Market Insights: Impact of Tech Companies on the S&P 500

Milestone Wealth Management Ltd. - Jun 21, 2024

Macroeconomic and Market Developments:

-

North American markets were mixed this week. In Canada, the S&P/TSX Composite Index decreased 0.47%. In the U.S., the Dow Jones Industrial Average climbed 1.53% and the S&P 500 Index was up 0.65%.

-

The Canadian dollar increased slightly this week, closing at 73.00 cents vs 72.82 cents USD last week.

-

Oil prices rose this week as U.S. West Texas crude closed at US$80.62 vs US$78.45 last week.

-

The price of gold declined this week, closing at US$2,322 vs US$2,331 last week.

-

May Retail Sales Stumble with Slim 0.1% Rise Despite Sports Boost: U.S. retail spending was weaker than expected in May, with sales rising just 0.1% on the month. On a year-over-year basis, sales rose 2.3%. Moderating gas prices pulled down receipts at gas stations, which reported a 2.2% monthly decline. That was offset somewhat by a 2.8% increase at sports goods, music, and bookstores.

-

Nvidia Briefly Overtook Apple and Microsoft, Becomes World's Most Valuable Company at $3.3 Trillion: On Tuesday, Nvidia (NVDA) briefly became the world's most valuable company, surpassing Apple, and Microsoft, reaching a valuation of roughly US$3.3 trillion before falling back to third by market close today. Driven by the incredible demand for AI technology and chips, the company’s stock price has surged 162.76% YTD.

-

Record Debt Strains Canadian Businesses, But New Startups Surge 30%: Canadian businesses face financial strain from pandemic loan debt, with total loans and credit hitting a record $31.9 billion and delinquency rates near historic highs, especially in retail and transportation. New installment loans surged 74% year-over-year in late 2023 as businesses transitioned from CEBA loans. Despite this, over 53,000 new businesses emerged in Q1 2024, a 30% increase from the previous year, unburdened by CEBA debt, providing a positive outlook.

-

Canadians Bet on Rate Cuts with Surge in Variable-Rate Mortgages: More Canadians are opting for variable-rate mortgages, anticipating future interest rate cuts by the Bank of Canada. In Q1, 12.9% chose these loans, up from 4.2% in Q3 2023. This shift began before the BoC cut its rate to 4.75% in June, with economists predicting a drop to 3% by the end of 2025. Buyers are betting on future rate decreases to lower long-term costs.

Weekly Diversion:

Check out this video: Two-year-old horse whisperer

Charts of the Week:

