Market Insights: Good Times in the Bad Times

Milestone Wealth Management Ltd. - Nov 15, 2024

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index rose 0.53%. In the U.S., the Dow Jones Industrial Average fell 1.24% and the S&P 500 Index pulled back by 2.08%.

- The Canadian dollar fell this week, closing at 71.2 cents vs 71.9 cents USD last week.

- Oil prices were down this week. U.S. West Texas crude closed at US$66.98 vs US$70.38 last week.

- The price of gold was down this week, closing at US$2,566 vs US$2,692 last week.

- The re-election of Donald Trump as U.S. president has set off a massive rally in the cryptocurrency space as traders bet on a less restrictive regulatory environment. Bitcoin has risen from $69,105 at the end of October to $91,699 as of this Friday. Similarly, Ethereum has gone from $2,509 to $3,091 in the same timeframe.

- U.S. inflation numbers were released this week. The U.S. Consumer Price Index (CPI) increased 0.2% in October, taking the 12-month inflation rate up to 2.6%. Excluding volatile food and energy prices, the Core CPI accelerated 0.3% for the month and was at 3.3% annually.

- The Producer Price Index (PPI), which measures U.S. wholesale prices, rose 0.2% on the month and up 2.4% for the past year. The Core PPI increased by 3.1% from a year ago.

- Calgary-based Suncor Energy (SU) shares got a lift this week after reporting better than expected results. Earnings came in at $1.48/share vs $1.12/share expected, production of 909.6 Mboe/d vs 807.6 Mboe/d expected. Cash flow also beat expectation at $3.36/share vs $2.40/share expected.

- Canadian tech company Shopify (SHOP) reported blowout earnings this week. Operating income came in at $283 million vs $122 million in the same quarter last year. Revenue also beat expectation at $2.16 billion vs $2.12 billion forecast by analysts. The company’s focus on powering its software with artificial intelligence attracted more merchants to use its product in the quarter.

- In the U.S., retail sales rose 0.4% in October (+0.6% including revisions to prior months), narrowly beating the consensus expected increase of 0.3%. Retail sales are up 2.8% versus a year ago which shows despite higher prices, consumers continue to buy.

Weekly Diversion:

Check out this video: The Story Behind John McCrae’s “In Flanders Fields” poem

Charts of the Week:

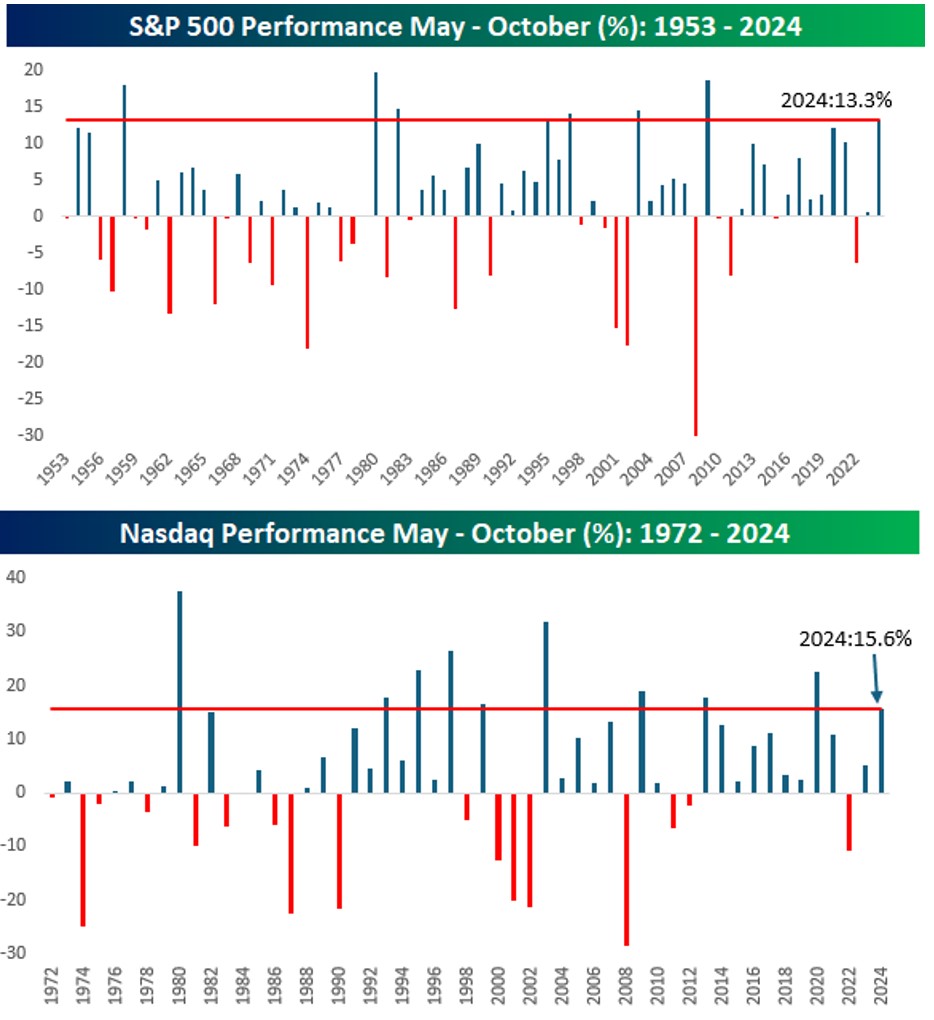

Now that the U.S. election is behind us, we wanted to look at market seasonality moving forward. As of the end of October, the U.S. stock market wrapped up what has historically been its weakest six-month period. However, 2024 proved to be an exception to this general trend, with both the S&P 500 Index and Nasdaq Composite delivering impressive gains. This also held true for our S&P/TSX Composite. Let's dive into the numbers and explore what this might mean for investors moving forward.

Historical Performance: May through October

Traditionally, the period from May through October has been lackluster for stocks. However, long-term data reveals a fascinating pattern:

- For the S&P 500 (since 1952) and the Nasdaq Composite (since 1971), the majority of returns have occurred during the November through April period, as shown by the charts below.

- Despite this trend, overall returns have been positive in both six-month periods, meaning that a buy-and-hold strategy is still the strongest one long-term.

Source: Bespoke Investment Group

2024: Bucking the Trend

This year has defied historical norms:

- The S&P 500 surged 13.3% from May through October, its best performance for this period since 2009.

- The Nasdaq Composite rallied an impressive 15.6%, marking its strongest showing during these months since 2020.

These gains are particularly noteworthy given that they occurred during what is typically considered the market's weaker half of the year, as we can see in the charts below.

Source: Bespoke Investment Group

What Does This Mean Going Forward?

With such strong performance in the rear-view mirror, investors might wonder if we've "borrowed" gains from the traditionally stronger November-April period. Historical data offers some encouraging insights:

- In years when the S&P 500 gained 10% or more from May through October, the following six months saw a median gain of 14.3%, with positive returns 90.9% of the time compared to median gains for all years at 6.9% with positive returns just 76.4% of the time.

- For the Nasdaq, when it rallied 15%+ during the May-October period, the subsequent six months yielded a median gain of 16.1%, with positive returns 80% of the time compared to median gains for all years at 10.1% with positive returns just 73.6% of the time.

These figures significantly outpace the typical performance for these indices during the stronger November-April period as can be seen in the chart below.

Source: Bespoke Investment Group

Key Takeaways for Investors

- Don't fear strong gains: There's no evidence to suggest that recent robust performance will negatively impact future returns.

- Seasonality matters, but isn't everything: While historical patterns are interesting, they shouldn't be the sole factor in investment decisions.

- Long-term perspective is crucial: Despite short-term fluctuations, the data reinforces the benefits of staying invested over time.

As we enter the historically stronger half of the year, investors have reason for cautious optimism. However, it's essential to remember that past performance doesn't guarantee future results. A well-diversified portfolio and a focus on long-term goals remain the cornerstones of sound investing strategy.

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Bespoke Investment Group

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner.