Market Insights: Powering AI at the Cost of Enormous Energy Consumption

Milestone Wealth Management Ltd. - Nov 29, 2024

Macroeconomic and Market Developments:

- North American markets were positive this week. In Canada, the S&P/TSX Composite Index rose 0.79%. In the U.S., the Dow Jones Industrial Average increased 1.39% and the S&P 500 Index rallied 1.06%.

- The Canadian dollar fell slightly this week, closing at 71.4 cents vs 71.5 cents last week.

- Oil prices declined this week. U.S. West Texas crude closed at US$68.15 vs US$71.25 last week.

- The price of gold fell this week, closing at US$2,674 vs US$2,711 last week.

- Canadian money manager CI Financial (CIX) announced that it is being taken over by an affiliate of Mubadala Capital for $32.00/share, implying a total enterprise value of ~$12.1 billion including debt. The cash purchase price represents a 33% premium to the last closing price prior to the announcement.

- The Canadian dollar dropped this week after the announcement by president-elect Trump pledging to impose a 25% tariff on all products from Canada and Mexico on his first day of office. Trump vowed the tariffs would be upheld until issues such as border protection and preventing the illegal flow of drugs were resolved.

- The U.S. Fed’s preferred inflation gauge, the Personal Consumption Expenditures (PCE) price index increased 0.2% for the month of October and 2.3% for the past year. The Core PCE, which excludes volatile items, rose 0.3% for the month and 2.8% from a year ago.

- Brookfield Asset Management (BAM) walked away from a plan to take Spanish blood-plasma company Grifols SA private, in combination with the Grifols family. Brookfield said it decided to not pursue the deal, after the Grifols board rejected its indicative offer that valued the company at €6.45 billion.

- The Canadian economy continues to grow, albeit at a weak pace. Canadian Real (after inflation) GDP edged up 0.1% in September, with Q3 growth pegged at 1.0% annualized. Early indications suggest GDP grew by 0.1% in October as well.

Weekly Diversion:

Check out this video: Crazy Goal

Charts of the Week:

In the rapidly evolving landscape of technology, data centers have become the backbone of our digital world. However, the advent of artificial intelligence (AI) is pushing these facilities to unprecedented scales, with power demands that could rival entire cities or even states and provinces. This trend is not only reshaping the tech industry but also raising significant concerns about energy consumption and environmental impact.

The Scale of Modern Data Centers

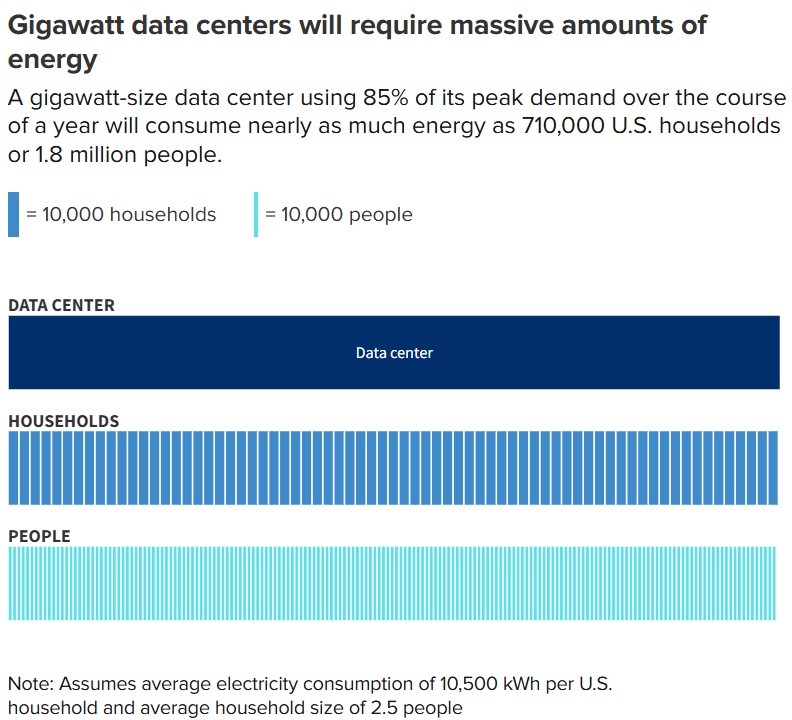

Data centers are growing at an astonishing rate, driven by the insatiable appetite of AI and cloud computing. According to the U.S. Department of Energy and the U.S. Census Bureau, these facilities are now reaching a scale where they could consume a gigawatt or more of power—equivalent to the electricity usage of approximately 700,000 homes or a city of 1.8 million people, as shown in the chart below. To put this into perspective, a gigawatt-scale data center could potentially use more electricity in a year than the entire state of Alaska, Rhode Island, or Vermont.

Source: CNBC, U.S. Energy Information Agency, U.S. Census Bureau

The AI Arms Race

The explosive growth of data centers is fueled by what industry experts call a "race of a lifetime to global dominance" in AI. Tech giants are pouring vast resources into these facilities, viewing them as critical for both economic and national security. This relentless pursuit of AI supremacy is driving the rapid expansion of data center campuses across the United States.

Challenges and Constraints

As data centers grow, they face several significant challenges:

- Power Availability: Existing utility infrastructure is struggling to meet the enormous power demands of these facilities.

- Land Scarcity: Suitable industrial-zoned land for data centers is becoming increasingly scarce.

- Grid Reliability: Some regions, like Northern Virginia—a long-established data center hub—are facing looming reliability issues due to surging demand and retiring power plants.

Geographical Shift

To address these challenges, data center developers are expanding into new markets. Companies like Tract are assembling vast tracts of land across the U.S., with significant holdings in Arizona and Nevada. Texas has also emerged as an attractive location due to its less burdensome regulatory environment and abundant energy resources.

Environmental Concerns

While tech companies prefer carbon-free renewable energy, the sheer scale of power needed means that natural gas will likely play a significant role in the short term. This reliance on fossil fuels could slow progress toward meeting carbon dioxide emissions targets. However, the industry is exploring various solutions:

- Investing in nuclear power, with companies like Microsoft supporting the restart of nuclear plants.

- Developing small nuclear reactors, as pursued by Amazon and Google.

- Implementing carbon capture and battery storage technologies to mitigate environmental impact.

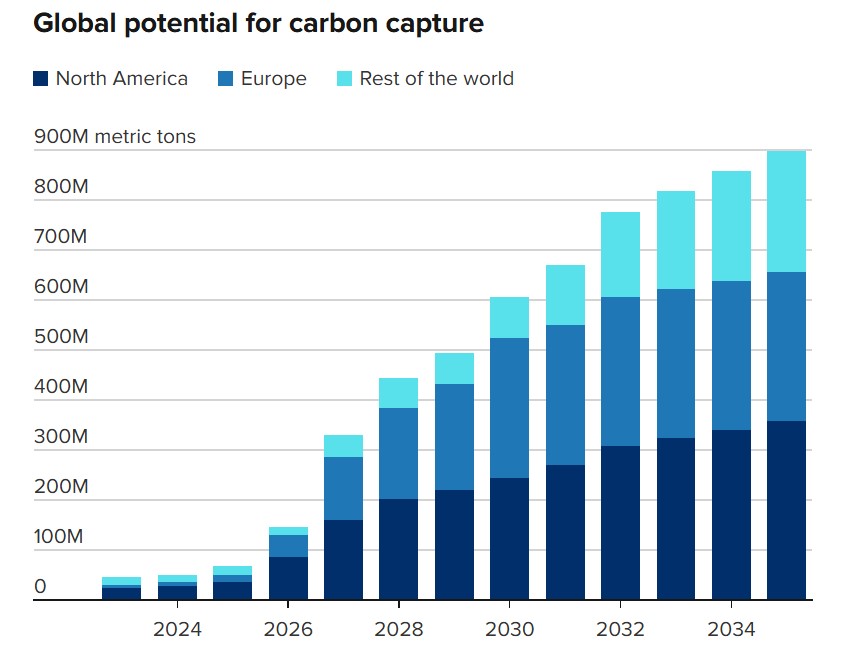

Further to this, carbon capture and storage is expected to grow drastically on the global stage as shown by the chart below, generating offsetting carbon credits in participating countries and regions. With participation growth, carbon credits are expected to become more valuable as governments crack down on carbon emissions and investment vehicles such as the KraneShares Global Carbon Strategy ETF have emerged.

Source: CNBC, Rystad Energy

The Path Forward

The data center industry faces a complex challenge: balancing the demands of AI and cloud computing with environmental responsibility. While the short-term increase in natural gas usage is concerning, many in the industry view it as a temporary measure. There's hope that advancements in renewable energy, battery and carbon storage, and AI-driven efficiency improvements will eventually reduce reliance on fossil fuels.

As we move forward, it's clear that the growth of gigawatt-scale data centers will have profound implications for our energy infrastructure, economy, and environment. The tech industry must work closely with utilities, system operators, and communities to ensure that these massive facilities become assets rather than liabilities to the power grid and the planet.

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, U.S. Energy Information Agency, U.S. Census Bureau, Rystad Energy

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner.