Market Insights: November 2024 Market Recap and December Outlook

Milestone Wealth Management Ltd. - Dec 06, 2024

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index rose 0.17%. In the U.S., the Dow Jones Industrial Average fell 0.60% and the S&P 500 Index increased 0.96%.

- The Canadian dollar fell again this week, closing at 70.7 cents vs 71.4 cents last week.

- Oil prices declined this week. U.S. West Texas crude closed at US$67.16 vs US$68.15 last week.

- The price of gold fell this week, closing at US$2,656 vs US$2,674 last week.

- Canadian electric bus and truck manufacturer Lion Electric (LEV) has filed for bankruptcy protection. The company also announced a reduction of its workforce through temporary layoffs of ~400 employees, in both Canada and the United States.

- Last weekend, Stellantis (STLA) chief executive Carlos Tavares unexpectedly resigned. The carmaker behind the Peugeot, Jeep, Ram and Fiat brands is in a profit slump and weakened U.S. sales.

- The U.S. ISM Manufacturing index remained below 50, indicating contraction, for the eighth month. However, the reading of 48.4 was an improvement and the highest level since June, suggesting improved optimism.

- Meanwhile, the U.S. ISM Non-manufacturing (Services) index declined to 52.1 in November, the weakest reading in three months. While still in expansion territory, the reading was well below the expected 55.7 level.

- French markets were down this week after a non-confidence vote in France’s National Assembly saw the collapse of Michel Barnier’s three-month old government. The no-confidence vote stemmed from Barnier’s attempt to push through the much-opposed 2025 budget that would have tried to rein in France’s budget deficit.

- Employment numbers for November were released on Friday. In Canada, the economy created 50,500 jobs, however the unemployment rate moved up from 6.5% to 6.8%. In the U.S., nonfarm payrolls increased by 227,000 jobs, with the unemployment rate ticking higher to 4.2%.

- Canada’s big banks released earnings this week:

- Scotiabank (BNS) reported lower than expected earnings of $1.57/share vs $1.60/share expected, and disappointing revenue of $8.53 billion vs $8.63 billion expected.

- Royal Bank of Canada (RY) reported better than expected earnings of $3.07/share vs $3.01 expected on revenue of $15.07 billion vs $14.72 billion expected.

- Bank of Montreal (BMO) came in below expectations at $1.90/share vs $1.93/share a year ago and $2.41/share expected, but raised its dividend by 2.58%.

- CIBC (CM) also raised its dividend, reporting earnings of $1.91/share vs $1.57/share a year ago and $1.79/share expected.

- TD Bank (TD) dropped sharply after reporting disappointing earnings and lowering future guidance, with earnings of $1.72/share vs $1.83/share expected.

Weekly Diversion:

Check out this video: Elite Powerlifter Pretends to be a Beginner

Charts of the Week:

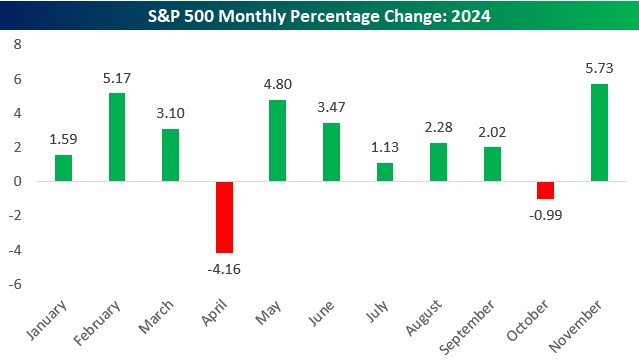

The S&P 500 Index closed out November 2024 with an impressive performance, marking its best month of the year so far. Let's dive into the key highlights and look ahead to what December might bring for investors.

November Performance

The S&P 500 posted a robust price gain of 5.73% in November, with positive returns on eight of the final nine trading days. Canada’s S&P/TSX Composite Index had an even stronger month, up 6.17%. This strong finish, as shown by the chart below, propelled the index to new heights (TSX as well), reflecting growing investor confidence as the year draws to a close.

