Market Insights: November Seasonality and U.S. Election Year Rallies

Milestone Wealth Management Ltd. - Nov 08, 2024

Macroeconomic and Market Developments:

- North American markets were very strong this week. In Canada, the S&P/TSX Composite Index rose 2.08%. In the U.S., the Dow Jones Industrial Average increased 4.61% and the S&P 500 Index rallied 4.66%.

- The Canadian dollar was up slightly this week, closing at 71.9 cents vs 71.7 cents USD last week.

- Oil prices were up this week. U.S. West Texas crude closed at US$70.38 vs US$69.50 last week.

- The price of gold was down slightly this week, closing at US$2,692 vs US$2,743 last week.

- The big story this week was the decisive re-election of Donald Trump as U.S. president. Republicans also took control of the Senate; however, the House of Representatives is still up for grabs. Markets cheered the win, with the Dow Jones up 3.57%, S&P 500 up 2.53% and NASDAQ up 2.95% the following day.

- In addition, the U.S. Federal Reserve lowered its benchmark overnight borrowing rate by 0.25%, to a target range of 4.50% - 4.75%. This rate cut follows the 0.50% cut the Fed made in September.

- Canadian jobs numbers were released on Friday, with the economy adding 15,000 jobs in October, below the 27,200 expected. The unemployment rate stayed flat at 6.5%.

- BCE fell to a new 13-year low this week after the company announced it has entered into a definitive agreement to acquire Ziply Fiber, a fibre Internet provider in the U.S. Pacific Northwest, for approximately $5.0 billion in cash and the assumption of outstanding net debt of around $2.0 billion. Additionally this week, BCE reported earnings below analysts' expectations.

- The U.S. ISM Non-Manufacturing (Services) index increased to 56.0 in October (levels above 50 indicate growth), easily beating the expected 53.8. The employment index increased to 53.0 from 48.1, while the supplier deliveries index rose to 56.4 from 52.1.

- Nvidia (NVDA) will be added to the Dow Jones Industrial average, replacing rival Intel (INTC). Additionally, Nvidia finished this week with a market capitalization of US$3.62 trillion, above Apple’s (AAPL) US$3.43 trillion valuation, making Nvidia the most valuable company in the world.

Weekly Diversion:

Check out this video: Say Cheese

Charts of the Week:

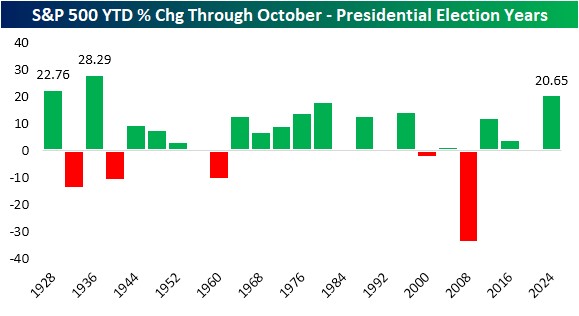

As we approach the end of 2024, investors are keeping a close eye on market trends, especially given the unique circumstances of this election year. The S&P 500 Index has shown remarkable strength, posting a year-to-date gain of over 20% through October—a performance not seen in an election year since 1936.

November has historically been a strong month for the stock market. Looking at data from the past century as shown in the charts below, November ranks as the fourth-best month for the Dow Jones Industrial Average (DJIA), with an average gain of 1.3% and positive performance 63% of the time.

This trend becomes even more pronounced when examining more recent data:

- Over the past 50 years, November has averaged a gain of 2.01%, second only to April, and with positive performance 71% of the time.

- In the last 20 years, November's average gain of 2.43% is nearly the best, just behind July's 2.45%, and with positive performance 71% of the time.

Source: Bespoke Investment Group

The current year's impressive 20% gain through October puts 2024 in rarified air for U.S. election years. Only two previous election years (1928 and 1936) have seen the S&P 500 rally 20% or more year-to-date by the end of October, as shown in the next chart.

Source: Bespoke Investment Group

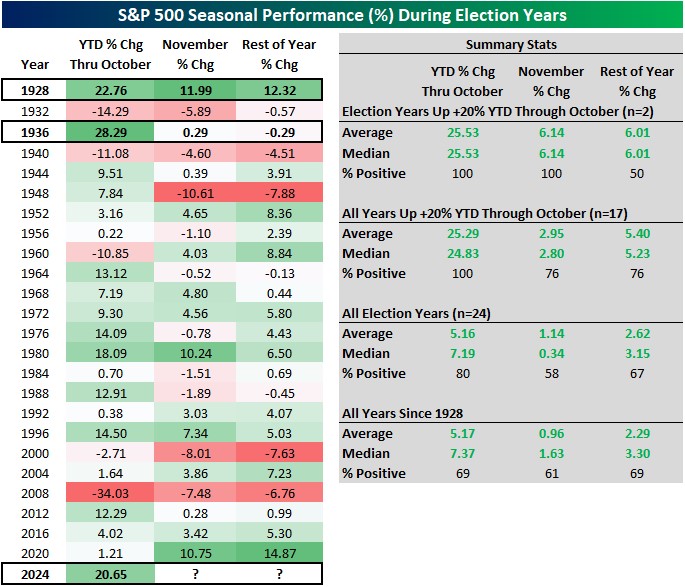

When considering all years (not just election years) where the S&P 500 was up 20% or more through October, the outlook for the remainder of the year has been generally very positive:

- November has averaged a gain of nearly 3%, with positive returns over 75% of the time

- The average gain from November through year-end exceeded 5.4%

This performance is more than double the average return for all years and all election years, suggesting that strong momentum in the first ten months often carries through to year-end. This information is shown in the tables below.

As we look ahead to the final months of 2024, several factors come into play:

- Historical Precedent: The strong year-to-date gains and positive November seasonality generally provide a favorable backdrop.

- Election Impact: The presidential election adds an element of uncertainty, which markets typically dislike. However, the resolution of this uncertainty post-election could potentially drive further gains.

- Economic Factors: Historical data and elections aside, investors should keep an eye on key economic indicators and corporate earnings, Federal Reserve policy, and global events, as these ultimately have the largest influence on market direction.

Source: Bespoke Investment Group

As 2024 draws to a close, the stock market finds itself in an intriguing position. The combination of strong year-to-date performance, positive seasonal trends, and the backdrop of a presidential election creates a unique environment for investors. While historical data suggests a favorable outlook for the remainder of the year, it's crucial to remember that past performance doesn't guarantee future results. Investors should remain vigilant, considering both the potential for continued momentum and the possibility of increased volatility as we navigate the final weeks of this election year.

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Bespoke Investment Group

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner.