Market Insights: Swings in the 50-Day Moving Average and Future S&P 500 Returns

Milestone Wealth Management Ltd. - Aug 23, 2024

Macroeconomic and Market Developments:

- North American markets were positive this week. In Canada, the S&P/TSX Composite Index rose 1.0%. In the U.S., the Dow Jones Industrial Average increased 1.27% and the S&P 500 Index jumped 1.45%.

- The Canadian dollar was up this week, closing at 74.1 cents vs 73.1 cents last week.

- Oil prices were negative this week. U.S. West Texas crude closed at US$74.91 vs US$76.72 last week.

- The price of gold was down slightly this week, closing at US$2,546 vs US$2,547 last week.

- The rail lockout was the big story in Canada this week. Early Thursday morning, both CN Rail (CNR) and Canadian Pacific Kansas City (CP) locked out over 9,000 employees after protracted negotiations failed to produce an agreement with the union. By Friday morning, Labor Minister Steven MacKinnon had imposed binding arbitration, putting an end to the work stoppage.

- The two-day Jackson Hole Symposium wrapped up on Friday, with Federal Reserve chair Jerome Powell’s speech laying the groundwork for interest rate cuts ahead, though he declined to provide exact indications on timing or extent. Powell said “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

- Inflation in Canada continued to moderate, with the Consumer Price Index (CPI) coming in at 2.5% for July, the lowest level since March 2021. The lower CPI reinforced belief that the Bank of Canada will continue to lower interest rates in the near term.

- Canada’s Alimentation Couche-Tard (ATD.b), owner of Circle K convenience stores, has made a proposal to take over Japanese company Seven & i Holdings, owner of 7-Eleven. If completed, the ~$31 billion deal would create the world’s top convenience store operator, with roughly 100,000 locations.

- Bank earnings kicked off in Canada on Thursday, with TD Bank (TD) reporting lower than expected quarterly earnings of $2.05/share vs $2.08/share expected. The bank also booked a $2.6 billion provision for investigations related to its anti-money laundering (AML) program which, together with the provision taken last quarter, reflects the Bank's current estimate of the total fines related to this matter.

Weekly Diversion:

Check out this video: Accidentally teaching your dog to talk

Charts of the Week:

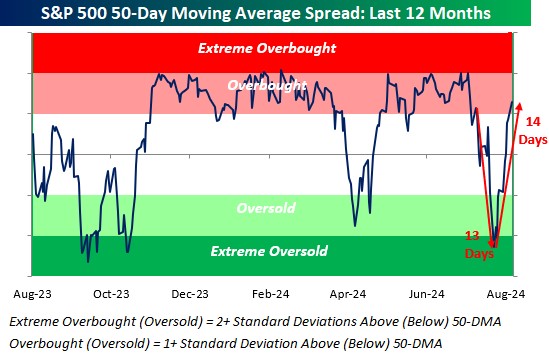

The recent performance of the S&P 500 has shown significant volatility, with the index experiencing an eight-day rally that has pushed it back into overbought territory for the first time since late July. This movement is illustrated in the chart below, demonstrating the S&P 500's 50-day moving average (DMA) spread, which is measured in standard deviations. The chart indicates that extreme overbought conditions occur when the index closes two or more standard deviations above its 50-DMA. This pattern of rapid shifts between overbought and oversold conditions is noteworthy, as the index has transitioned from extreme oversold to overbought levels in a remarkably short span, taking only 14 days to rebound from its last extreme oversold reading on July 23.

Source: Bespoke Investment Group

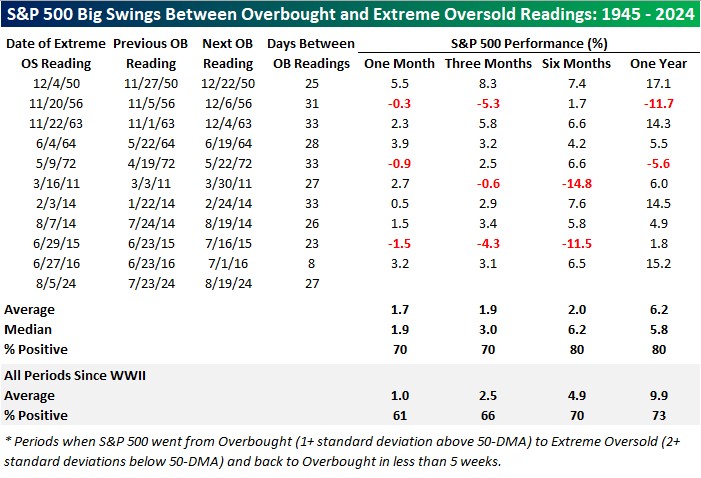

Historically, such swift transitions are rare; since World War II, there have only been ten instances where the S&P 500 has moved from oversold to extreme overbought and back to overbought within five weeks. The last of these occurrences was during the Brexit vote in June 2016, which saw an even quicker turnaround in just eight days. The frequency of these rapid swings has increased in recent years, with six of the ten occurrences since 2010. This trend raises questions about market structure and liquidity in the post-Financial Crisis era, indicating a potential shift in market dynamics.

Looking ahead, the performance of the S&P 500 following such rapid movements has been mixed. As we can see in the chart below of past cycles, while the index's one-, three-, and six-month returns following a return to overbought territory have posted more consistent positive returns as shown by the 80% positivity rate, the average returns at 6.2% falls short of the all-periods average since WWII of 9.9%. This suggests that despite the recent impressive rally, investors should exercise caution and avoid overinterpreting the speed of the market's rebound, as the long-term outlook remains uncertain and varied across different historical contexts.

Source: Bespoke Investment Group

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Bespoke Investment Group

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.