Market Insights: Gold's Glittering Ascent

Milestone Wealth Management Ltd. - Sep 27, 2024

Macroeconomic and Market Developments:

- North American markets were slightly positive this week. In Canada, the S&P/TSX Composite Index was up 0.37%. In the U.S., the Dow Jones Industrial Average increased 0.59% and the S&P 500 Index rose 0.62%

- The Canadian dollar was up this week, closing at 74.0 cents vs 73.7 cents last week.

- Oil prices were down this week. U.S. West Texas crude closed at US$68.57 vs US$71.92 last week.

- The price of gold continued to climb this week, closing at US$2,674 vs US$2,644 last week.

- Canadian Real GDP was up 0.2% in July, following essentially no change in June. Early information indicates that Real GDP was flat in August. Economists are forecasting Q3 growth to come in at 1.0%, well below the Bank of Canada's estimate of 2.8%.

- In the U.S., inflation moved closer to the Fed’s 2% target last month, leaving room for more potential interest rate cuts. The Personal Consumption Expenditures (PCE) price index rose 0.1% for the month, and 2.2% from a year ago. The Core PCE also increased by 0.1% and was up 2.7% year over year.

- The Wall Street Journal reported that Qualcomm (QCOM) approached Intel (INTC) about the possibility of making a takeover offer. If a deal materialized, it would be the largest deal ever in the chip industry.

- Nvidia (NVDA) shares got a lift this week after headlines surfaced that CEO Jensen Huang has finished selling company stock under a pre-announced trading plan. Huang reportedly sold shares from June 14 through September 13 at prices ranging from $91.72 to $140.24, grossing approximately $713 million from the sales.

- Canadian tech company Lightspeed Commerce (LSPD) confirmed that it is currently conducting a strategic review of its business and operations, effectively putting the company up for sale.

- Former CEO of Alameda Research Caroline Ellison has been sentenced to two years behind bars with three years probation for her role in the fraud that led to the collapse of cryptocurrency exchange FTX. Along with the jail time, she would also have to forfeit about $11 billion.

Weekly Diversion:

Check out this video: Best Shot Ever

Charts of the Week:

The precious metal that has captivated humanity for millennia is once again stealing the spotlight in 2024. Gold is on an impressive streak, poised for its sixth consecutive day of gains and fifth straight record closing high. This remarkable performance comes on the heels of the Federal Reserve's recent rate cut, demonstrating gold's enduring appeal as a safe haven asset.

Gold's journey to new heights is particularly noteworthy when viewed through a historical lens. Since 1976, all-time highs in gold prices have been relatively rare occurrences, gracing just 2% of all trading days. These record-breaking moments have typically clustered around three distinct periods and are shown by the red highlighted portion of the chart below:

- Late 1970s to early 1980: The first major surge

- Post-Financial Crisis era: From 2008 until its 2011 peak

- 2020 onwards: A brief new high during COVID, then the new current bull run of 2024

Source: Bespoke Investment Group

Interestingly, gold experienced a 25-year drought without any new records between the first and second periods. The 2008 financial crisis and subsequent zero-interest rate policy from the Fed sparked a renewed interest in gold, leading to a series of new highs until late 2011, until it stalled out for another decade.

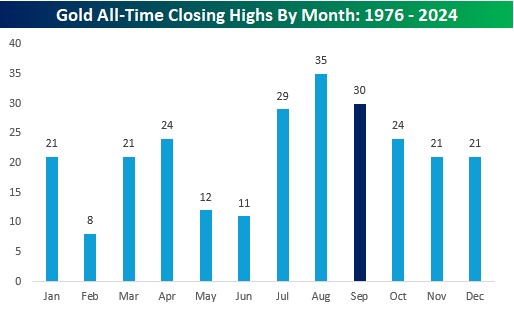

This year has been nothing short of extraordinary for gold. Consider these eye-opening statistics:

- 36 new closing highs (averaging once a week)

- 14% of all record closing highs in gold's history have occurred in 2024 alone

- September has seen 6 new records, catapulting it to second place for the month with the most all-time highs

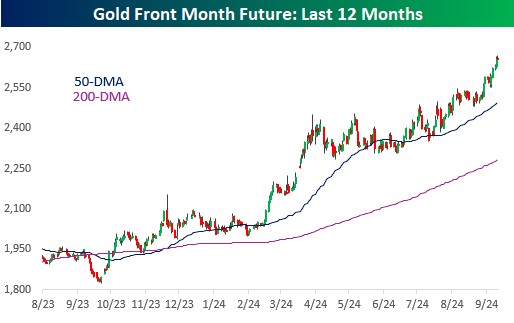

The next chart below demonstrates gold’s front month futures price over the past 12 months as well as the 50-day moving average (DMA) and the 200-DMA. As we can see, gold surged earlier in the year before trading in a sideways range from April through July. Investors starting piling back into the inflation hedge shortly after, hitting multiple new highs in September.

Source: Bespoke Investment Group

Several factors are contributing to gold's stellar performance:

- Fed's Easing Cycle: The certainty of a new easing cycle has investors flocking to gold as an inflation hedge.

- Economic Uncertainty: Global economic concerns continue to bolster gold's safe-haven status.

- Diversification: Investors are using gold to balance their portfolios amidst market volatility.

It is worth noting that gold's September performance stands in stark contrast to the S&P 500 Index. While September is typically a weak month for stocks, it has become a powerhouse for gold. This divergence highlights gold's unique role in the financial ecosystem. The last chart shows gold’s all-time closing highs by month since 1976, and as we can see, September ranks second only to August for the number of all-time closing highs.

Source: Bespoke Investment Group

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Bespoke Investment Group

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.