Market Insights: Changing Rate Environment and Canadian Housing

Milestone Wealth Management Ltd. - Sep 06, 2024

Macroeconomic and Market Developments:

- North American markets were down this week. In Canada, the S&P/TSX Composite Index declined 2.42%. In the U.S., the Dow Jones Industrial Average dropped 2.93% and the S&P 500 Index fell 4.25%.

- The Canadian dollar was down this week, closing at 73.7 cents vs 74.2 cents last week.

- Oil prices were dropped this week. U.S. West Texas crude closed at US$68.09 vs US$73.61 last week.

- The price of gold was also down this week, closing at US$2,525 vs US$2,534 last week.

- The Bank of Canada lowered its benchmark interest rate by 0.25% on Wednesday as expected, bringing its key lending rate to 4.25%. BOC Governor Tiff Macklem said, ““First, headline and core inflation have continued to ease as expected. Second, as inflation gets closer to target, we want to see economic growth pick up to absorb the slack in the economy, so inflation returns sustainably to the two per cent target.”

- Private equity firm Birch Hill Equity Partners has signed a deal to buy Rexall Pharmacy and online retailer Well.ca from McKesson Corp (MCK). McKesson Canada purchased Rexall in December 2016 for $3 billion from the Katz Group of Companies.

- The U.S. Institute for Supply Management (ISM) Manufacturing survey came in at 47.2 for August (levels below 50 indicate contraction). The reading was below the predicted 47.9, but slightly better than July’s 46.8 level. Meanwhile, the U.S. ISM Non-Manufacturing (Services) index remained in expansion territory, increasing to 51.5 in August, slightly better than the expected 51.4.

- Oil prices suffered their biggest weekly loss of 2024, despite the announcement that OPEC+ has decided to pause its planned oil output increase for two months after a significant drop in prices due to weak demand. The group will delay boosting supply by 180,000 bpd in October and November.

- Employment numbers for August were released on Friday morning. In Canada, the economy added 22,000 jobs, with the unemployment rate rising to 6.6%, the highest level since May 2017 and up from 6.4% last month. In the U.S., nonfarm payrolls expanded by 142,000, below the 161,000 expected gain. The unemployment rate ticked down to 4.2% from 4.3% in July.

Weekly Diversion:

Check out this video: Remembering Johnny

Charts of the Week:

In late July, we posted about Calgary’s housing market and wanted to provide an update. Calgary housing market conditions are shifting away from the intense seller's market seen earlier this year. In August, the months of supply (how many months all the current homes for sale on the market would take to sell) exceeded two months, a level not observed since late 2022, due to slowing sales and increasing inventory. The market is experiencing improved supply thanks to rising new construction and an uptick in new listings. This trend is anticipated to persist for the rest of the year.

However, it's important to recognize that overall supply remains constrained, particularly for more affordable homes. While these changes are steps towards a more balanced market, the transition will be gradual. It will take time for supply levels to increase sufficiently to support more equilibrium between buyers and sellers.

Source: Calgary Real Estate Board

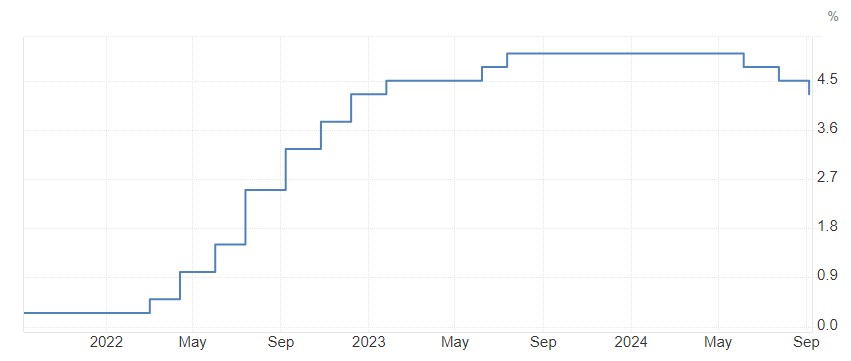

This week, the Bank of Canada cut its benchmark interest rate by 0.25% to 4.25%, marking the third consecutive rate reduction. This move has sparked discussions about its impact on Canada's real estate markets. For those with variable-rate mortgages, this relief will be reflected immediately; however, those with fixed-rate mortgages won’t see any relief until renewal. Despite the rate cuts, mortgage rates remain high, and housing affordability is still a challenge which is leaving many prospective buyers on the sidelines.

Furthermore, economists are predicting that rates will continue to fall throughout 2024 and into 2025. With the outlook of cheaper rates to come, many experts are expecting home sales to remain subdued and the housing market to face ongoing challenges in 2025 and 2026, potentially affecting resales. While the rate cuts are seen as positive, their full impact on the housing market may take time to materialize, and affordability remains a significant concern for many potential buyers.

Source: Bank of Canada, Financial Post

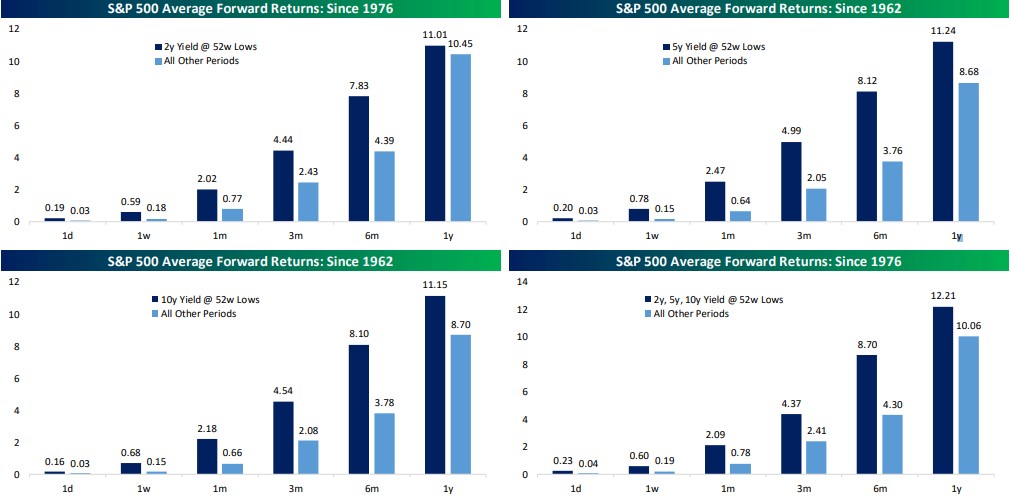

Shifting to the U.S., the Federal Reserve will make its next rate decision on Sept. 18th; however, interest rates across the United States Treasury (UST) curve have been falling, hitting 52-week lows this week. The yield curve is a graphical illustration of the relationship between interest rates and bond yields across varying maturities. New lows for yields across the UST curve have historically been associated with above-average returns for the S&P 500 over various time horizons.

When 2-year, 5-year, and 10-year rates hit 52-week lows, either individually or simultaneously, the stock market tends to outperform its average returns in the subsequent day, week, month, three months, six months, and one year, as shown in the tables below. This pattern holds true regardless of which maturity hits a new low or if all maturities reach new lows on the same day. While lower interest rates can be seen as a positive factor for equity valuations due to lower discount rates for future cash flows, they may also reflect concerns about slowing economic activity or reduced risk appetite. Despite these potential conflicting signals which may cause short-term volatility, the historical data suggests that new 52-week lows in Treasury yields have generally been followed by much stronger-than-average performance in the stock market.

Source: Bespoke Investment Group

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Bespoke Investment Group

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.