Market Insights: U.S. Markets Sensitive to Incoming Inflation Data

Milestone Wealth Management Ltd. - Sep 13, 2024

Macroeconomic and Market Developments:

- North American markets bounced back strongly this week. In Canada, the S&P/TSX Composite Index rose 3.46%. In the U.S., the Dow Jones Industrial Average increased 2.60% and the S&P 500 Index rallied 4.02%

- The Canadian dollar was down slightly this week, closing at 73.6 cents vs 73.7 cents last week.

- Oil prices were also up this week. U.S. West Texas crude closed at US$69.22 vs US$68.09 last week.

- The price of gold was positive this week, closing at US$2,609 vs US$2,525 last week.

- U.S. headline inflation cooled in August. The Consumer Price Index (CPI) registered 2.5% for the past year, down from 2.9% in the July-to-July period. Excluding volatile food and energy prices, the Core CPI was up 3.2% from a year ago. Meanwhile, wholesale prices, as measured by the Producer Price Index (PPI) were up 1.7% for the past year, with the Core PPI coming in at 3.3%.

- Unions have been in a strong bargaining position this year. Air Canada (AC) continues to try to negotiate with pilots to avoid a strike that could start this weekend. Meanwhile, more than 30,000 Boeing (BA) workers walked off the job early Friday after staff rejected a new labor contract and approved a strike with a 96% vote. And American Airlines (AAL) flight attendants voted to ratify a new agreement that would give cabin crews a pay hike of up to 20.5% and would pay attendants for boarding time.

- Standard & Poors announced changes to the S&P/TSX Composite Index. Bird Construction (BDT) and Triple Flag Precious Metals (TFPM) will be added to the index. Africa Oil (AOI), Ballard Power (BLDP), Canfor (CFP), Canada Goose (GOOS), and Westshore Terminals (WTE) will be removed.

- Additionally, Standard & Poors is making changes to the S&P 500 index. Software maker Palantir (PLTR) will take the place of American Airlines (AA) and computer maker Dell (DELL) is replacing Etsy (ETSY). Dell had previously been a member of the S&P 500 from 1996 to 2013, at which time the company was taken private.

- Apple (AAPL) held it’s annual September iPhone event on Monday, releasing a slightly upgraded iPhone 16, introduced a new AI platform called "Apple Intelligence", and the Apple Watch Series 10 with a larger screen.

Weekly Diversion:

Check out this video: Who is More Excited?

Charts of the Week:

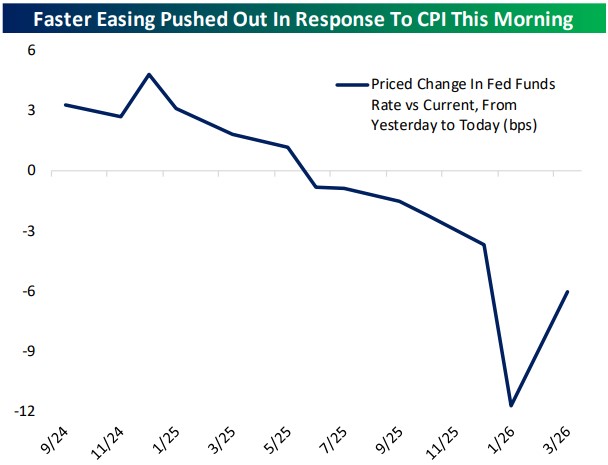

Recent economic data, particularly the Consumer Price Index (CPI) release, has prompted a shift in market expectations regarding the Federal Reserve's monetary policy trajectory. In response to Wednesday’s CPI data this week, markets adjusted their outlook in just one day, with the Fed Funds futures indicating rates could be up to 5 basis points (bps) or 0.05% higher through mid-2025 compared to pre-release projections (first chart below). However, in the near-term, this week we have actually seen the probability of a 50 bps cut increase from 30% last Friday to 47% today. This highlights the market's sensitivity to inflation data and its impact on anticipated Fed actions. Look no further than the S&P 500 Index which was down 4.25% last week, but up 4.02% this week.

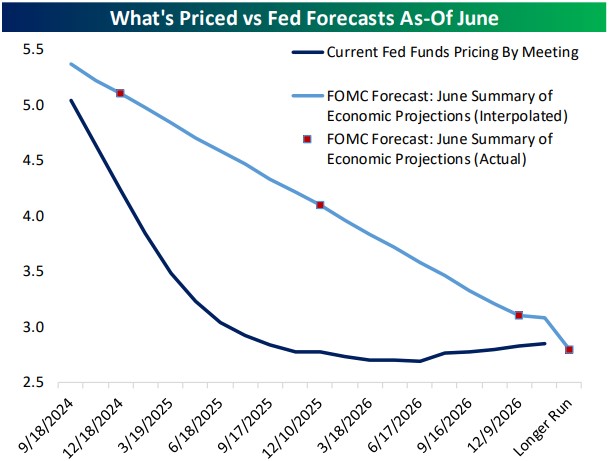

A notable discrepancy exists between current market pricing and the Federal Open Market Committee's (FOMC) June projections, as illustrated in the second chart. Despite the June Summary of Economic Projections suggesting a stronger economy than current FOMC rhetoric implies, the market is pricing the Fed Funds rate at the end of 2025 approximately to be 100 bps lower than the FOMC's June forecast. This divergence underscores the evolving nature of economic expectations and the challenges in aligning market sentiment with official projections.

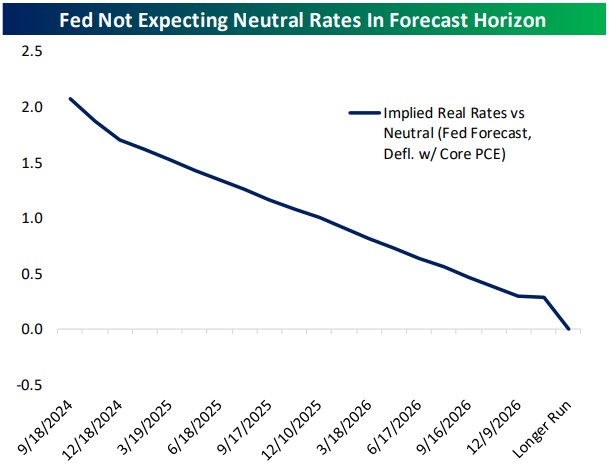

Given recent statements by key FOMC officials, including Chair Powell and Governor Waller, indicating a shift towards easing, it's anticipated that the FOMC will revise its forecasts downward at the upcoming meeting. While it's unlikely that forecasts will be adjusted to neutral levels in a single revision, a reduction of up to 50 bps in the 2025 Fed Funds rate forecast is possible as shown in the third chart. This potential adjustment reflects the FOMC's responsiveness to changing economic conditions and market expectations.

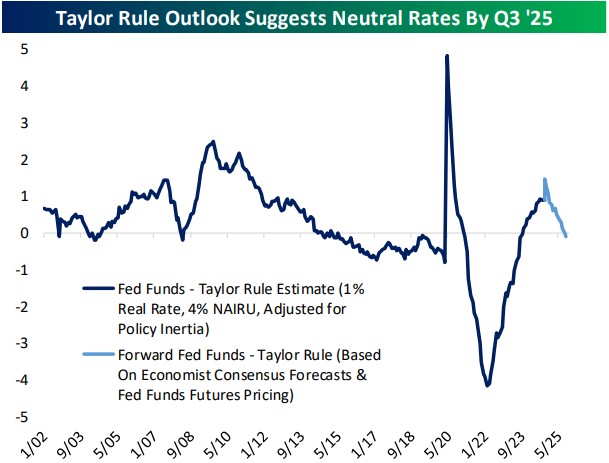

The current monetary policy stance is generally considered restrictive, with the last chart showing that the Taylor Rule suggests the current policy rate is over 100 bps too tight. The Taylor Rule is a monetary policy targeting model first developed in 1992 by economist John B. Taylor. Both economic forecasts and Fed Funds futures pricing indicate that policy is expected to remain tighter than neutral for about another year. This outlook implies that while the Fed is anticipated to ease its stance, the transition to a neutral policy is expected to be gradual, reflecting ongoing concerns about inflation and economic stability.

Source: Bespoke Investment Group

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Bespoke Investment Group

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.