Market Insights: Canadian Inflation in Perspective

Milestone Wealth Management Ltd. - Nov 22, 2024

Macroeconomic and Market Developments:

- North American markets were positive this week. In Canada, the S&P/TSX Composite Index rose 2.23%. In the U.S., the Dow Jones Industrial Average increased 1.96% and the S&P 500 Index rallied 1.68%.

- The Canadian dollar jumped this week, closing at 71.5 cents vs. 71.2 cents USD last week.

- Oil prices advanced this week as well. U.S. West Texas crude closed at US$71.25 vs US$66.98 last week.

- The price of gold rebounded this week, closing at US$2,711 vs US$2,566 last week.

- The market was on high alert this week as Nvidia (NVDA), the current largest publicly traded company in the world, released earnings on Wednesday. As expected, the company blew away earnings and revenue expectations, with revenue up by 94.1% to $35.1 billion, well above estimates of $33.2 billion and profit of $0.91/share vs estimates of $0.74/share. The results seemed to barely satisfy investors as the stock was up just 0.53% the following day.

- Canada's inflation rate rose to 2.0% in October from a year ago, up from 1.6% in the September-to-September timeframe. Calgary led the country, with a 3.3% inflation rate for the past year, mostly due to rising shelter costs.

- U.S. discount airline Spirit Airlines (SAVE) has filed for bankruptcy protection after mounting losses, heightened competition, and a failed merger finally weighed on the budget airline. The airline has lost more than $2.5 billion since the start of the pandemic and faces debt payments totaling $1.1 billion in the next year.

- Canadian clothing retailer Groupe Dynamite, owner of popular stores Dynamite and Garage, went public on the TSX this week under the symbol GRGD following its ~14.3 million share IPO which was priced at $21.00/share.

- Canadian retail sales jumped 0.4% to $66.9 billion in September, marking the fourth consecutive month of growth. Sales were up in six of nine subsectors and were led by increases at food and beverage retailers.

Weekly Diversion:

Check out this video: Corgi Race Gone Wrong

Charts of the Week:

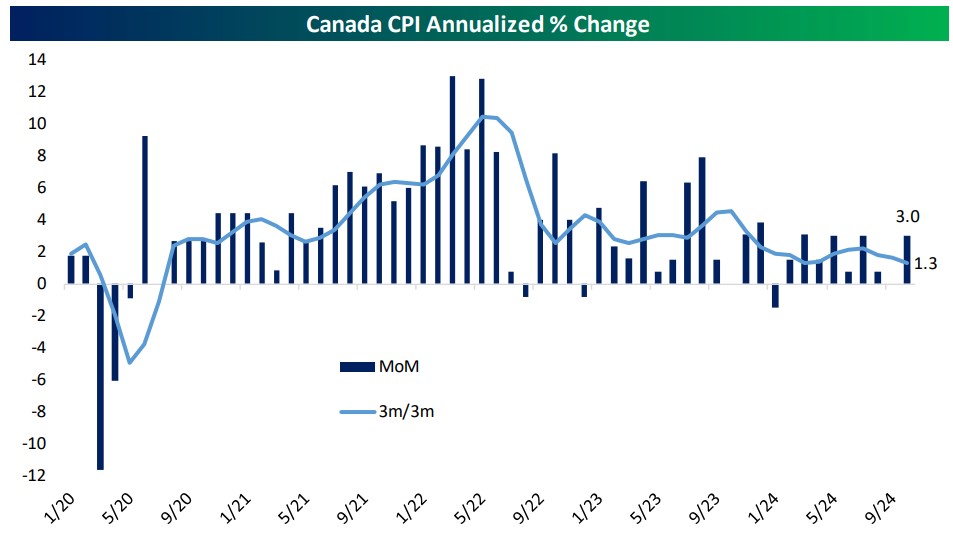

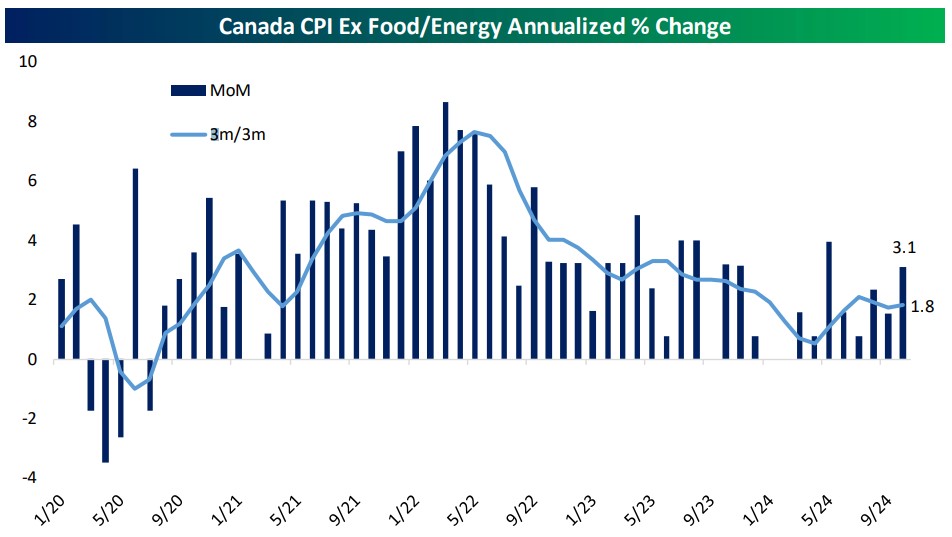

Canadian headline inflation showed a slight uptick in October, with the year-over-year (YoY) rate reaching 2.0%, marginally higher than the estimated 1.9%. Core inflation measures also came in slightly above expectations, indicating a modest strengthening in price pressures across the economy.

