Market Insights: Ether Approved for ETF

Milestone Wealth Management Ltd. - May 24, 2024

Macroeconomic and Market Developments:

- North American markets were down this week. In Canada, the S&P/TSX Composite Index dipped 0.70%. In the U.S., the Dow Jones Industrial Average fell by 2.33% and the S&P 500 Index dropped by 0.03%.

- The Canadian dollar decreased this week, closing at 73.18 cents vs 73.45 cents USD last week.

- Oil prices marginally slid this week. U.S. West Texas crude closed at US$77.71 vs US$79.96 last week.

- The price of gold pulled back this week, closing at US$2,333 vs US$2,415 last week.

- Crypto Climbs: Bitcoin, Ethereum Soar on Rate Hike Rumors: Bitcoin (BTC) jumped ~3% to almost $69,000, while Ethereum (ETH) jumped 20% to over $3,700 this week after the U.S. SEC approved the creation of ETFs based on the spot price of Ether.

- Canada's Inflation Slows, Rate Cut? Canada's core inflation rate slowed to 2.7% in April, down from 3.05% in March, driven by lower transportation, vehicle, and housing costs. While the downward inflation trend is positive, the Bank of Canada's upcoming decision hinges on various factors, including employment growth, overall inflation and economic growth.

- Fast-Food Faceoff: Burger King (QSR) is set to launch a $5 meal deal ahead of McDonald’s (MCD), intensifying the value war in the fast-food industry. Amid inflation concerns, both chains aim to attract budget-conscious consumers as McDonald’s plans a similar $5 meal deal.

- NVIDIA's AI-Powered Future Shines Bright After Record Q1: all eyes were on NVIDIA (NVDA) this week, with the chip maker reporting record quarterly revenue of $22.1 billion, up 265% year-over-year, driven by high demand for AI chips and GPUs (graphics processing units). As a result, NVIDIA’s stock price moved up to a new all-time high this week, with a market capitalization of US$2.62 trillion.

- DuPont Divides: DuPont (DD) is joining sprawling conglomerates like General Electric (GE) and Johnson & Johnson (JNJ) in splitting its businesses into more focused companies. The chemical giant, which was formed in 1802, will separate into three publicly traded entities.

- TD Bank (TD) kicked off Canadian bank earnings this week, reporting better than expected quarterly earnings of $2.04/share vs $1.85/share expected, on total revenue of $13.82 billion vs $12.40 billion in the same quarter last year.

Weekly Diversion:

Check out this video: Caught on Camera: Terrifying Tornado Strikes Lincoln, Nebraska

Charts of the Week:

In a landmark decision yesterday, the U.S. Securities and Exchange Commission (SEC) approved applications from NASDAQ, CBOE and NYSE to list exchange-traded funds (ETFs) tied to the spot price of Ether, opening a new chapter for the cryptocurrency (second largest after Bitcoin) and paving the way for these products to begin trading later this year. This approval, following on the heels of successful Bitcoin ETFs launched earlier this year, suggests a more welcoming stance by regulators towards crypto. Ether ETFs offer a secure and regulated way for investors to participate in the Ether market, potentially attracting institutional capital and boosting its stability. While individual ETF applications still need SEC clearance, this decision marks a significant step towards mainstream adoption of Ether.

