Market Insights: Calgary Real Estate Update

Milestone Wealth Management Ltd. - Jul 26, 2024

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index rose 0.55%. In the U.S., the Dow Jones Industrial Average increased 0.75% and the S&P 500 Index fell 0.83%.

- The Canadian dollar devalued this week, closing at 72.30 cents vs 72.80 cents USD last week.

- Oil prices declined this week. U.S. West Texas crude closed at US$76.88 vs US$80.26 last week.

- The price of gold also decreased this week, closing at US$2,384 vs US$2,400 last week.

- Google parent Alphabet (GOOGL) beat Q2 revenue estimates, helped by demand for cloud computing services and advertising on its search engine. Sales were $71.36 billion while net income was $1.89 per share. While Google was known to have a head start in the AI space, the company now faces questions on whether it can weather competition from the likes of OpenAI and Microsoft, who are aiming to draw people away from traditional search engines.

- Rogers Communications (RCI.B) reported a significant increase in second-quarter profit, rising to $394 million from $109 million a year ago, partially due to reduced restructuring and acquisition costs from its purchase of Shaw Communications. On an adjusted basis, earnings per diluted share were $1.16, up from $1.02 the previous year, while revenue grew to $5.09 billion from $5.05 billion, driven by gains in its wireless and media sectors.

- Visa’s (V) latest quarterly revenue narrowly missed analyst expectations, a rarity for the world’s largest payment network, who last missed revenue estimates in 2020. Revenue for the third quarter was $8.9 billion, just 0.6% shy of the average analysts’ estimate, while adjusted net income rose 4.9% to $4.9 billion or $2.42 per share, short of Wall Street’s estimate of $2.43 per share.

- Loblaw (L) reported its Q2 adjusted earnings of $2.15 per share, ahead of the average analyst estimate. Revenue was up 1.5% compared to last year, however, it fell short of expectations. Yesterday, the company agreed to pay part of $500 million to settle class action lawsuits for their role in a bread price-fixing arrangement that occurred between 2001 and 2015. George Weston will pay $247.5 million, while Loblaw will pay the balance.

- Economics

- The U.S. announced that Q2 Real GDP increased at a 2.8% annual rate in Q2, beating the consensus expectation of 2.0%, due primarily to growth from personal consumption, inventories, business investment in equipment, and government purchases.

- Also in the U.S., the Personal Consumption Expenditures (PCE) Price Index, the U.S. Fed’s preferred measure of inflation, rose 0.1% in June and is up 2.5% versus a year ago. The “core” PCE deflator, which excludes food and energy, rose 0.2% in June and is up 2.6% in the past year.

- The Bank of Canada cut interest rates for a second consecutive month by another 0.25% on Wednesday, moving the benchmark rate to 4.50%. The markets are currently pricing additional cuts before the end of this year.

Weekly Diversion:

Check out this video: Dog's Done Walking For The Day

Charts of the Week:

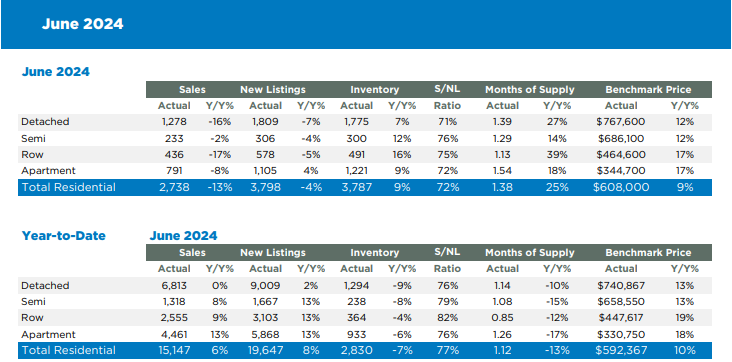

The Calgary real estate market in June 2024 showed some signs of cooling compared to the previous year where it has been red hot, with sales declining by 13% to 2,738 units as shown in the first table below from the Calgary Real Estate Board. This decrease was primarily attributed to supply challenges and rising prices in lower price ranges, particularly affecting detached homes which saw a 16% year-over-year sales decline. Despite this slowdown, overall sales remain 17% above long-term trends, indicating a still-robust market.

Source: The Calgary Real Estate Board

The market continues to favor sellers, with inventory levels increasing slightly but remaining 40% below long-term trends. The months of supply (a measure for how long it would take all current listings to sell) increased to 1.38, and although this is an increase it is still indicative of a strong seller's market (under two months). Back in March, the supply was actually under one month with a listing absorption rate of 105.2%, the tightest conditions our market has seen since 2006. In June, this listing absorption rate dropped to 72.3%, but still in the seller’s market zone. Generally, a listing absorption rate above 50% is indicative of a seller’s market, 30-50% balanced, and under 30% is a buyer’s market.

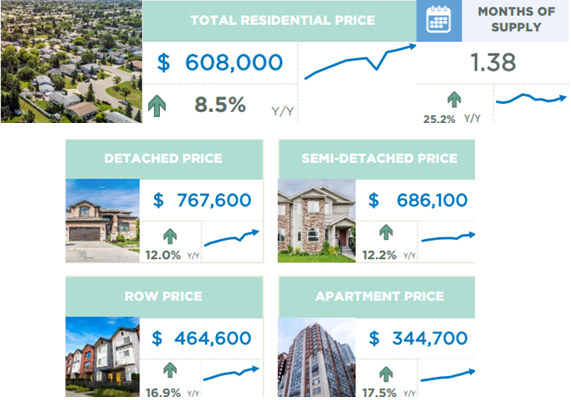

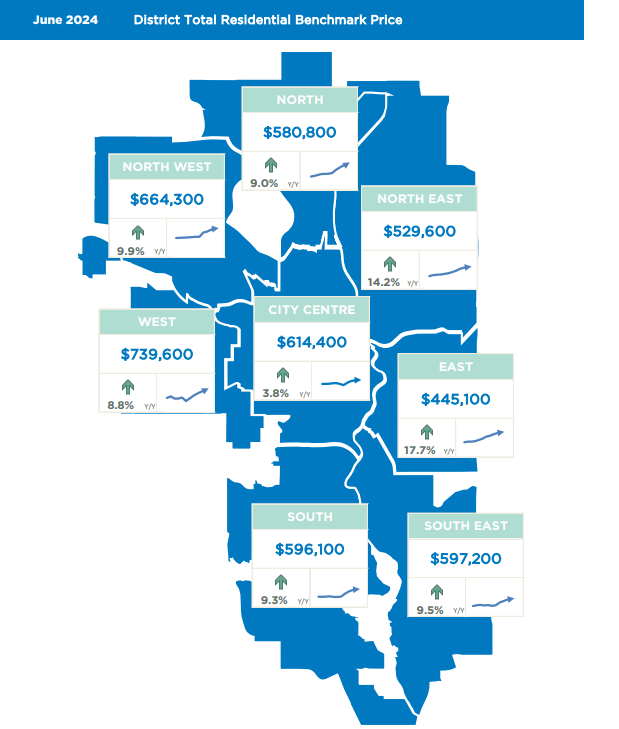

This tight supply, especially in lower price ranges, has driven further price increases across all property types and districts. The next image illustrates the benchmark price for all residential properties rose to $608,000 in June, marking an 8.5% increase year-over-year overall. apartment pricing saw the largest increase of 17.5%, followed by row pricing at 16.9%, then semi-detached and detached housing rising by 12.2% and 12.0% over the last year. Notably, the Northeast and East districts experienced the most significant year-over-year price gains as shown in the District Residential Total Benchmark Price map below.

Source: The Calgary Real Estate Board

Source: The Calgary Real Estate Board

While detached homes faced the largest sales decline, other property types showed varying results. Apartment sales declined by 7.6%, but year-to-date sales are up 13% and at record-high levels. The semi-detached and row home segments also saw declines in sales but continued to experience strong price growth. The persistent imbalance between supply and demand, particularly in the lower price ranges, suggests that the Calgary real estate market may continue to see upward pressure on prices in the near term, despite the recent cooling in sales volume. Time will also tell if the two consecutive quarter point target rate decreases by the Bank of Canada (directly impacts prime lending rate) in June and most recently this week will have an impact on future property sales and prices.