Inflation Metrics

Headline and Core CPI

While the headline figure hit the Bank of Canada's (BoC) 2% target, both headline and core CPI (excluding food and energy) remain below 2% on a three-month annualized basis, as shown in the following two charts. This suggests that short-term inflationary pressures are still relatively contained.

Source: Bespoke Investment Group

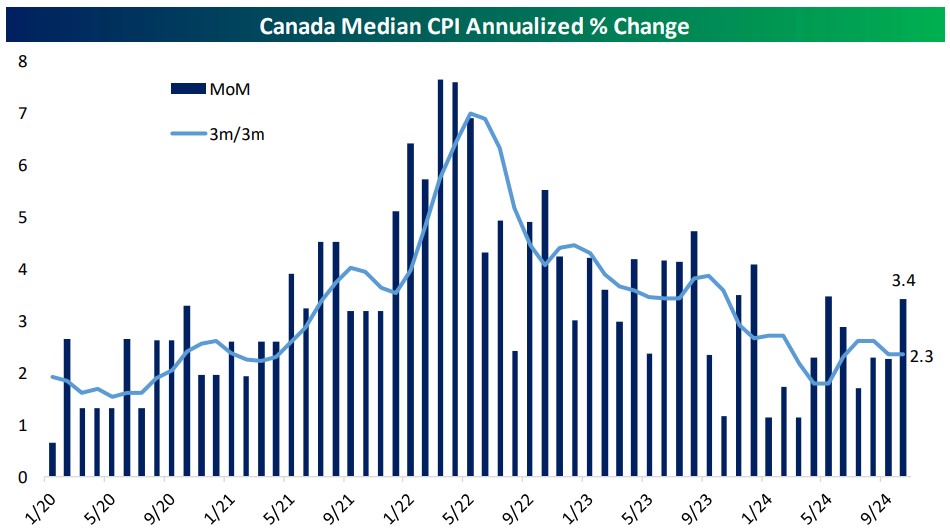

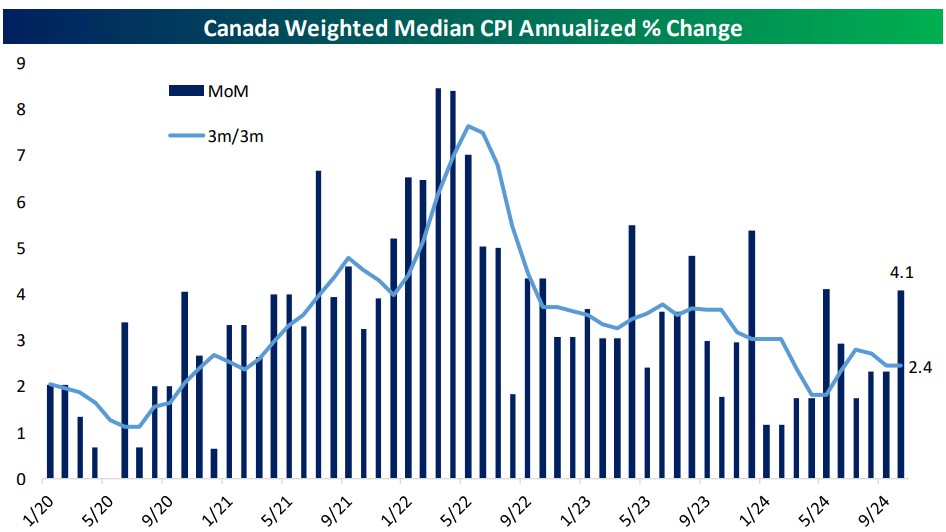

Alternative Core Measures

Other core inflation metrics paint a somewhat different picture, shown in the last two charts below:

- Median CPI: Above 2% on a three-month annualized basis

- Weighted mean CPI: Also exceeding 2% by the same measure

These alternative measures indicate that underlying inflationary pressures may be slightly more pronounced than the headline figures suggest.

Source: Bespoke Investment Group

Market Reaction

The inflation data triggered notable market movements:

- Canadian dollar rallied, recording two consecutive days of gains before falling slightly to end the week.

- Canadian Government Bonds underperformed U.S. Treasuries by 0.05%-0.08% (5-8 basis points) across the yield curve.

- Market expectations for a significant 50 basis points (bps) target rate cut at the December 11th BoC meeting have diminished since the last monthly inflation data hit. As of the 19th, the implied probability from futures markets now shows only a 28% chance of a larger 50bps cut versus a 72% chance for a 25bps cut.

Outlook

While Canadian inflation has shown signs of firming compared to a few months ago, it may be premature to conclude that it has settled above the BoC's target. The central bank will likely continue to monitor these developments closely, balancing the need to maintain price stability with supporting economic growth. The recent data and market reactions suggest that the BoC may adopt a more cautious approach to monetary policy in the near-term, potentially reconsidering the likelihood of aggressive rate cuts in the immediate future.

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Connected Wealth, Bespoke Investment Group

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner.