Market Insights: U.S. Electric Vehicle Sales Slowdown or Just a Blip?

Milestone Wealth Management Ltd. - May 31, 2024

Macroeconomic and Market Developments:

- North American markets were down this week. In Canada, the S&P/TSX Composite Index decreased 0.74%. In the U.S., the Dow Jones Industrial Average dipped 1.15% and the S&P 500 Index was down 0.70%.

- The Canadian dollar rose this week, closing at 73.39 cents vs 73.18 cents last week.

- Oil prices decreased slightly this week. U.S. West Texas crude closed at US$77.21 vs US$77.71 last week.

- The price of gold decreased this week, closing at US$2,328 vs US$2,333 last week.

- Household Spending Fuels 1.7% Q1 Growth for Canada: Canada's economy grew 1.7% annualized in Q1 2024, driven by increased household spending. Q4 2023 growth was revised down to 0.1%, and preliminary April data is suggesting 0.3% growth.

- Trump Guilty on 34 Counts in Hush-Money Trial as 2024 Campaign Heats Up: Former President Donald Trump has been found guilty on all 34 charges of falsifying business records in a hush-money trial, just as the 2024 campaign cycle kicks into high gear. A sentencing hearing is scheduled for July 11, only days before the Republican National Convention. Trump Media (DJT) shares fell 5.30% on Friday in response, however the company still has a $8.67 billion market cap, with Trump owning 65% of the shares.

- ConocoPhillips Acquires Marathon Oil in $17B Mega Merger: ConocoPhillips (COP) is acquiring Marathon Oil (MRO) in a $17 billion all-stock deal, adding 2 billion barrels of shale assets in Texas, New Mexico, and North Dakota. Assuming the deal goes through, this would boost ConocoPhillips' market cap to over $150 billion.

- April's PCE Shows Steady Inflation, Fed Cautious on Cuts: April's Personal Consumption Expenditures (PCE) index met expectations, with the core PCE up 2.8% annually. Goods prices rose 0.2%, while services increased 0.3%. The PCE is the U.S. Federal Reserve’s preferred measure of inflation and closely watched by both economists and the markets.

- U.S. GDP Growth Dips to 1.3%, Core Economy Still Strong: U.S. Q1 Real (after inflation) GDP growth was revised lower to a 1.3% annualized rate from the prior estimate of 1.6%. Core GDP, including consumer spending and business investment, rose at 2.8%.

Weekly Diversion:

Check out this video: Paws in the Air: The Luxury Airline Just for Dogs

Charts of the Week:

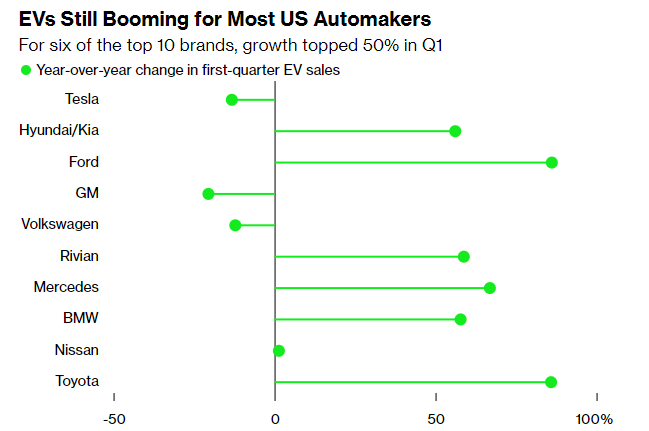

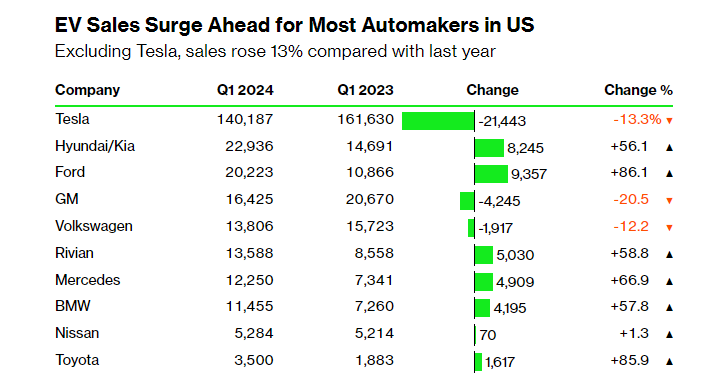

The U.S. has seen a significant slowdown in electric vehicle (EV) sales; however, data may suggest this is more of a temporary blip rather than a long-term trend. This slowdown has led to Ford dramatically scaling back expansion plans and Tesla laying off 10% of its global workforce. Despite flat sales in the first quarter of 2024, several automakers like Hyundai-Kia, Ford, and BMW saw significant year-over-year growth, indicating a tale of two EV markets where consumers are favoring models with superior battery range, faster charging, and competitive pricing. The two charts below highlight the EV sales growth for the top 10 brands selling EVs in the U.S. It is important to note that if you exclude Tesla’s sales numbers, U.S. EV sales grew 13% over last year.

Source: Cox Automotive, Bloomberg Green (Note – Company sales include branded subsidiaries)

Source: Cox Automotive, Bloomberg Green (Note – Company sales include branded subsidiaries)

General Motors and Tesla are the two companies primarily responsible for the slowdown, due in large part to product cycle issues. GM discontinued the Chevy Bolt before its replacements was ready, while Tesla's Model 3 production was interrupted for a facelift. However, GM is poised to become a major driver of EV growth in the U.S., with the imminent launch of affordable models like the Equinox SUV, Blazer, and electric pickups with extended range, powered by GM's new Ultium battery line, a modular battery and drive unit system that can be applied to a large range of vehicles.

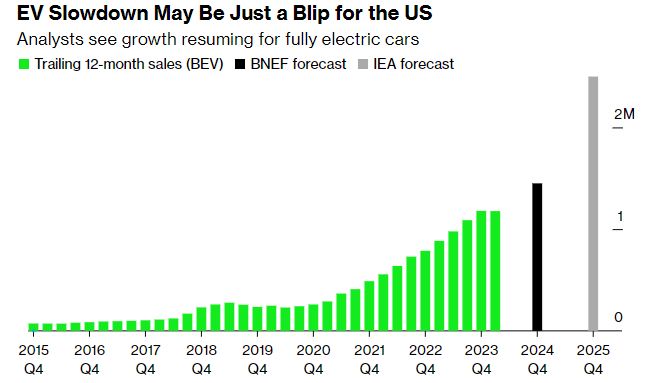

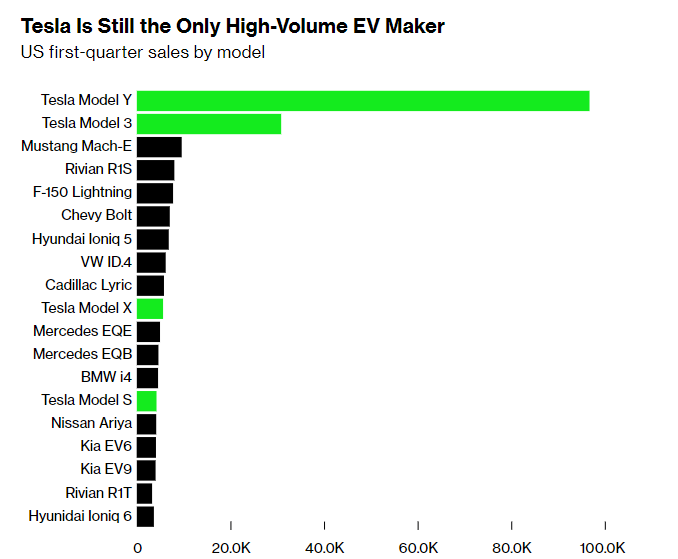

Despite the temporary slowdown, long-term forecasts for U.S EV sales remain optimistic. The International Energy Agency (IEA) estimates fully electric vehicle sales will soar to 2.5 million in 2025, up from 1.1 million in 2023. The first chart below illustrates this estimated production growth. Other automakers like Hyundai, Ford, and Stellantis (EV Jeep and Ram manufacturer) are aggressively introducing affordable EV models to build economies of scale and compete with Tesla's dominance. Experts stress automakers should not overreact to Tesla's stumbles and instead focus on mass EV production to gain market share. It is also important to note that Tesla is still the only high-volume EV maker in the U.S. that has been able to sell more than 100,000 EVs per year across its EV lineup, but this year, Hyundai, GM, and Ford are each on track to reach that 100,000 threshold, adding much needed U.S. EV competition. The second chart highlights U.S. first-quarter sales by model.

Source: Bloomberg Green, IEA (STEPS), BloombergNEF

Source: COX Automotive

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Bespoke Investment Group

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.