Market Insights: The Rise of Nuclear Power in Big Tech's AI Revolution

Milestone Wealth Management Ltd. - Oct 18, 2024

Macroeconomic and Market Developments:

- North American markets were positive this week. In Canada, the S&P/TSX Composite Index rose 1.43%. In the U.S., the Dow Jones Industrial Average increased 0.96% and the S&P 500 Index rallied 0.85%, both reaching record highs.

- The Canadian dollar was down slightly this week, closing at 72.4 cents vs 72.7 cents USD last week.

- The price of gold jumped this week, closing at US$2,736 vs US$2,676 last week.

- Oil prices were negative this week. U.S. West Texas Crude closed at US$69.33 vs US$75.49 last week.

- Canadian inflation cooled again in September, with the Consumer Price Index (CPI) increasing just 1.6% from a year ago, down from the 2.0% annual pace in August. Excluding gasoline, the annual pace of inflation was 2.2% in September.

- In the U.S., the CPI rose 0.2% in September and is up 2.4% from a year ago. And the Producer Price Index (PPI), a measure of inflation on wholesale goods, was unchanged in September and up 1.8% year over year.

- Retail sales in the U.S. rose by 0.4% in September, beating the forecasted 0.3% increase and highlighting the strength of consumer spending. Excluding autos and gas stations, sales grew by 0.7%.

- Goldman Sachs (GS) reported third-quarter earnings that topped analysts’ estimates, helped by strong dealmaking activity which supported its investment banking division. Earnings per share rose by nearly 45% y/y to $8.40, well above the expected figure of $6.89. Similarly, Morgan Stanley (MS) beat estimates, as its investment banking, wealth management, and trading divisions all outperformed expectations. Profit jumped by 32% to $1.88 billion, beating expectations of $1.58 billion.

- Netflix (NFLX) was up on Friday after reporting strong earnings, including adding over 5 million new subscribers. Subscriber growth was driven by its crackdown on password sharing and the introduction of an ad-supported subscription, bringing its total subscriber base to 282.7 million.

Weekly Diversion:

Check out this video: Another big win for SpaceX

Charts of the Week:

In the race to power the future of artificial intelligence (AI), tech giants are turning to an unexpected ally: nuclear energy. Alphabet (Google) recently announced a groundbreaking partnership with Kairos Power, a developer of small modular reactors (SMRs). Microsoft, not to be left behind, has inked a deal with Constellation to breathe new life into a dormant nuclear reactor at the infamous Three Mile Island nuclear power plant. Amazon, too, has joined the nuclear bandwagon with a $500 million investment in Dominion Energy, exploring the development of a SMRs. We have discussed the importance and implications of SMRs in past writings.

