Market Insights: The Long-Awaited Rate Decision and Recession Risks

Milestone Wealth Management Ltd. - Sep 20, 2024

Macroeconomic and Market Developments:

- North American markets were positive this week. In Canada, the S&P/TSX Composite Index rose 1.27%. In the U.S., the Dow Jones Industrial Average increased 1.62% and the S&P 500 Index was up 1.36%

- The Canadian dollar was up slightly this week, closing at 73.7 cents vs 73.6 cents last week.

- Oil prices were also positive this week. U.S. West Texas crude closed at US$71.92 vs US$69.22 last week.

- The price of gold jumped this week, closing at US$2,644 vs US$2,609 last week.

- All eyes were locked on the U.S. Federal Reserve this week. On Wednesday, the central bank elected to lower its key overnight borrowing rate by 0.50% to a range of 4.75% - 5.0%. Outside of the emergency rate cuts during Covid, the last time the FOMC cut by half percent was in 2008 during the global financial crisis.

- Canadian inflation for August was released on Tuesday. The Consumer Price Index (CPI) rose 2.0% in August from a year ago, the slowest pace since February 2021 and down from the 2.5% rate from July to July. The Bank of Canada’s two core inflation measures also fell, averaging a 2.35% yearly pace.

- Oracle’s stock price has been on a run lately, leading Larry Ellison, Oracle founder and 98% owner of the Hawaiian island of Lanai, to briefly become the world’s second richest person. Amazon founder Jeff Bezos reclaimed the second spot by a small margin, but both still trail Elon Musk by a modest ~$50 billion.

- Rogers Communications (RCI.b) has agreed to acquire Bell's 37.5% stake in Maple Leaf Sports & Entertainment for $4.7 billion, giving it 75% ownership of the sports conglomerate. MLSE owns owns the NHL Maple Leafs, NBA Raptors, CFL Argonauts, MLS Toronto FC and AHL Marlies.

- Constellation Energy (CEG), the biggest U.S. operator of reactors, announced plans to restart the Unit 1 reactor at Three Mile Island, renaming the plant the Crane Clean Energy Center. They will invest $1.6 billion to revive it and sell all the output to Microsoft (MSFT), who is seeking a carbon-free electricity for data centers to power the AI boom. In other news, Microsoft announced a quarterly dividend raise of 10% and unveiled a new $60 billion stock-buyback program.

Weekly Diversion:

Check out this video: ATM Dispenses Kitten

Charts of the Week:

This week, the U.S. Federal Reserve (Fed) made headlines by cutting interest rates for the first time since the early days of the COVID-19 pandemic. On Wednesday, the Fed announced a reduction of 0.50 percentage points, bringing the federal funds rate down to a new target range of 4.75% to 5.00%. This decision was more aggressive than some analysts had anticipated, with mixed speculation leading up to the meeting focusing on a potential cut of either 0.25 or 0.50 basis points(bps).

Fed Chair Jerome Powell explained that the decision stemmed from a combination of cooling inflation and some signs of an economic slowdown, particularly within the labor market. The Fed appears to be prioritizing employment support over inflation concerns at this juncture. Looking ahead, the Fed indicated that further rate cuts may be on the horizon, with projections suggesting additional reductions later in 2024 and into 2025. Currently, the Fed Funds futures markets are pointing to another 75bps in cuts this year, and then a further 125bps in 2025. This marks a notable shift from the previous trend of rate increases aimed at combating high inflation.

Financial markets initially responded positively to the news, though some volatility ensued as investors processed the implications of such a significant cut. The Fed's decision reflects a proactive approach to stabilizing economic growth and addressing challenges in the job market.

Although economic slowdown was a factor for the Fed when making the recent rate decision, according to our own Milestone Recession Risk (MRR) Composite, the risk that a recession has started or starting next month is still relatively low with a current score of 7.5/10. For most of this year it has fluctuated between 6 and 7.5. As further incoming data arrives, this may change, so we update our rating on a weekly basis.

Our MMR Composite is comprised of 10 indicators that we believe are the most accurate in terms of signals and have provided the best lead times to U.S. recession. By using a 10-factor composite, we don’t rely on just one indicator, it is a broad array of economic and financial indicators. This is an important and objective tool that forms part of our investment management process in terms of risk management. If you would like further details on this, please don’t hesitate to ask.

Milestone Recession Risk Composite

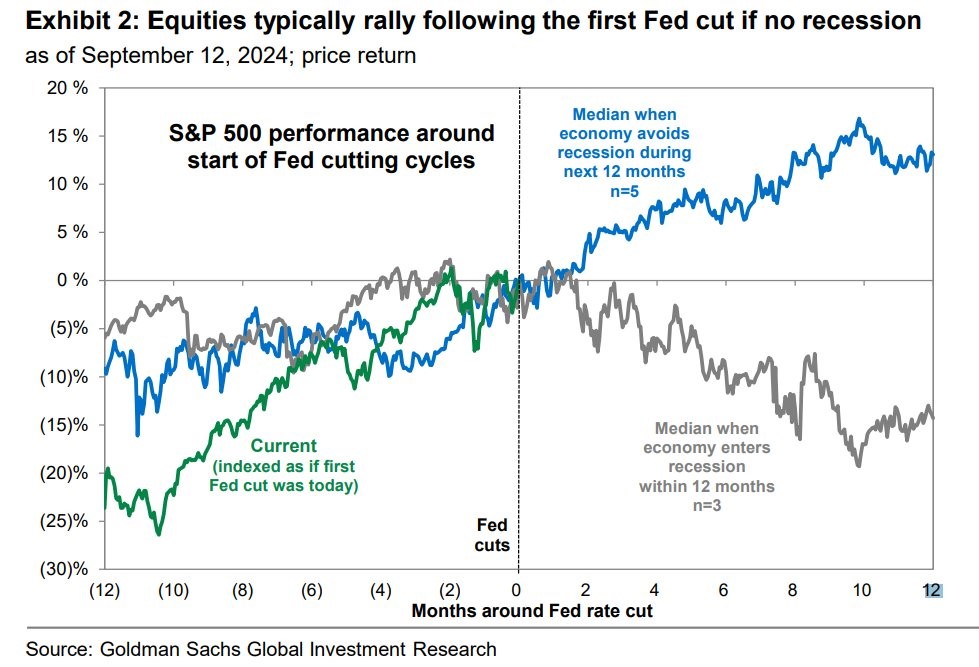

The S&P 500 Index has typically rallied in the past following the first Fed cut when no recession occurs in the next 12 months. This is what you may have heard called soft vs. hard landing. Lower borrowing costs stimulate economic activity, as businesses and consumers can access cheaper loans. This tends to boost corporate profits and consumer spending, which is generally positive for stocks. On the other hand, if it is more of an indication of a severe deterioration in economic growth and unemployed, with the Fed being ‘behind the curve’, it can also be viewed negatively. The Fed's decision to cut rates this week, along with their accompanied statement, is suggesting their confidence that inflation is under control, while allowing them to focus on supporting economic growth. This will hopefully reassure investors about the economic outlook.

Source: Goldman Sachs Global Investment Research

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Goldman Sachs Global Investment Research

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.