Market Insights: U.S. Inflation Data and Future Rate Decisions

Milestone Wealth Management Ltd. - Jun 14, 2024

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index decreased 1.68%. In the U.S., the Dow Jones Industrial Average dipped 0.61%, however, the S&P 500 Index was up 1.52%.

- The Canadian dollar increased slightly, closing at 72.82 cents vs 72.66 USD cents last week.

- Oil prices rose this week as U.S. West Texas crude closed at US$78.45 vs US$75.53 last week.

- The price of gold increased as well, closing at US$2,331 vs US$2,294 last week.

- U.S. Fed on hold: All eyes were once again on the U.S. Federal Reserve this week. The central bank elected to hold interest rates flat, as expected, and indicated they intend to lower interest rates once by the end of the year.

- New Entrants Boost S&P/TSX Lineup: The S&P/TSX Composite Index will welcome four new companies on June 24th, 2024: Aya Gold & Silver (AYA), CES Energy Solutions (CEU), Calibre Mining (CXB), and NFI Group (NFI) will all be added to the index.

- IFS AB Acquires Copperleaf for C$1.0B: Copperleaf Technologies Inc. (CPLF) announced it will be acquired by IFS AB for C$12.00/share in cash, valuing Copperleaf at ~C$1.0 billion. This transaction represents an 18% premium to the 10-Jun-24 closing price, a 66% premium to the 90-day average, and a 70% premium to the 3-May-24 price. This is a position held in our Growth & Income and Global Opportunities mandates.

- U.S. Inflation Steadies: May CPI Flat, Annual Rate at 3.3%: U.S. inflation continued to moderate, with the CPI coming in flat for May and increasing 3.3% from a year ago. Economists had been looking for a 0.1% monthly gain and a 3.4% annual rate. Excluding volatile food and energy prices, core CPI increased 0.2% on the month and 3.4% from a year ago, compared to respective estimates of 0.3% and 3.5%.

- National Bank to Acquire Canadian Western Bank in $5 Billion Share Swap: National Bank of Canada (NA) announced it will acquire all the outstanding common shares of Canadian Western Bank (CWB) by way of a share exchange, valuing CWB at approximately $5.0 billion. The proposed takeover will see each CWB share, other than those held by National Bank, exchanged for 0.450 of a common share of National Bank.

- Canadian Debt-to-Income Ratio Drops as Disposable Income Rises: Statistics Canada reported a decrease in Canadians' debt-to-income ratio in the first quarter of 2024. Household credit market debt dropped to 176.4% of disposable income from 178.0% in the previous quarter, meaning $1.76 in debt per dollar of income. The household debt service ratio also fell slightly from 14.98% to 14.91%, as a 1.9% rise in disposable income outpaced a 1.4% increase in debt payments.

Weekly Diversion:

Check out this video: How could you not love that job?

Charts of the Week:

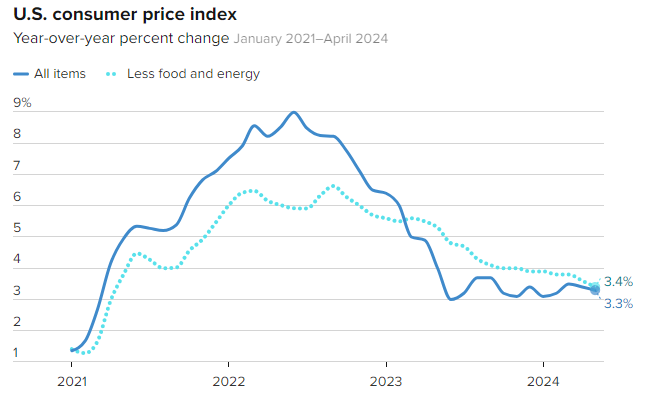

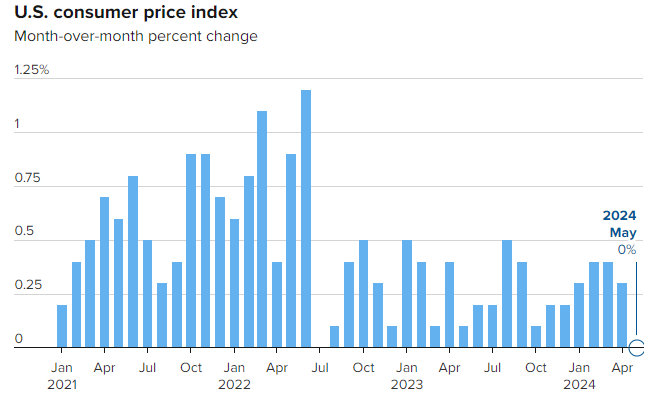

This week the U.S. Bureau of Labor Statistics announced that the Consumer Price Index (CPI) showed no increase in May, indicating a slight easing of inflation's grip on the economy. The CPI rose 3.3% annually, lower than the expected 3.4%. Excluding volatile food and energy prices, the Core CPI increased 0.2% monthly and 3.4% annually, below estimates of 0.3% and 3.5%, respectively. The first chart illustrates the year-over-year (YoY) U.S. CPI percentage change for both ‘All items’ and ‘Less food and energy’ since the beginning of 2021. The second chart highlights the month-over-month percentage change in CPI and as we can see, April 2024 was the first month over this period without an increase. This positive surprise in inflation data led to a short-term rally in stock market futures, primarily the tech sector, and a drop in Treasury yields.

Source: U.S. Bureau of Labor Statistics via CNBC

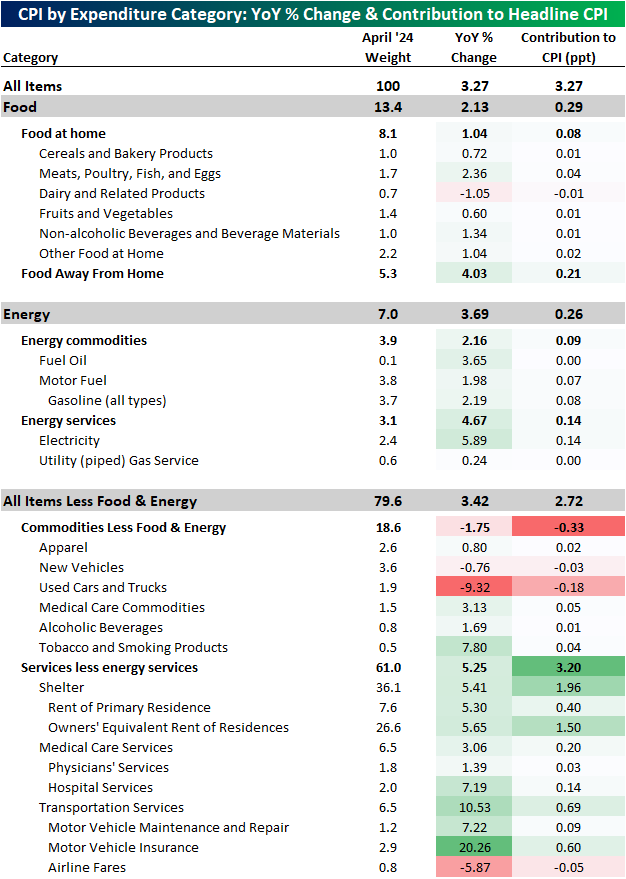

While the overall inflation numbers were lower, shelter inflation remained a concern, increasing 0.4% for May and 5.41% over the past year. Housing-related costs have been a persistent issue in the Federal Reserve's inflation battle. The non-food and energy commodity prices were a significant factor contributing to the weaker 3.27% YoY increase in the headline CPI number in May. Specifically, vehicle prices played a crucial role in this category. Used car and truck prices fell by an impressive 9.3% YoY, marking the largest decline since March of last year. This decline in used vehicle prices contributed to cooling inflation. However, the impact of lower used vehicle prices was offset by a massive 20.26% YoY increase in motor vehicle insurance prices. Although this growth rate has decelerated slightly to the slowest since December, it remains one of the most rapid insurance price growths in the past 50 years. The next chart shows the YoY changes to the various categories of the CPI report as well as their weights and contributions (in percentage points) to that 3.27% YoY increase in the headline number in May.

Source: Bespoke Investment Group

The inflation data comes at a crucial time as the Federal Reserve weighs its next moves on monetary policy. While the Fed elected to maintain interest rates after its most recent meeting on Wednesday, traders increased the odds of a rate cut in September and December following the CPI release. However, Fed officials have emphasized the need for more sustained positive inflation data before easing policy, as durable inflation has kept the central bank on the sidelines since its last rate hike in July 2023.

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Bespoke Investment Group, U.S. Bureau of Labor Statistics

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.