Market Insights: Investor Sentiment After A Six-Month Bull Run

Milestone Wealth Management Ltd. - Oct 25, 2024

Macroeconomic and Market Developments:

- North American markets were negative this week. In Canada, the S&P/TSX Composite Index declined 1.46%. In the U.S., the Dow Jones Industrial Average fell 2.68% and the S&P 500 Index waned 0.96%.

- The Canadian dollar was down slightly this week, closing at 72.0 cents vs 72.4 cents last week.

- Oil prices were positive this week. U.S. West Texas crude closed at US$71.65 vs US$69.33 last week.

- The price of gold jumped this week, closing at US$2,756 vs US$2,736 last week.

- The Bank of Canada made its latest interest rate decision this week. The Canadian central bank lowered interest rates by 0.50% to 3.75%, down from 5.00% at the start of the year. According to Tiff Macklem, “We took a bigger step today because inflation is now back to the 2.0% target, and we want to keep it close to the target”.

- Canadian Retail Sales for August increased 0.4% for the month to $66.6 billion, below July's 0.9% rise. Core Retail Sales, excluding car sales, gas stations and vehicle parts, fell 0.4% vs expectations of a 0.2% increase. The largest increases were observed at motor vehicles/parts dealers, while sales at gasoline stations and fuel vendors were down.

- Lululemon Athletica (LULU) has entered an arrangement with sports merchandiser Fanatics Inc. and the NHL to design and develop fan apparel. The new Lululemon clothes will feature 11 of the NHL’s 32 teams this season, including the Rangers, Bruins, Maple Leafs and Canucks, with plans to expand to all the league’s franchises next year.

- Canadian National Railway (CNR) reported quarterly earnings that slightly missed expectations, as the impact of wildfires across the nation weighed heavily on the transport company. Quarterly revenues rose by 3% to $4.11 billion, but net income dropped 2% to $1.09 billion. Meanwhile, Canadian Pacific Kansas City (CP) reported lower than expected earnings of $0.99/share vs $1.01/share expected, on revenue of $3.55 billion vs the expected $3.59 billion.

- Tesla (TSLA) had a big week after delivering strong earnings and released a forecast for as much as 30% growth in vehicle sales next year. The stock price has struggled this year, but with this week’s lift, the stock has now moved into positive territory for 2024.

Weekly Diversion:

Check out this video: How to Deal with a Bear

Charts of the Week:

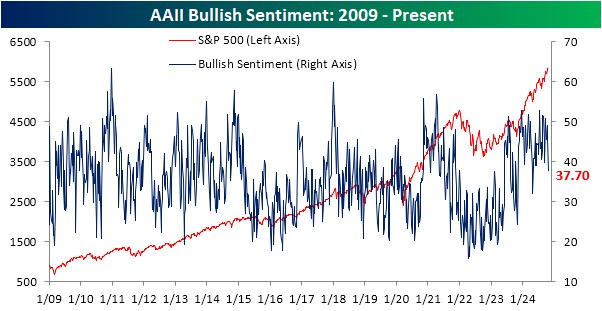

The stock market has been on a great run the past few months, with bullish sentiment dominating for an impressive 26 consecutive weeks. This streak has surpassed recent records, becoming the longest run of positive investor outlook since 2015.

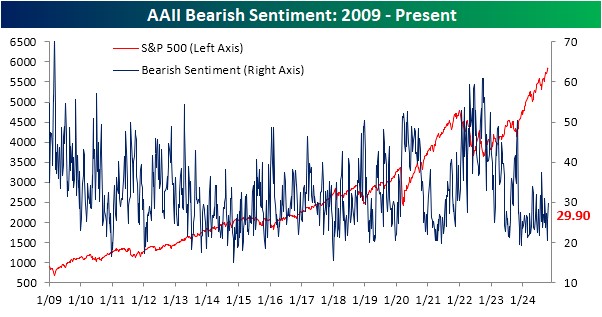

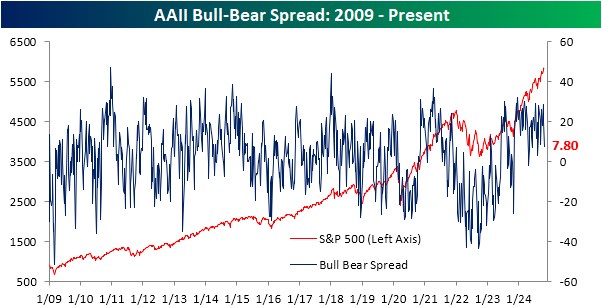

The American Association of Individual Investors (AAII) conducts a weekly sentiment survey that provides valuable insights into investor psychology. Recent data is represented in the next three charts:

- Bullish sentiment has dipped to 37.7%, down from 45.5% last week.