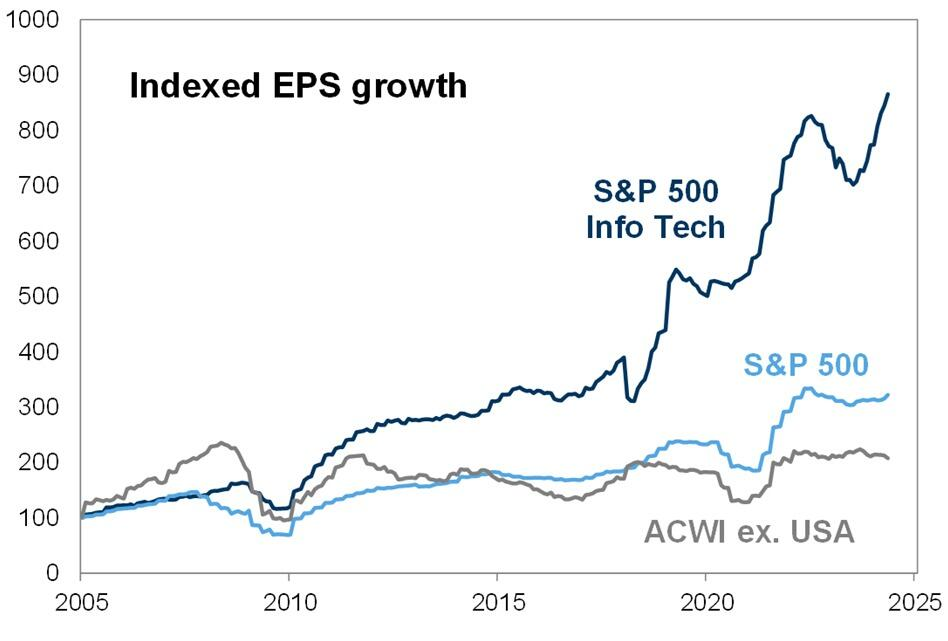

On Tuesday, Nvidia topped Microsoft as the largest company by market capitalization before falling back to third by the end of the week. More importantly, Nvidia has seen its shares increase 162.76% YTD, and along with a few other tech stocks, has driven significant gains for the S&P 500 Index. As of Monday, Nvidia alone had contributed approx. 34% of the 14% YTD return for the S&P 500, while Microsoft, Nvidia, Google, Amazon, and Meta had collectively accounted for 60% of the index’s YTD returns. Further to this, again as of Monday, these five stocks had collectively returned 45% YTD and comprised of 25% of the S&P 500 equity market cap. The first chart highlights the indexed earnings per share (EPS) growth for the S&P 500 Info Tech sector (dark blue line) vs. the S&P 500 Index, and the ACWI (All Country World Index) excluding U.S. securities. As we can see, there has been more volatility from the Info Tech sector, but we are seeing drastically higher returns, including this past year.

Source: ZeroHedge

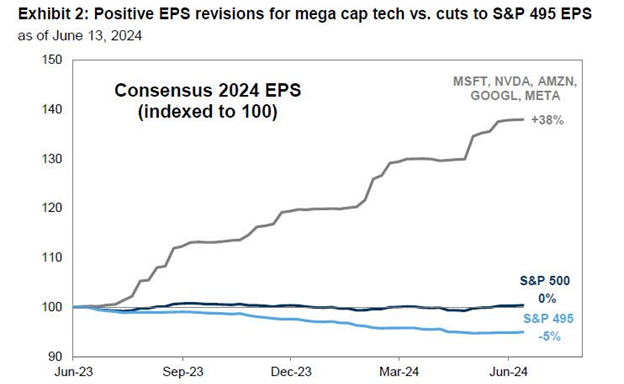

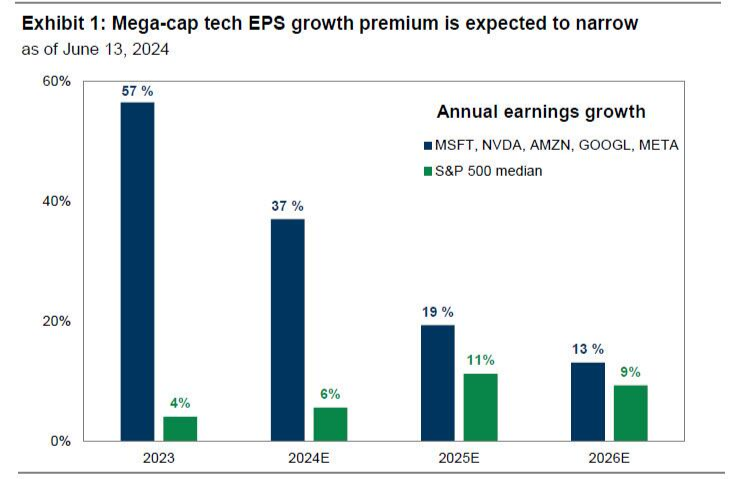

The strong Q1 earnings growth of 84% year-over-year for these five companies, compared to 5% for all of the S&P 500, has driven this outperformance. Analysts have raised their 2024 EPS forecasts for Microsoft, Nvidia, Google, Amazon, and Meta by 38%, while lowering forecasts for the other 495 S&P 500 stocks by 5% as shown in the next chart. While these Tech mega-caps are expected to have a 31% EPS growth premium over the median S&P 500 company in 2024, this gap is projected to narrow to 8% in 2025 and 4% in 2026, highlighted in the second chart below.

Source: FactSet, Goldman Sachs Global Investment Research via ZeroHedge

Source: Goldman Sachs Global Investment Research via ZeroHedge

The performance gap between the cap-weighted (each component stock is weighted according to its total market capitalization) and equal-weighted (each constituent stock is assigned the same weight) S&P 500 indices over the last two years is the widest in nearly 24 years, indicating poor market breadth. As we can see in the chart below, the red line represents the equal-weight S&P 500 index which has been relatively unchanged since the start of 2022 while the green line represents the cap-weighted S&P 500 index, showing significant gains attributed to the higher weighted, and now tech-dominated stocks of the S&P 500.

Source: ZeroHedge

The strong returns of a few stocks that are driving a major index raise concerns about the sustainability of this momentum-driven rally, as momentum reversals can be severe. The surge in valuations, rather than earnings growth, is driving the winners, which could signal a potential bubble in those companies. For this reason, it is important to maintain broad diversification to help limit significant drawdowns in the event of a correction.

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Bespoke Investment Group, FactSet, Goldman Sachs, Zero Hedge

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.