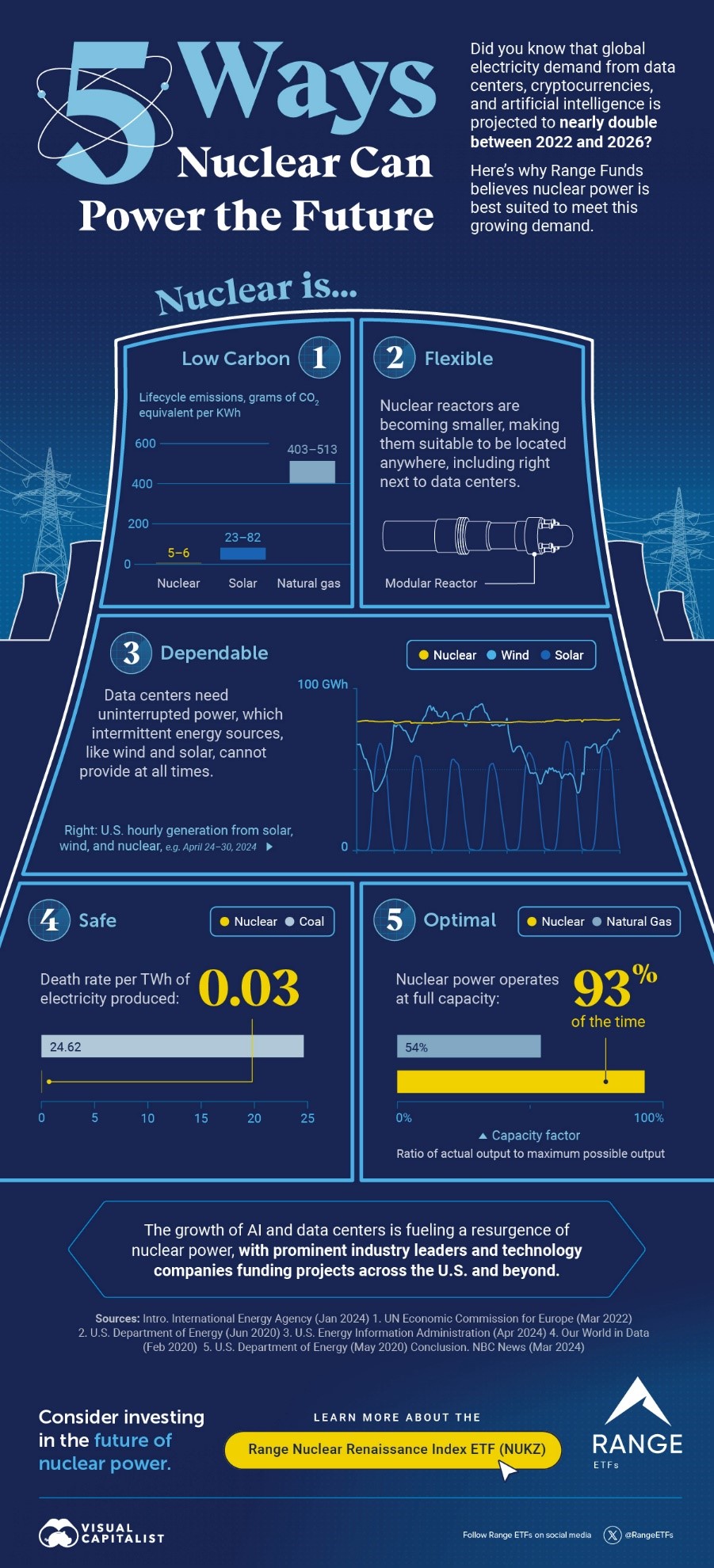

The exponential growth of AI applications has led to a corresponding spike in energy consumption. Global electricity demand from data centers, AI, and cryptocurrency sectors is projected to more than double by 2026, reaching over 1,000 terawatt-hours. Because of this increase in expected energy consumption, companies are looking to nuclear energy as a clean, flexible, dependable, safe, and optimal energy solution for future power needs as the following chart illustrates.

Source: Visual Capitalist

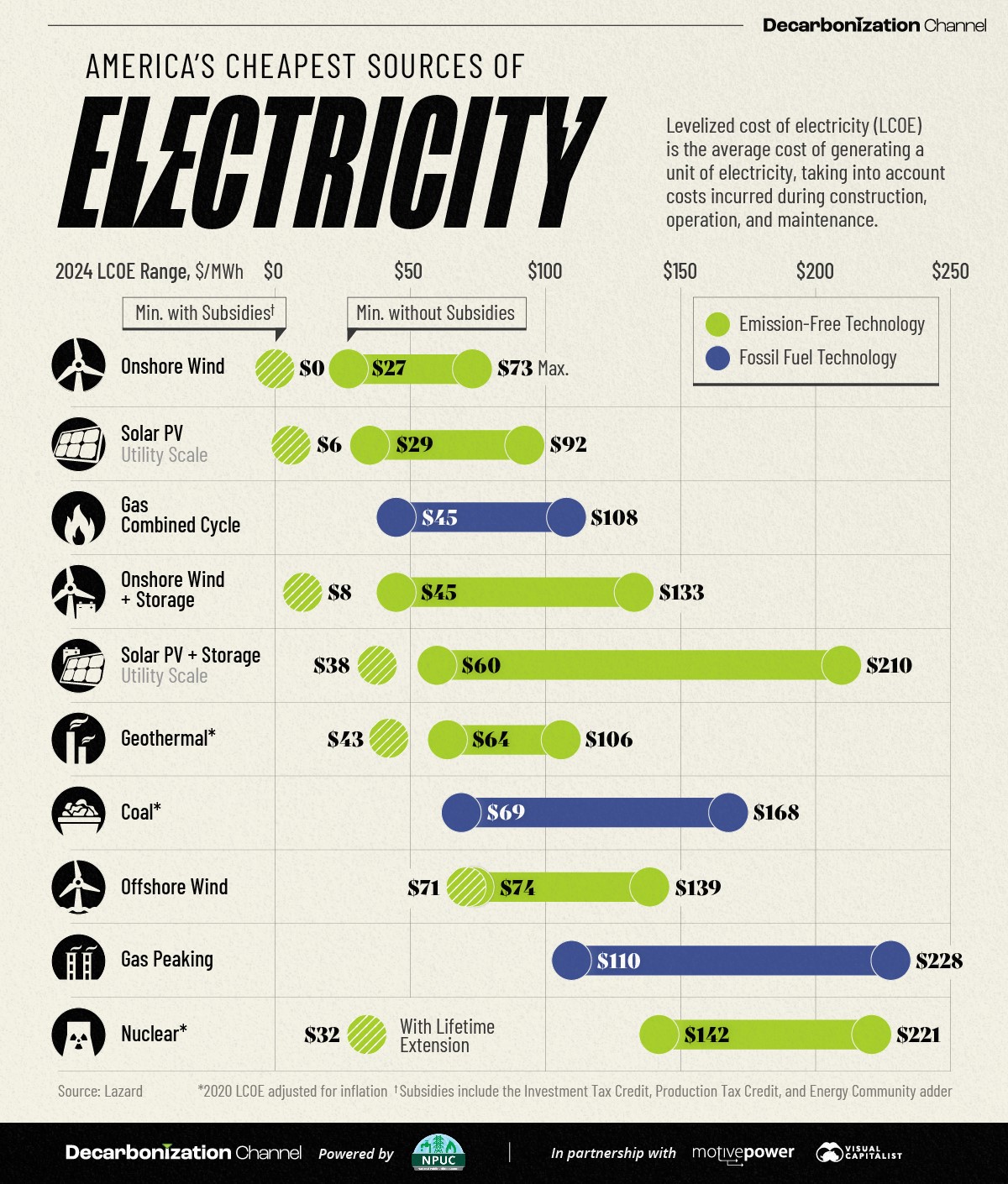

Interestingly, nuclear energy presents a distinctive cost structure, with the highest minimum cost among all energy sources at $142 per megawatt-hour (MWh). However, the economics of nuclear power improve dramatically when the lifetimes of nuclear plants are extended. These extensions significantly reduce the minimum marginal cost of nuclear electricity to $32 per MWh. Notably, 95% of U.S. nuclear plants benefit from this substantial cost reduction, as shown in the chart below.

Source: Visual Capitalist

Milestone Wealth and our clients have benefited from this trend in many of our mandate, investing in the only available publicly listed physical uranium investment even before it started trading as the Sprott Physical Uranium Trust; these strong returns of over 150% from our first purchase on July 13, 2021, to today are shown in the chart below.

Source: Morningstar

As AI continues to evolve and expand, the tech industry's energy needs will only grow. The turn towards nuclear power, and particularly SMRs, represents a significant shift in how these companies approach their energy strategies. While challenges and controversies remain, it's clear that the marriage of AI and nuclear energy will play a crucial role in shaping the future of technology and sustainability. The coming years will undoubtedly see further developments in this space, as tech giants strive to balance their ambitious AI goals with environmental responsibility and energy security.

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Connected Wealth – Richardson Wealth, Visual Capitalist, Morningstar

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.