- Bearish sentiment has risen to 29.9%, an increase of 9.3 percentage points in two weeks.

- Despite the recent downshift, bulls still outnumber bears by 7.8 percentage points.

Source: Bespoke Investment Group

This recent downturn in bullish sentiment coincides with a modest decline in the S&P 500 Index, highlighting the delicate balance between market performance and investor confidence.

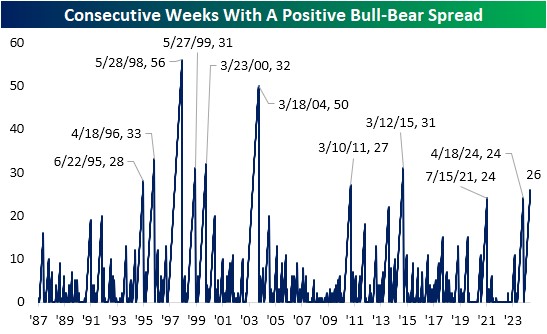

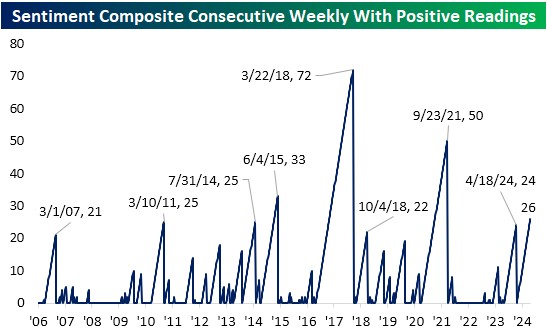

The current 26-week streak of bulls outnumbering bears is quite remarkable, as shown in the chart below. To put this into perspective:

- It surpassed two 24-week runs that ended in July 2021 and April 2024.

- Only eight other times in history has sentiment remained net bullish for more than half a year.

Source: Bespoke Investment Group

While the AAII survey provides valuable insights, it's not the only widely followed sentiment indicator:

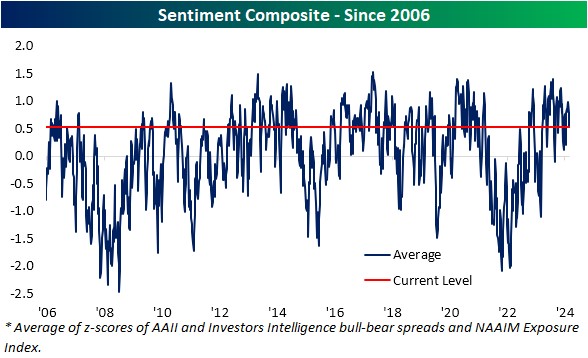

- The Sentiment Composite, created by Bespoke Investment Group, combines data from AAII, Investors Intelligence, and the National Association of Active Investment Managers (NAAIM), shows investors remain firmly bullish, as shown in the following chart.

- Current levels are approximately 0.54 standard deviations above the historical average, but not at an extreme level.

Source: Bespoke Investment Group

The Sentiment Composite has also been positive for half a year or 26 weeks as well, joining an elite club of three other extended bullish runs, as shown below:

- 33-week streak ending in mid-2015.

- 50-week streak concluding in September 2021.

- Record-breaking 72-week streak ending in March 2018.

Source: Bespoke Investment Group

The current prolonged period of bullish sentiment suggests a strong undercurrent of optimism in the market. However, it's important to note that sentiment can also at times be a contrarian indicator. Extreme bullishness might signal that the market is due for either a pause and sideways movement until it gains energy again, or sometimes even a pullback or correction. As we navigate this unique market environment, investors should:

- Stay vigilant and monitor for signs of market exhaustion

- Maintain a diversified portfolio to mitigate potential risks

- Consider the broader economic context when making investment decisions

While the bulls have had an impressive run, the recent dip in sentiment serves as a reminder that market dynamics can shift quickly. As always, a balanced and informed approach to investing remains crucial.

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Connected Wealth – Richardson Wealth, Bespoke Investment Group

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.