Source: Bespoke Investment Group

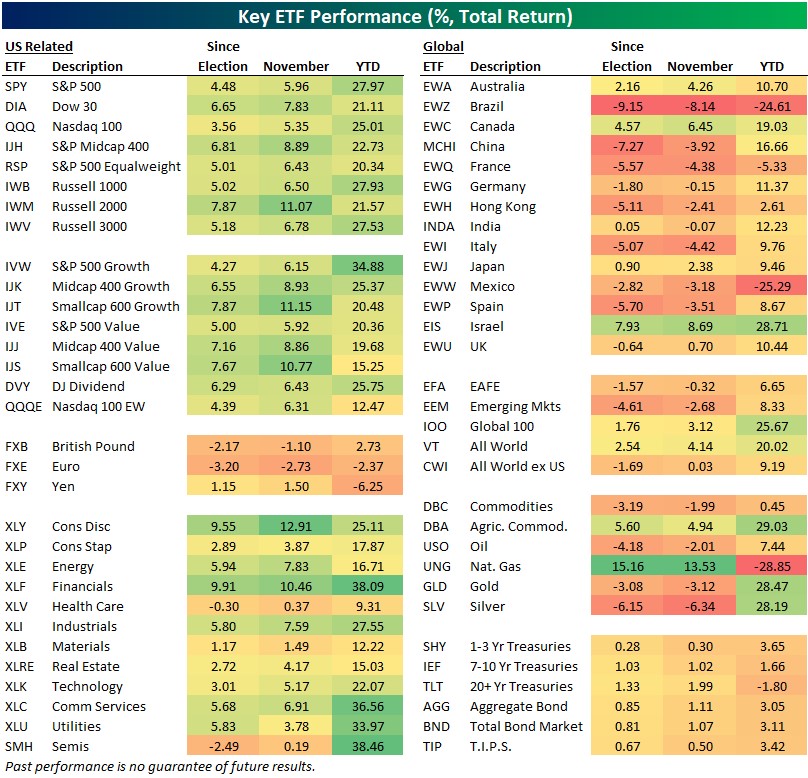

U.S. Sector and Asset Class Performance

- US Equities: Large-cap indices like the S&P 500 (SPY) and Dow Jones Industrial Average (DIA) saw gains of 5.96% and 7.83%, respectively.

- Small Caps: The Russell 2000 outperformed, surging 11.07%.

- Sectors: U.S. consumer discretionary led the pack with a 12.91% gain, followed closely by U.S. financials at 10.46%.

- International Markets: In stark contrast to U.S. and Canada performance, many international markets struggled. For instance, Brazil declined over 8%, while European markets like France and Germany also saw negative returns.

- Mid-Size Momentum: Stocks with market caps between $48-$65 billion (4th decile) had the strongest gains, outperforming both mega-caps and small-caps.

The chart below highlights this information using ETFs that track specific indexes or markets. This shows the stark contrast between North American and international equity markets. The largest fixed income markets have also had weak returns overall.

Source: Bespoke Investment Group

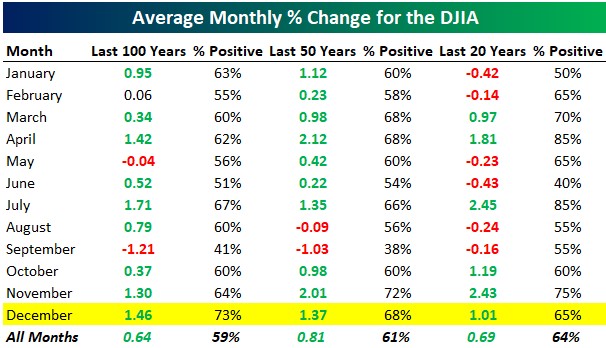

Looking Ahead to December

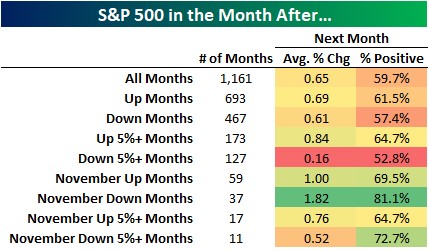

Historically, December has been a favorable month for stocks. Here's what the data suggests in the next three charts:

- Consistent Performance: Over the past 100, 50, and 20 years, December has averaged gains of more than 1% for the Dow Jones Industrial Average. (first chart)

- Post-Strong November: When November sees gains of 5%+ (as in 2024), December has historically averaged a 0.76% increase with positive returns 64.7% of the time, far outpacing years where November is down 5%+, with average December gains of just 0.16%. (second chart)

- YTD Performance Impact: With the S&P 500 up 26% YTD through November, history is on the bulls' side. In years with 20%+ gains through November, December has averaged a 1.77% increase with positive returns 77.3% of the time. (third chart)

Source: Bespoke Investment Group

Cautionary Notes

While the overall outlook appears positive, investors should consider a few potential headwinds:

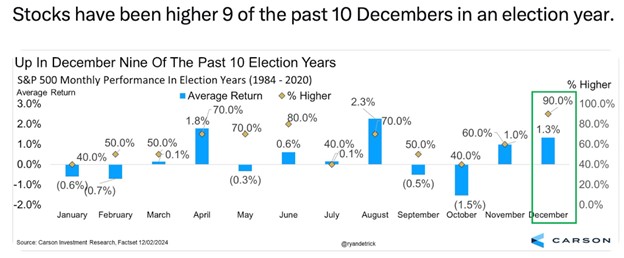

- Election Year Dynamics: In previous election years with similar setups (5%+ November gains and 20%+ YTD gains), December performance has been mixed, as shown by the first chart below. However, as the second chart shows, it is important to note that 9 of the past 10 election years has seen positive returns for the S&P 500 in December.

- Overbought Conditions: After such a strong run, some consolidation or profit-taking wouldn't be surprising.

- Global Uncertainties: Ongoing geopolitical tensions and divergent international market performance could impact multinational companies.

Source: Bespoke Investment Group

Source: Carson Group, @RyanDetrick

As we enter the final month of 2024, investors should remain vigilant while acknowledging the historically favorable seasonal trends. As always, past performance does not guarantee future results, and a diversified approach remains prudent in navigating market uncertainties.

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Bespoke Investment Group, Carson Group @RyanDetrick

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner.