Market Insights: Third Quarter Wrap-up

Milestone Wealth Management Ltd. - Oct 08, 2024

*For PDF version, please click here*

Key Updates on the Economy & Markets

The major development in the past quarter was the U.S. Federal Reserve’s (Fed) decision to cut interest rates by 0.50%, the first rate cut of this cycle. This follows the Bank of Canada’s third 0.25% rate cut this year. It came as the Fed shifted its focus, with unemployment rising to a 33-month high and inflation moving back to target. In the equity market, stocks ended the quarter higher despite some turbulence, including a brief but sharp sell-off in early August. North American equity markets posted their fourth consecutive quarterly gain and ended September near an all-time high. This letter recaps 3Q24, discusses the Fed’s first rate cut, examines the increase in market volatility, and looks ahead to the final quarter of 2024.

The Federal Reserve Cuts Interest Rates by -0.50%

In September, the Fed started the process of normalizing interest rates after a volatile five years. To recap, the Fed cut interest rates to near-zero during the COVID pandemic to support the economy. It kept rates near 0% until March 2022, when it began raising interest rates in response to soaring inflation. From March 2022 to July 2023, the world’s most closely watched central bank raised rates by +5%, one of the largest and fastest rate-hiking cycles in recent decades. The Fed held interest rates steady for over a year as it waited for inflation to return to its 2% target, and after 14 months, it started the rate-cutting cycle with a -0.50% cut at its last meeting.

The Fed’s transition to cutting interest rates comes as its focus shifts from lowering inflation to supporting the labor market. Since the last rate hike in July 2023, inflation has dropped from 3.3% to 2.6%. However, over the same period, unemployment has risen from 3.5% to 4.2%, the highest level since October 2021. The Fed is more confident that inflation will return to its 2% target, but it’s concerned about the health of the U.S. labor market. The key question for the Fed and investors is what the labor market softening over the past year represents. Is the labor market simply normalizing after experiencing significant disruption during the pandemic, or is it an early sign of weakening labor demand? This uncertainty is one reason the Fed moved to cut interest rates.

