Market Insights: First Rate Cute and the Calgary Housing Market

Milestone Wealth Management Ltd. - Jun 07, 2024

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index dropped 0.55%. In the U.S., the Dow Jones Industrial Average increased 0.51% and the S&P 500 Index jumped 1.60%.

- The Canadian dollar fell this week in the wake of the Bank of Canada lowering the bank rate, closing at 72.66 cents vs 73.39 cents last week.

- Oil prices dropped this week. U.S. West Texas crude closed at US$75.53 vs US$77.21 last week.

- The price of gold decreased this week, closing at US$2,294 vs US$2,328 last week.

- BoC Kicks Off Rate Cuts, Signals More to Come: The Bank of Canada cut interest rates by 0.25% to 4.75%, the first G-7 central bank to start an easing cycle. Governor Tiff Macklem cited confidence in hitting the 2% inflation target, with more cuts possible. In response, bonds rallied and the loonie depreciated.

- New Canadian Content Rules - Consumers to Pay More for Streaming: New Canadian streaming regulations, effective September 1st, will require foreign services like Netflix (NFLX) and Spotify (SPOT) to allocate 5% of their Canadian revenue towards local content. Expected to raise $200 million annually, this move may lead to consumer price hikes and reduced investment in Canada.

- May Jobs Surge: Canada Adds 26.7K Jobs, US Payrolls Jump 272K Despite Rising Unemployment: Friday was jobs day, with employment numbers for May being released in North America. In Canada, our economy added 26,700 jobs, although part-time positions increased while full-time jobs declined. The unemployment rate rose to 6.2%. Meanwhile, nonfarm payrolls in the U.S. expanded by 272,000 for the month, up from 165,000 in April and well ahead of the estimate of 190,000. Despite that gain, the unemployment rate rose to 4.0%, the first time it has breached that level since January 2022.

- Viridian Acquisition to Buy Park Lawn in $1.2B All-Cash Deal: Viridian Acquisition, an affiliate of Homesteaders Life Company and Birch Hill Equity Partners Management Inc, announced it is to acquire Park Lawn (PLC) at C$26.50/share in all-cash transaction valued at ~C$1.2 billion, including Park Lawn's net debt.

- Manufacturing Blues: U.S. and Canadian Sectors Contract in May: U.S. factory activity contracted in May, with output nearly stagnating and orders falling significantly. The Institute for Supply Management's manufacturing index dropped to 48.7, the lowest in three months and below the expected 49.5 (reading below 50 indicate contraction). Meanwhile, Canadian manufacturing activity further contracted in May, with the S&P Global Canada Manufacturing Purchasing Managers' Index dropping slightly to 49.3 from April's 49.4.

Weekly Diversion:

Check out this video: The Best Way to See the World

Charts of the Week:

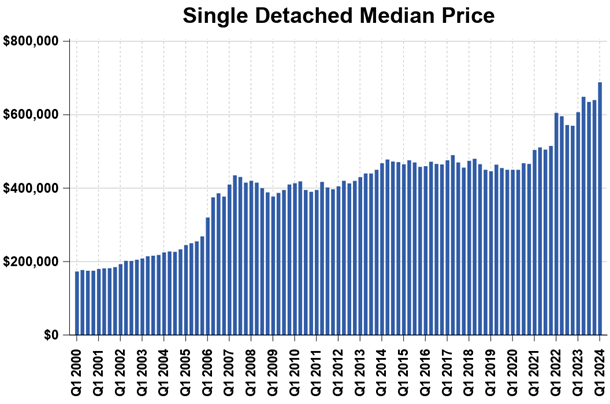

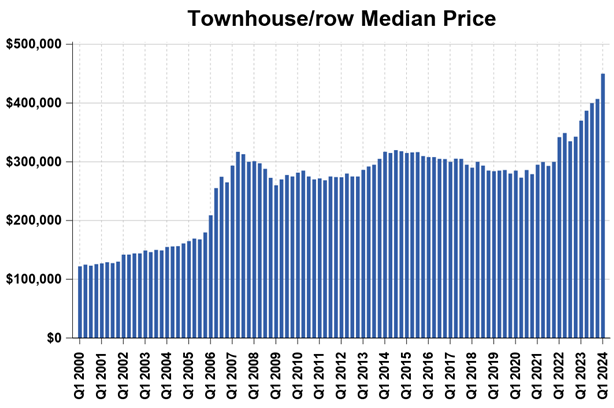

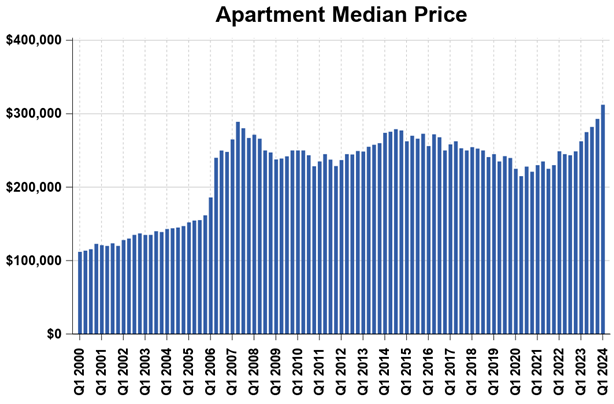

This week, the Bank of Canada announced its first key target rate cut of 0.25% from 5.00% to 4.75%, which marks the first decrease since the hikes began in March 2022. This anticipated rate cut and the potential for future cuts in 2024 have been seen as a catalyst for the housing market in Canada with many potential buyers waiting on the sidelines for more favourable mortgage rates.

In Alberta, and especially here in Calgary, we have seen a very strong housing market over the last three years, reaching all-time price highs in 2024, driven primarily by the rise in population over recent years. As the first chart illustrates, the median price for single detached homes in Calgary reached $688,500 in Q1 2024, marking a year-over-year increase of 13.4%. This trend extends out to townhouses as shown in the second chart below, with the median pricing hitting $450,000 and rising 21.6% year-over-year. Finally, the median price for apartment units reached $312,250 in the first quarter of 2024 as shown in the last chart, marking an impressive year-over-year increase of 19%.

Source: Calgary Real Estate Board via The Canadian Real Estate Association

Time will tell if future expected interest rate cuts will have a further impact on an already extremely hot housing market in Calgary and Alberta.

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Bespoke Investment Group

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.