Market Insights: Rise of the Small Caps

Milestone Wealth Management Ltd. - Jul 19, 2024

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index rose slightly by 0.07%. In the U.S., the Dow Jones Industrial Average increased 0.72% and the S&P 500 Index fell 1.97%.

- The Canadian dollar devalued this week, closing at 72.80cents vs 73.30 USD cents last week.

- Oil prices waned this week. U.S. West Texas crude closed at US$80.26 vs US$82.18 last week.

- The price of gold declined slightly this week, closing at US$2,400 vs US$2,411 last week.

- A software update (isn’t it always the “update”) from CrowdStrike, a commonly used cybersecurity program, took down Microsoft systems. With Windows installed on 70% of computers, the scale of the disruption has been significant, affecting businesses in various industries across the globe. Microsoft said it is aware of the issue caused by a third-party software program and that the underlying problem has been fixed but confirmed the “residual impact is continuing to affect some Microsoft 365 apps and services.”

- Cleveland-Cliffs Inc. (CLF) has reached an agreement to acquire Canadian steelmaker Stelco Holdings Inc. for approximately C$3.85 billion (US$2.5 billion) or C$70/share. This acquisition marks Cleveland-Cliffs' first major move since its unsuccessful bid for U.S. Steel Corp. last year.

- US Bank Earnings:

- Morgan Stanley (MS) beat earnings expectations as a rebound in trading and investment banking helped the bank’s institutional securities division earn more revenue. Equity trading generated an 18% jump in revenue to $3.02 billion while fixed income trading revenue rose 16% to $1.99 billion. Investment banking revenue surged 51% to $1.62 billion, on a rise in fixed income underwriting revenue.

- Bank of America (BAC) missed estimates for net interest income in the second quarter but said the key metric would climb by the end of the year. NII, one of the bank’s biggest sources of revenue, fell to $13.7 billion in the three months through June.

- Canada’s annual inflation rate fell to 2.7 per cent in June, down from the 2.9 per cent year-over-year growth in May, Statistics Canada said Tuesday. It largely attributed the deceleration to slower year-over-year growth in gasoline prices. However, core inflation, which excludes food and energy prices that tend to be more volatile, ticked up 0.2 per cent on a seasonally adjusted basis, down from last month’s 0.3 per cent gain.

- Taiwan Semiconductor Manufacturing Co (TSM) raised its revenue growth projections for 2024 after beating quarterly profit estimates, driven by strong AI demand. TSMC, which supplies Apple and Nvidia, now expects over mid-20% sales growth and forecasts up to $23.2 billion in current quarter revenue.

- Netflix (NFLX) extended its subscription lead over rivals, topping expectations by adding 8.05 million subscribers in Q2 while raising revenue and profit margin guidance. Earnings rose 48% to $4.88 a share, exceeding the $4.74 analysts estimate. Revenue rose 17% to $9.56 billion, which was slightly ahead of expectations.

Weekly Diversion:

Check out this video: When You Drop Something Your Dog Can't Eat

Charts of the Week:

Since Wednesday, stock markets have been showing weakness, with tech stocks leading the decline. The Nasdaq closed the week down 3.65%, while the S&P 500 dropped 1.97%, the worst week in three months. The Russell 2000 (small market cap index for the U.S.) fared much better, rising 1.68% this week. Two main factors that could be contributing to this short-term tech downturn: potential tighter trade restrictions on chip companies dealing with China, and former President Trump's comments about Taiwan paying for U.S. defense against China. These developments highlight the bipartisan focus on China as a key issue.

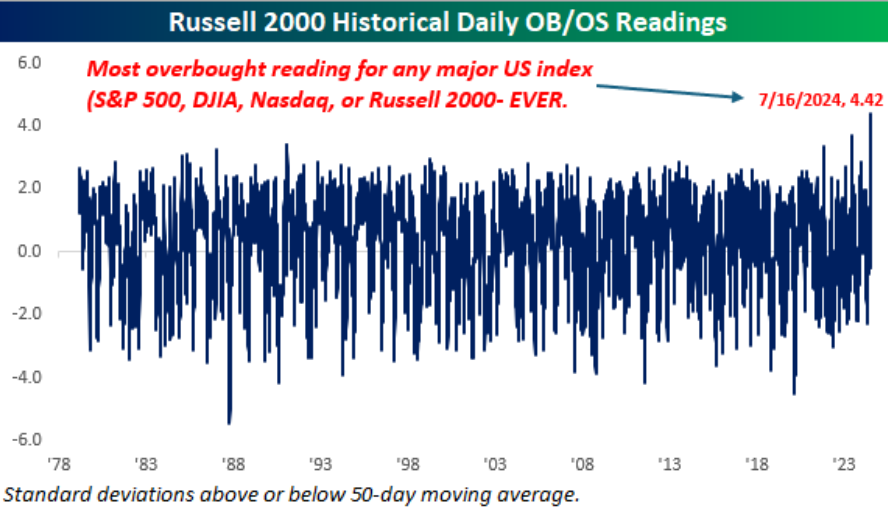

The Russell 2000 recently experienced an unprecedented rally ending on Tuesday, closing at 4.42 standard deviations above its 50-day moving average. As shown in the chart below, this marks the most overbought level in the index's history. Not only that, no other major U.S. index (Dow since 1900, S&P 500 since 1928, and NASDAQ since 1971) in history has ever closed at that much of an extreme. In the financial world, maybe this will go down as one of those ‘where were you when’ moments. Interestingly, three of the four most overbought daily readings for the Russell 2000 have occurred since November 2021, potentially due to increased large cap market concentration at the top, making the rest of the market more susceptible to extreme snapback rallies.

Source: Bespoke Investment Group

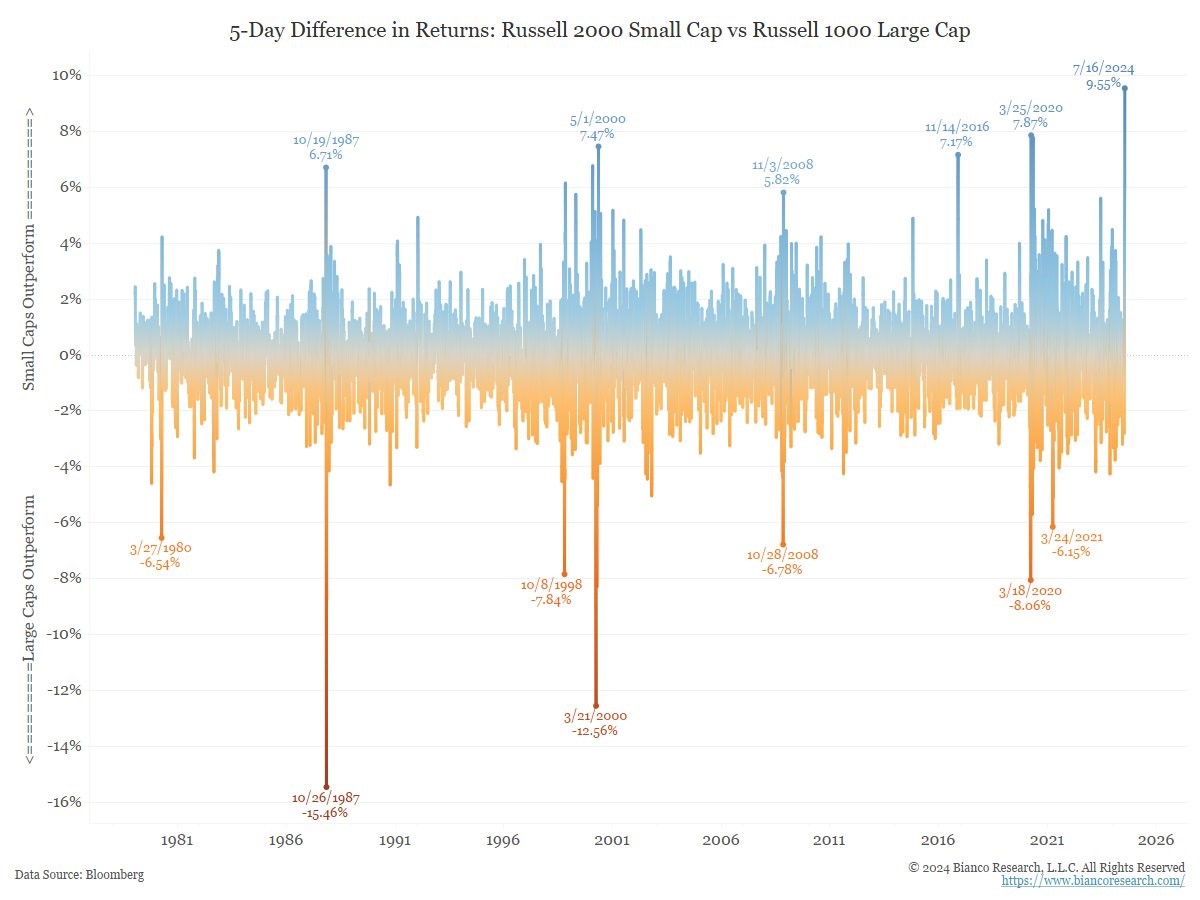

In addition to this, July 16th marked the largest 5-day difference in returns between the Russell 2000 Small Cap Index and the Russell 1000 Large Cap Index in history, coming in at 9.55%. The table below shows this new record as well as previous records dating back to 1978. This in combination with the above, could quite easily be labelled as the most unprecedented upward relative movement of small cap stocks vs. large cap stocks that we have ever seen over the span of a few days. Only time will tell if this is meaningful or not.

Source: Bloomberg, via Bianco Research LLC

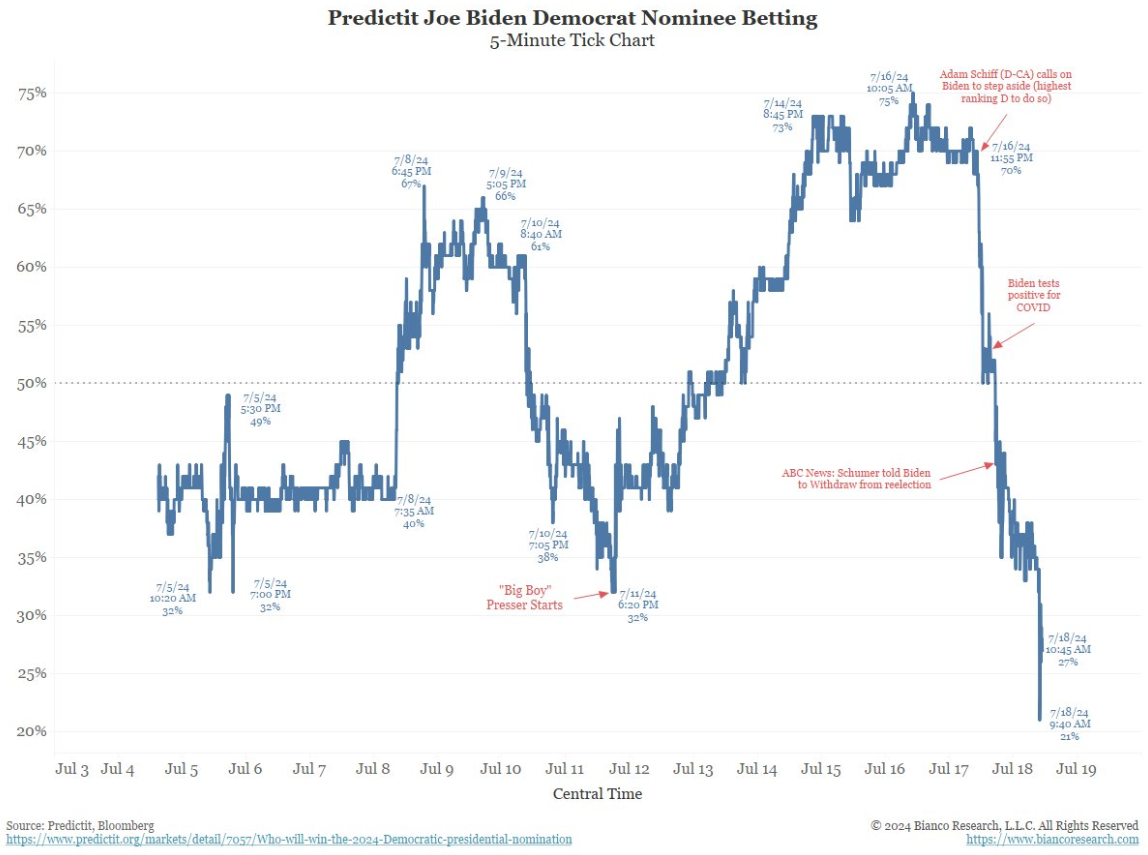

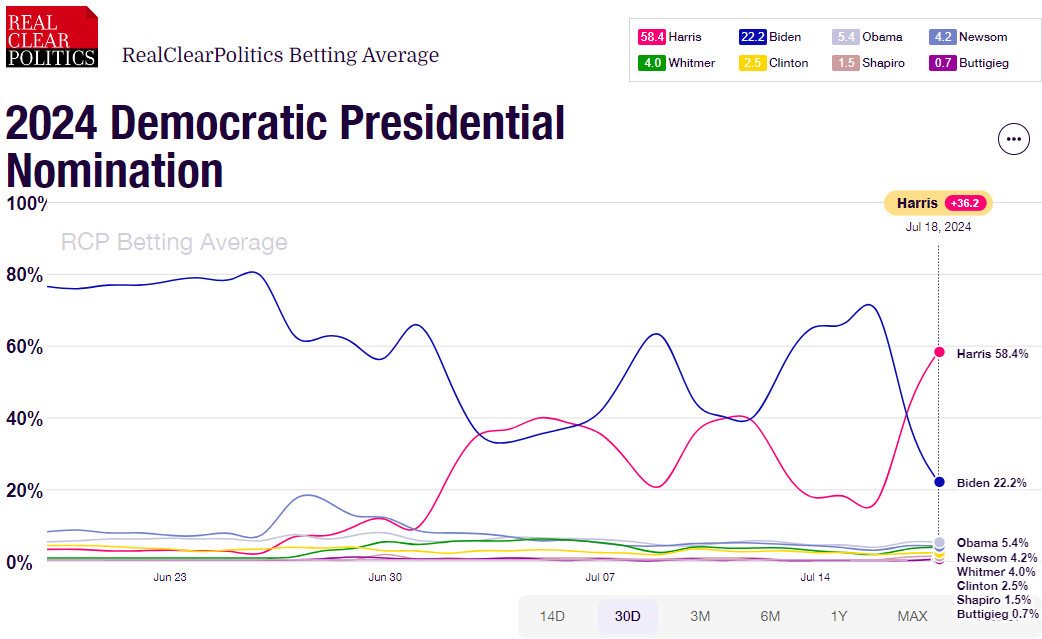

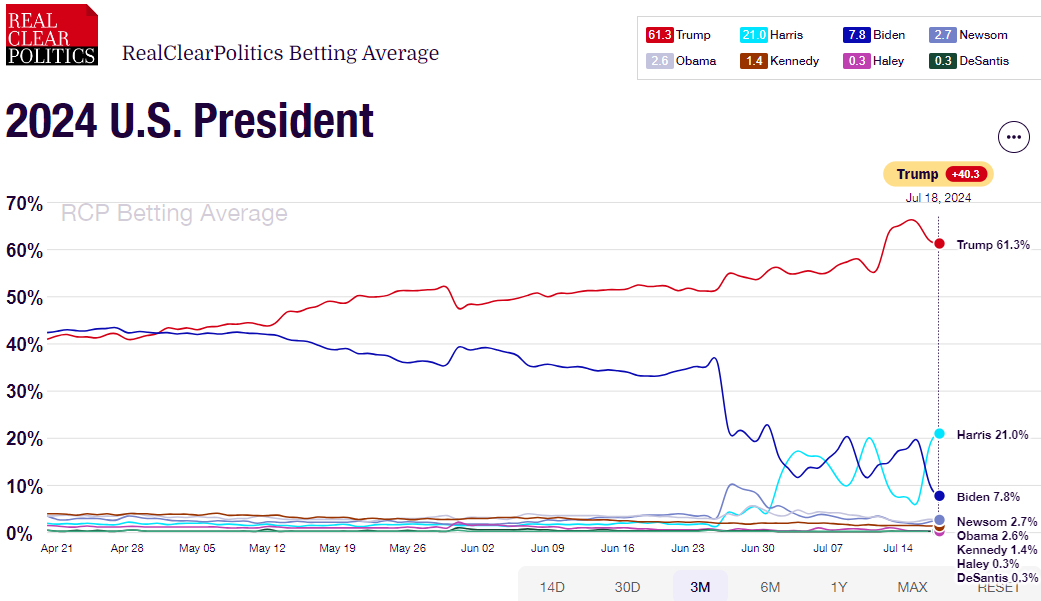

Shifting focus to the upcoming U.S. election, things are heating up with a huge change in odds for who may be the Democratic nominee for the Presidential Election, according to PredictIt.org. As of yesterday, Biden’s nominee odds had fallen from 75% just three days ago, to a new low of just 21%. This event, and the current odds for the Democratic nominee and the next U.S. President, are shown in the three charts below. It will be interesting to watch these numbers as the Democrats determine their next steps.

Source: PredictIt, Bloomberg, via Bianco Research LLC

Source: Real Clear Politics

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Bespoke Investment Group, Bianco Research LLC, PredictIt.org, Real Clear Politics

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.