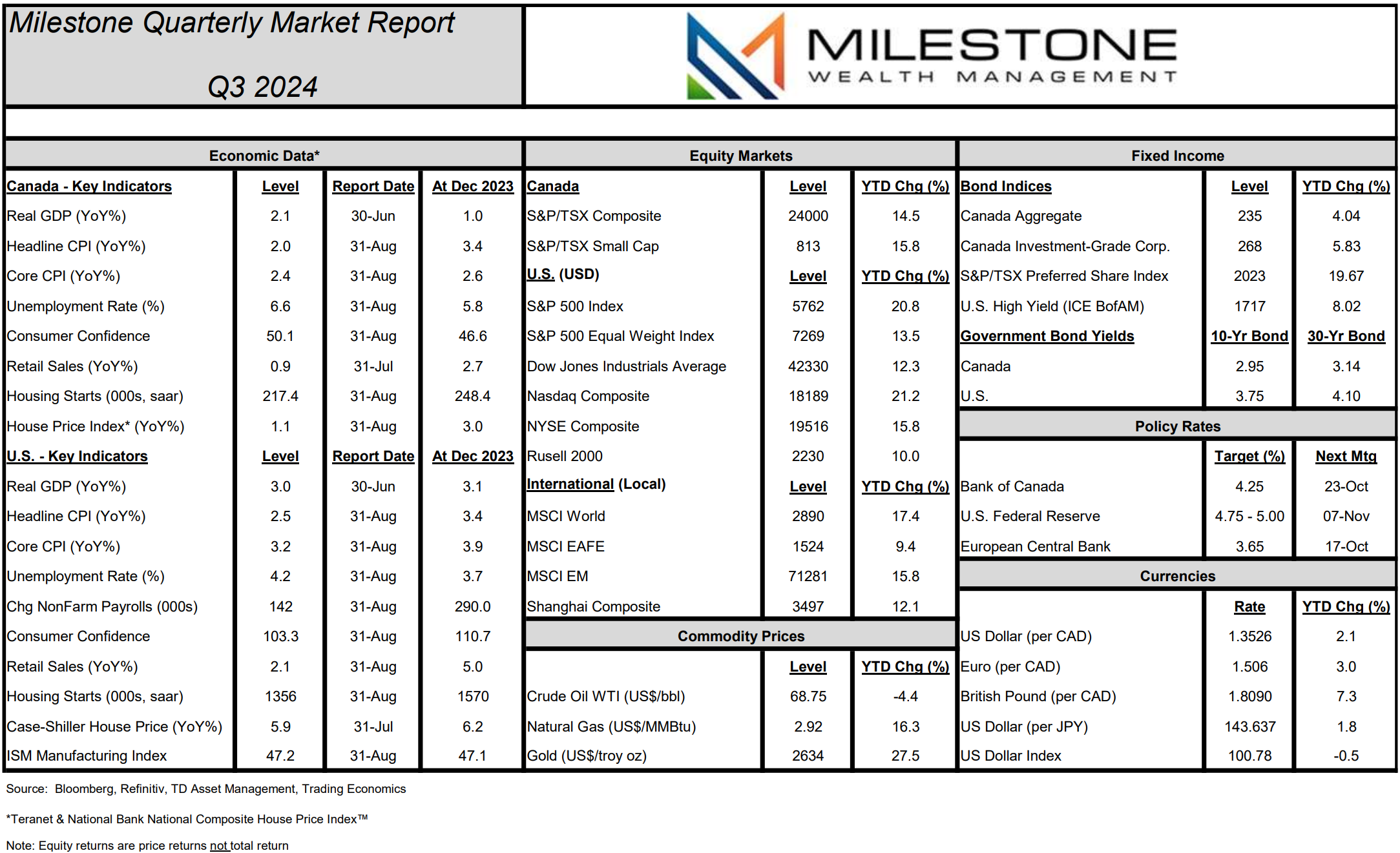

Investors expect the Fed to cut interest rates at its two remaining meetings this year, with further reductions expected throughout 2025. Figure 1 below uses Fed funds futures to show the market’s rate-cut expectations. The market expects an additional 0.50% of rate cuts by the end of this year, followed by another -1.50% by the end of 2025. Investors are betting that the combination of falling inflation and rising unemployment will cause the Fed to implement significant rate cuts. History indicates that the actual timing and amount of rate cuts will depend on the economy’s path. A weaker economy would justify more rate cuts, while a stronger economy could require fewer rate cuts. Next, we will examine how the Fed’s interest rate hikes have affected the economy over the last 18 months.

Analyzing the Impact of the Fed’s Interest Rate Hikes on the U.S. Economy

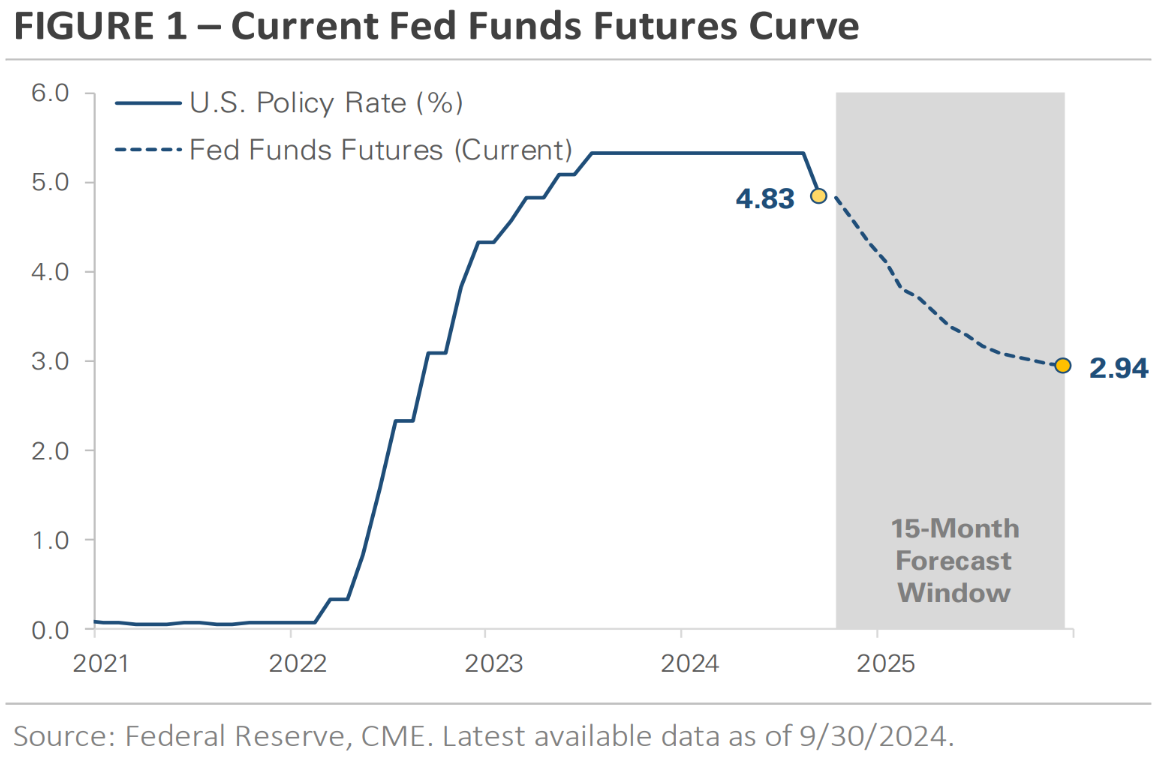

Figure 2 below graphs four economic indicators that offer insight into the current state of the U.S. economy: manufacturing PMI, housing starts, consumer credit, and retail sales. To show the impact of interest rate hikes, the start of the Fed’s tightening cycle in March 2022 is marked on each chart.

The first chart shows the Manufacturing PMI (Purchasing Managers' Index), a key gauge of manufacturing activity. Values above 50 indicate expansion, while those below 50 signal contraction. The pandemic triggered a sharp decline in manufacturing, followed by a strong recovery in 2021. However, since the Fed began raising interest rates, the PMI has steadily declined and remained below 50. This suggests the manufacturing sector is contracting, with higher interest rates likely putting downward pressure on the industry.

The second chart tracks the number of new residential construction projects, an important leading indicator and a key measure of housing market health. After dropping early in the pandemic, housing starts rebounded through early 2022. However, as the Fed raised interest rates, the number of housing starts declined. This downward trend reflects the impact of higher mortgage rates, which have reduced affordability and dampened construction activity.

The third chart tracks the year-over-year change in consumer credit outstanding. This metric provides insight into the willingness of consumers to take on new debt. Loan growth surged during the pandemic, fueled by fiscal stimulus, low interest rates, and rising wages. However, since the Fed began raising rates, loan growth has flatlined. Slowing loan growth can be a sign that consumers are less willing or able to borrow due to higher interest rates, which can curb purchases of interest-rate-sensitive goods like homes, autos, and boats.

The fourth chart graphs retail sales. Consumer spending is a key driver of economic growth since it’s the largest portion of GDP. Retail sales plummeted as the economy shut down in the pandemic, but spending rebounded sharply in late 2020 and 2021. While retail sales growth has slowed with rising interest rates, it remains positive, indicating that consumer spending is holding up relatively well despite higher rates. The consumer’s willingness to keep spending has been a source of strength and economic resilience.

Together, these data points reveal the effect of rate hikes on the economy. Higher interest rates appear to be weighing on manufacturing, housing, and loan growth. However, the main engine of the economy, the consumer, continues to spend. The data suggests that the current level of interest rates is restrictive, and the Fed’s goal in lowering rates is to stimulate interest-rate-sensitive sectors and prevent a deeper slowdown. Economists will monitor these data points in the coming months and quarters to gauge the impact of the Fed’s interest rate cuts on the economy.

Financial Markets Experience Increased Volatility

In early August, the stock and bond markets experienced significant volatility. Signs of investor angst started to appear during earnings season in July, when investors raised concerns about the high costs of developing artificial intelligence (AI) and whether future revenues would justify the expensive investments. A few weeks later, investors were spooked as unemployment rose from 4.1% to 4.3%. Investors worried the Fed had waited too long to cut rates and risked tipping the U.S. economy into a recession that could be hard to reverse.

This sudden surge in market volatility caused investors to sell stocks and buy bonds, leading to a significant deleveraging event across global financial markets. The S&P 500 Index traded down nearly -8% from mid-July through the first week of August. However, the volatility was short-lived, and the index rebounded to end August with a modest gain. There was some residual volatility in early September as investors returned from summer break, but the equity market again recovered quickly and set a new all-time high later in the month. The rise in market volatility marks a significant shift from the past 12 months of steady S&P 500 gains, but so far, investors have brushed it aside.

Equity Market Recap – Stocks Trade Higher as Investors Rotate Within the Market

Despite the volatility, the S&P 500 Index and the S&P/TSX Composite set new all-time highs in 3Q24. However, it was the change in stock market leadership that made headlines. The Equal-Weighted S&P 500, the Russell 2000 (small-mid caps), and the Value factor all outperformed the S&P 500, while the Growth factor underperformed. A similar pattern occurred at the sector level, with underperformers from the first half of 2024 outperforming in 3Q24. Interest-rate-sensitive U.S. sectors outperformed in anticipation of rate cuts, with the Utility and Real Estate sectors both gaining over +17%. Cyclical sectors, including Industrials, Financials, Consumer Discretionary, and Materials, also outperformed the S&P 500. In contrast, the Technology sector lagged the market rally, ending the quarter flat after outperforming in the first half of the year.

Two key events, the Fed's first interest rate cut in September and growing concerns about AI's profitability, led to the change in market leadership in 3Q24. In the first half of 2024, uncertainty around Fed policy and concerns about the economy pushed investors toward large-caps and AI stocks. Meanwhile, smaller companies underperformed due to worries about their sensitivity to higher interest rates. With the Fed now officially cutting interest rates and doubts emerging about AI's monetization potential, investors sought out new investment opportunities in 3Q24.

International stocks outperformed U.S. stocks in 3Q24 for the first time in seven quarters. The MSCI Emerging Market Index gained +7.7%, outperforming the S&P 500 by almost +2%. The MSCI EAFE Index of developed market stocks also outperformed the S&P 500, returning +6.8%. International stocks benefited from two themes: a weaker U.S. dollar and AI companies’ underperformance during the stock market rotation. However, despite outperforming in 3Q24, the two major international indices are still underperforming year-to-date due to their lack of exposure to AI stocks.

Credit Market Recap – Bonds Trade Higher in Anticipation of Interest Rate Cuts

In 3Q24, bonds traded higher as investors prepared for the start of the Fed’s rate-cutting cycle. The 10-year Treasury yield fell from 4.37% at the end of June to 3.79% at the end of September. The 2-year yield, which is a proxy for investors’ rate cut expectations, fell from 4.72% to 3.64% over the same period. Canada’s own 2-year Gov’t bond yield fell off a cliff, dropping from 4% to 2.91%, signaling even more rate cuts here than the U.S and indications of a weaker economy here. Falling yields provided a boost to bond prices overall (yields and prices have a reciprocal relationship), but there was an interesting dynamic within the credit market. The top two performing corporate bond groups were on opposite ends of the rating spectrum, but their returns were both linked to the start of rate cuts.

On one end, U.S. CCC-rated bonds, the lowest-rated and most sensitive to economic conditions, produced a total return of over +11% as corporate credit spreads tightened. The group’s outperformance suggests that investors expect interest rate cuts to stimulate economic growth and make refinancing easier. On the other end, AAA-rated bonds, the highest quality and most sensitive to interest rate changes, gained over +6% as the market priced in the first rate cut and yields fell. Together, the two groups’ outperformance indicates that investors expect rate cuts to boost economic growth and relieve pressure on highly leveraged companies.

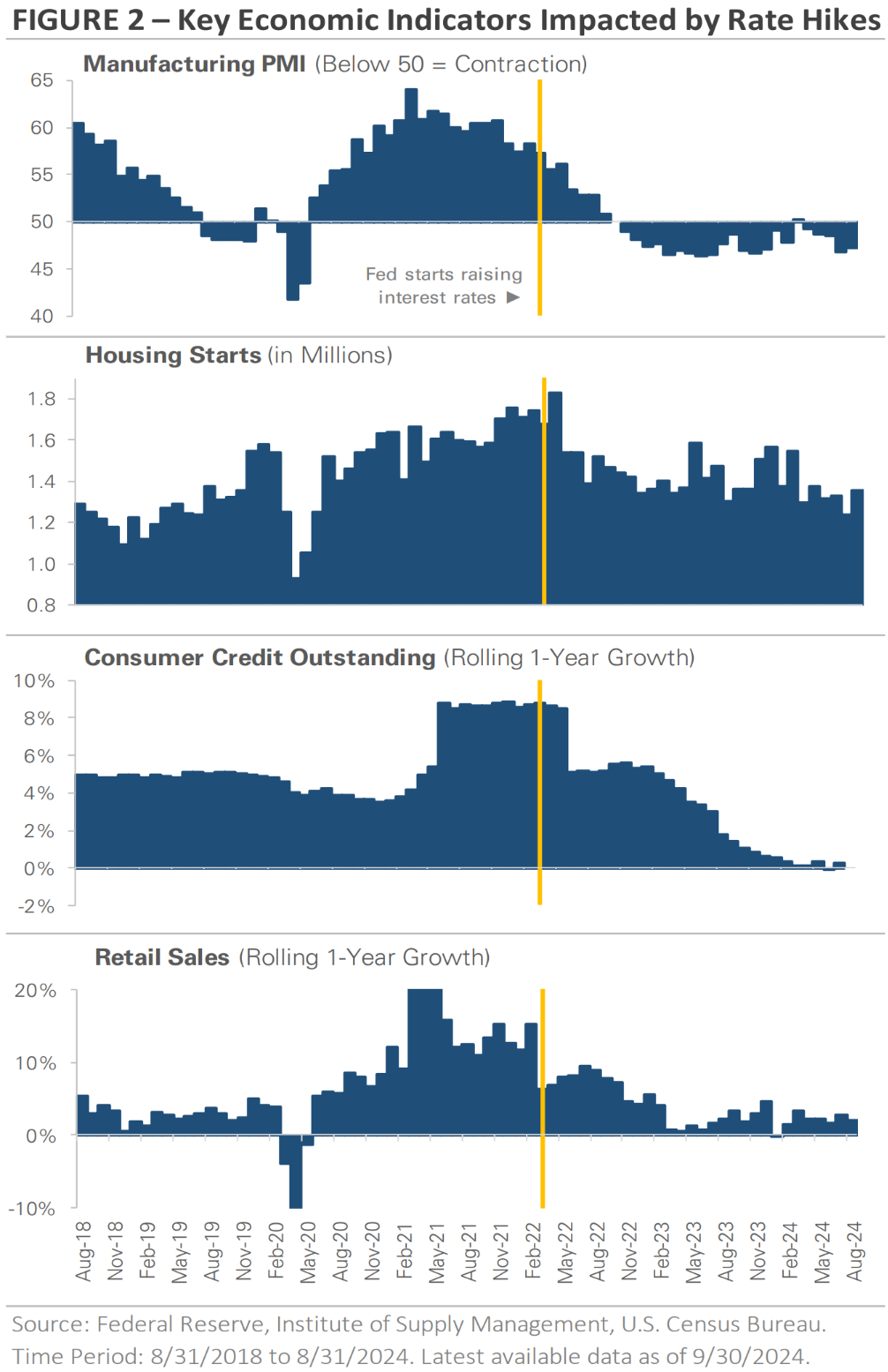

Credit spreads, which measure the difference in yield between two bonds of similar maturity but different credit quality, remain tight by historical standards and potentially indicate limited relative upside price opportunities. Figure 3 next graphs the credit spreads for U.S. corporate investment grade (IG) and high yield (HY) bonds over the past 20 years. The IG spread stands at 0.92%, meaning that investors are earning an extra +0.92% of yield by owning IG over similar Treasury bonds. Since 2004, the median IG spread has been 1.35%. The situation is similar for HY bonds, where the current spread is 3.14% compared to a median of 4.37%.

The takeaway is that corporate bond investors are receiving less yield compensation for taking on corporate credit risk compared to the past 20 years. Credit spreads are often used to gauge financial conditions and investor sentiment toward the economy. Today’s tight spreads signal economic stability, strong market liquidity, investor willingness to buy risky assets, and low perceived default risk.

Fourth Quarter Outlook – Themes to Watch

With the Fed beginning to lower interest rates, investors are focused on what happens next. The two key questions are how much the Fed will cut interest rates and how the economy will respond to those rate cuts. The next six months will be critical in providing answers to these questions, and investors will analyze each economic data point for clues about the economy’s trajectory. This intense focus on economic data may have the unintended consequence of keeping market volatility elevated as investors flip between optimism and pessimism.

