management Ltd. - Jan 17, 2025

Macroeconomic and Market Developments:

- North American markets were positive this week. In Canada, the S&P/TSX Composite Index rose 1.21%. In the U.S., the Dow Jones Industrial Average was up 3.69% and the S&P 500 Index popped 2.91%.

- The Canadian dollar fell slightly this week, closing at 69.1 cents vs 69.3 cents last week.

- Oil prices rallied this week. U.S. West Texas crude closed at US$77.42 vs US$75.70 last week.

- The price of gold increased this week, closing at US$ 2,740 vs US$2,717 last week.

- The market reacted positively to U.S. inflation data released this week. The Consumer Price Index (CPI) increased by 0.4% in December, with the annual inflation rate at 2.9%. The Core CPI, which excludes food and energy, rose 3.2% over the past year, slightly better than the 3.3% forecast.

- Similarly, the U.S. Producer Price Index (PPI), which measures wholesale prices, increased by 0.2% in December. Over the past year, producer prices have risen by 3.3%. Energy prices saw a 3.5% increase in December, while food prices declined by 0.1%.

- Johnson & Johnson (JNJ) has announced a $14.6 billion acquisition of Intra-Cellular Therapies, marking the largest biotech transaction in over a year. Intra-Cellular Therapies focuses on treatments for central nervous system disorders, including mental health and neurological conditions. Intra-Cellular Therapies are currently advancing a late-stage drug for major depressive disorder.

- U.S. Retail Sales increased by 0.4% in December and are up 3.9% for the year. Auto sales were up 8.4% in 2024, the most significant jump since 2021. Core retail sales rose 0.5% for the month and 5.6% on an annualized rate for Q4.

- Big banks in the U.S. released earnings this week, with JPMorgan Chase (JPM) beating earnings expectations with its trading division posting record fourth-quarter performance. Fueled by volatility from the U.S. elections, trading revenue rose 21% year-over-year to $7.05 billion. Bank of America (BAC) also beat analysts’ estimates, as investment-banking fees hit the highest in three years and net interest income outperformed forecasts. And Morgan Stanley (MS) also impressed investors with equity trading revenue jumping 51% in the quarter and reaching an all-time high for the full year, thanks in part to the increase in trading in the wake of the U.S. election.

Weekly Diversion:

Check out this video: Dog Parenting: from Wolves to Doodles

Charts of the Week:

As we step into 2025, the Canadian Economy continues to see a lot of unknowns with the threat of tariffs from the U.S. as well as a developing leadership race. Looking to the U.S., however, the economic landscape continues to defy expectations, with the bull market showing no signs of slowing down.

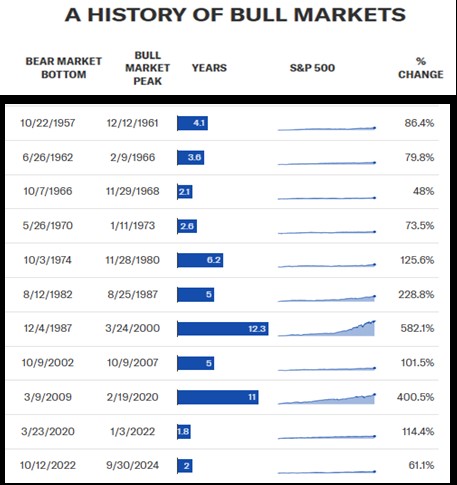

Historical analysis of bull markets reveals encouraging trends for the current economic climate. Examining the previous 11 bull markets, researchers discovered that the average duration exceeded five years as per the chart below.

Source: Carson Investment Research, Y Charts, as of 09/30/2024 (Current Bull Market is at 2 years 3 months)

A Strong Foundation

The past two years have been nothing short of remarkable for the U.S. stock market. This strength spilled over into Canada as well last year, with its first 20%+ total return year since 2021. The S&P 500 achieved back-to-back gains of over 20%, a feat not seen since the late 1990s. This impressive run has been fueled by several factors:

- The Federal Reserve's pivot to cutting interest rates

- Strong corporate earnings

- Expanding profit margins

- A broadening bull market across various sectors

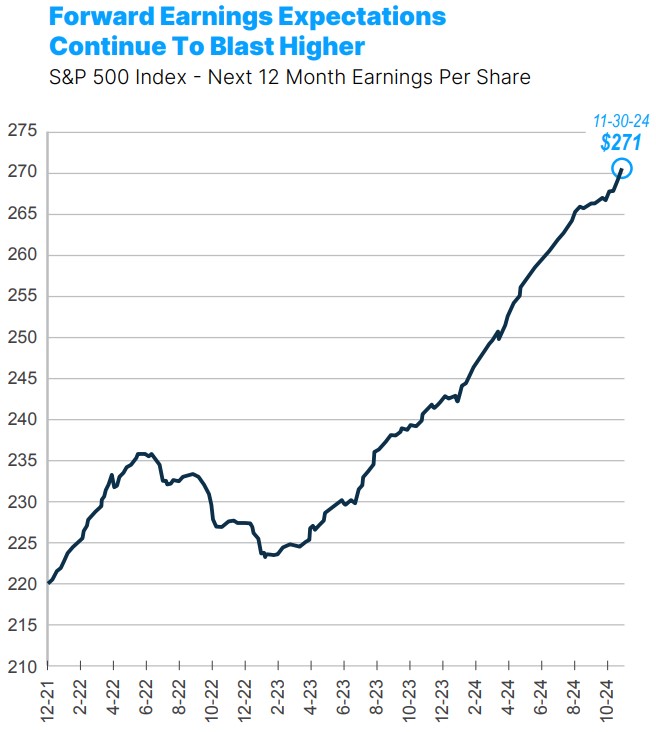

Earnings: The Engine of Growth

One of the primary drivers of this sustained bull market has been robust corporate earnings. Forward 12-month S&P 500 earnings have reached new highs, now at $271 per share, up significantly from $225 in early 2023, as shown in the chart below.

Source: Carson Investment Research, Factset

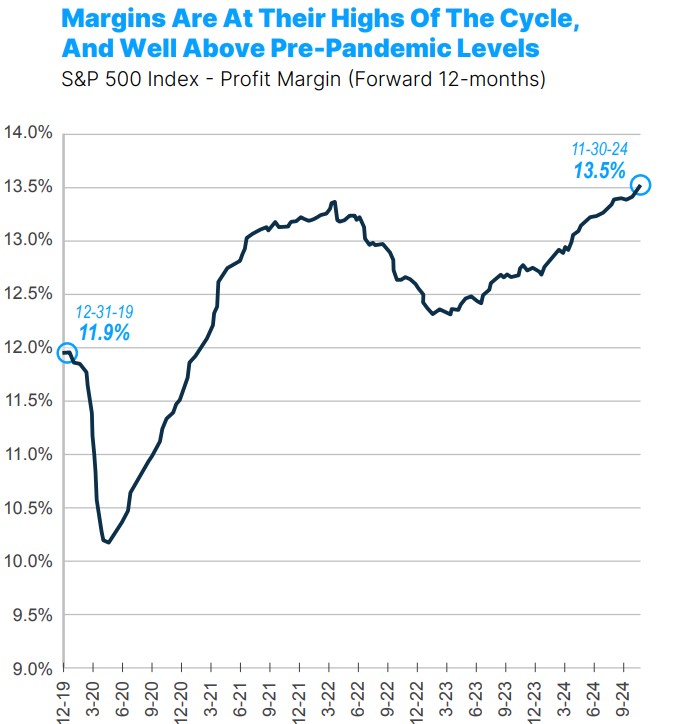

Margin Expansion and Productivity

An often-overlooked aspect of the current economic landscape is the expansion of profit margins. Companies have leveraged cost-cutting measures implemented in 2022 to improve their operating leverage. This has resulted in margin expansion even as sales have grown, contributing to overall economic productivity gains, as can be seen in the following chart.

Source: Carson Investment Research, Factset

*Profit margin estimated as next 12-months earnings divided by sales.

Market Breadth Improves

Unlike 2023, where technology stocks dominated, 2024 saw a broader market rally. All 11 sectors posted gains, with seven sectors achieving double-digit growth. This diversification is a healthy sign of underlying market strength and suggests the potential for continued growth across various industries. However, we would like to see this improve further whereby we see better returns in the smaller to mid-capitalization space.

Historical Perspective

Looking at past market performance in the table below, there's reason for optimism. When the S&P 500 has gained over 20% in consecutive years, the following year has been positive 75% of the time, with an average gain of 12.3%.

Source: Carson Investment Research, Factset

As we navigate through 2025, the economic outlook remains positive, with strong corporate earnings, expanding margins, and a broadening bull market providing tailwinds for investors. While it's important to remain vigilant about valuations and potential risks, diversification and a long-term perspective remain key to navigating any market environment.

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Carson Investment Research, First Trust

©2025 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.