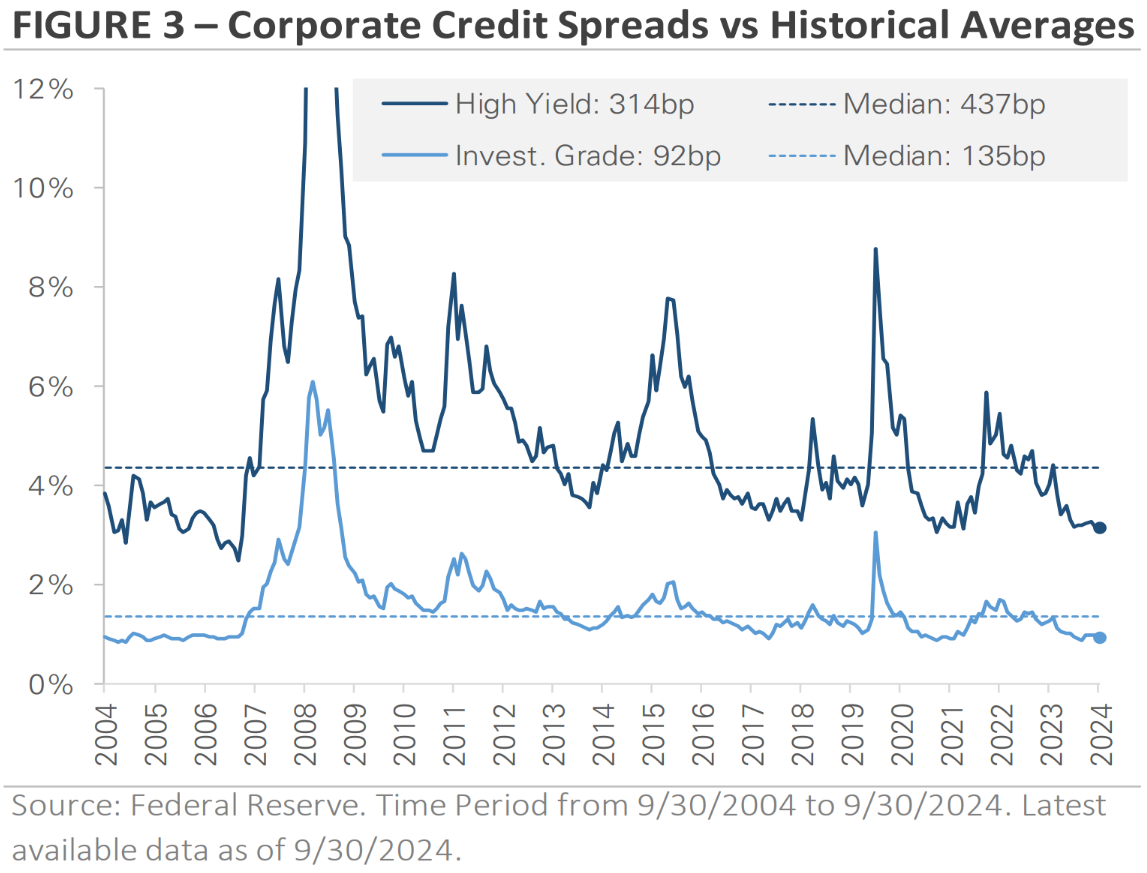

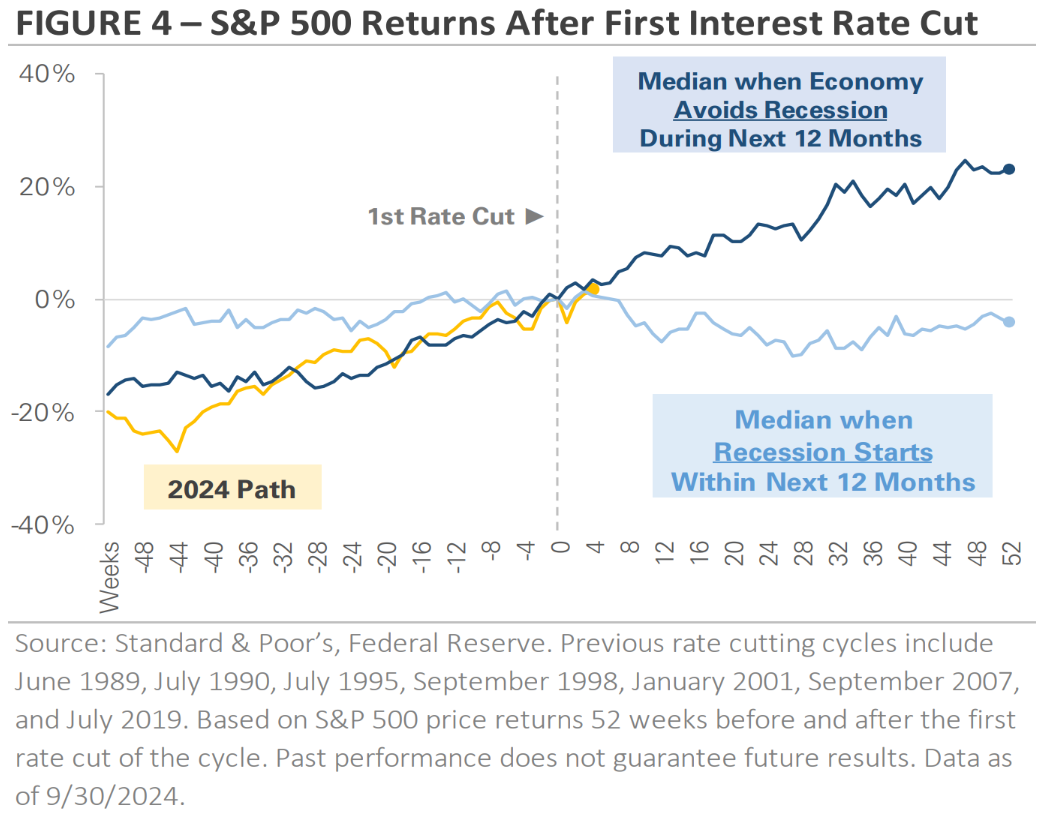

The next chart demonstrates why the economy’s direction is important. Figure 4 tracks the S&P 500’s performance in the 12 months before and after the first interest rate cut. It features two paths. The dark blue line represents the S&P 500’s median return path when the economy avoids a recession in the 12 months following the first rate cut. The light blue line represents the S&P 500’s median return path when the economy enters a recession within 12 months after the first rate cut. For comparison, the two lines are indexed to 100 the week of the Fed’s first interest rate cut.

Historically, the S&P 500 has performed very differently depending on whether the economy falls into a recession after the first rate cut. When rate cuts stimulate economic growth, the S&P 500 gains an average of +23% over the next 12 months. However, if a recession follows, the S&P 500 produces an average return of -4%. Our team will monitor economic data in the coming months to see what impact interest rate cuts have on the economy. At present, our Milestone Recession Risk Composite continues to show a low probability that the U.S. has entered or will enter a recession in the next three months.

As we wrap up this quarter’s market update, we want to briefly touch on the upcoming presidential election. With the election quickly approaching, you may be wondering how the outcome will affect financial markets and whether you should change your investment strategy. Political views can stir strong emotions but making investment choices based on those feelings can lead to poor portfolio decisions. Data suggests that whichever party occupies the White House, this has little to no impact on long-term investment performance, with fundamental factors like corporate earnings growth and valuations, as well as exogenous factors like inflation, impacting the stock market far more than political headlines. The U.S. economy’s success, growth, and resiliency don’t change with each new election, and neither should our long-term investment strategy.

Thank you for your continued trust in Milestone and for the opportunity to assist you in working toward your financial goals. We understand the risks facing both the markets and the economy and are committed to helping you effectively navigate this unique and at times challenging investment environment. Successful investing is a marathon, not a sprint, and even intense volatility is unlikely to alter a diversified approach set up to meet your long-term investment goals. Therefore, it’s critical to stay invested, remain patient, and stick to the plan, as we’ve worked with you to establish a unique, personal allocation target based on your financial position, risk tolerance, and investment timeline.

Here is our Milestone Quarterly Market Report on economic data, capital markets, commodities, and currencies through September 30th, 2024:

Disclosure:

Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner, or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.

Sources: Bloomberg, Refinitiv, TD Asset Management, Trading Economics, Teranet, and National Bank of Canada, Barchart, MarketDesk Research LLC, Standard & Poors, MSCI, Dow Jones, Federal Reserve and various Central Banks, CME, Institute of Supply Management, U.S. Census Bureau

©2024 Milestone Wealth Management Ltd. All rights reserved.