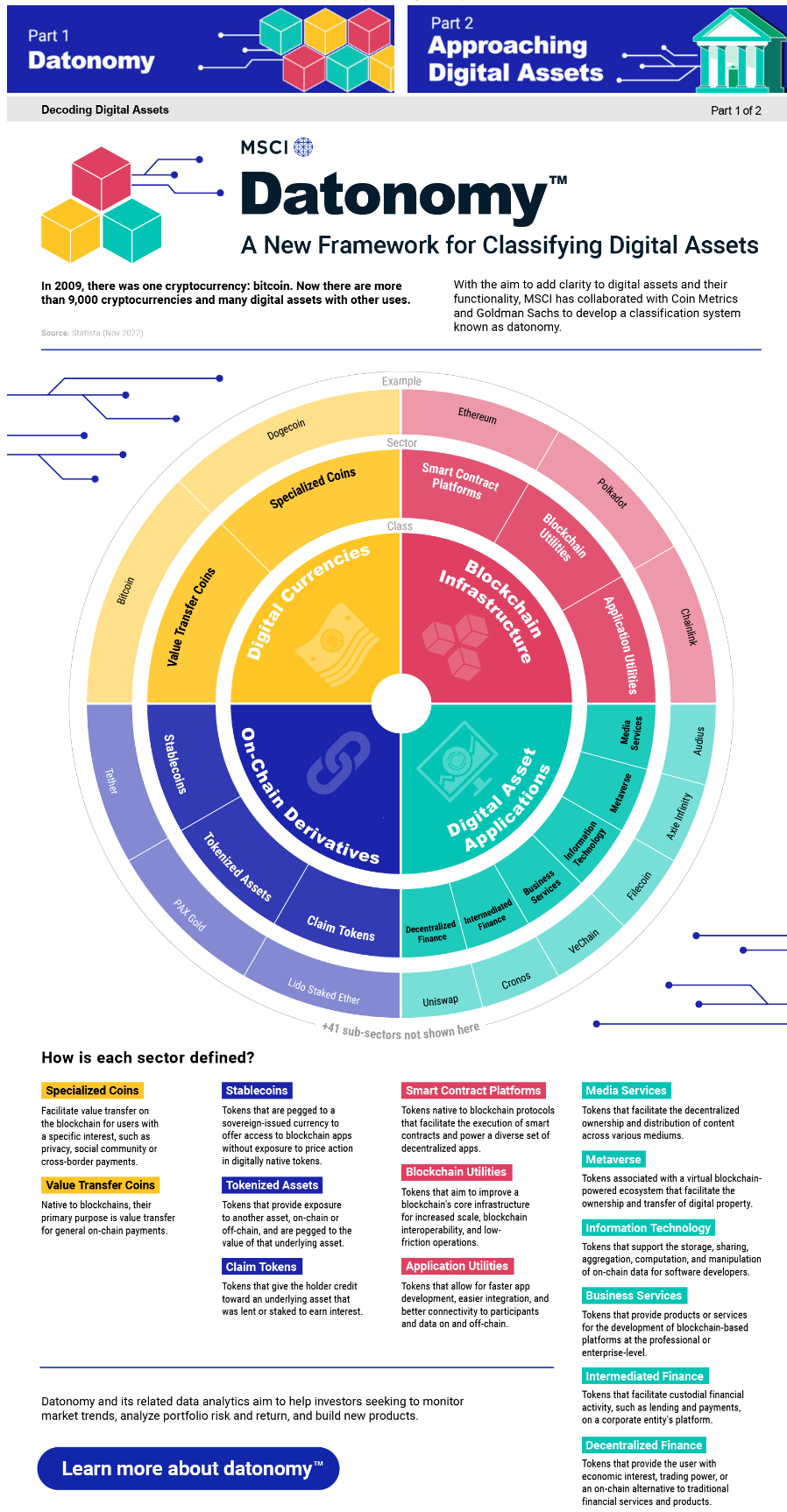

Ether (often denoted by ETH) is the native cryptocurrency of the Ethereum blockchain platform. Unlike Bitcoin, which primarily serves as a digital currency and store of value, Ethereum is a programmable blockchain that allows for the development of decentralized applications (dApps) and smart contracts. Ether functions as the fuel for transactions on the Ethereum network, used to pay for the computational power required to execute these applications and contracts. The following graphical illustration highlights the different popular digital assets, as well as their sector and class.

Source: MSCI Inc. via The Visual Capitalist, Coin Metrics, Goldman Sachs (Nov 2022)

The price of Ether defied the broader crypto market slump this week, surging against the trend. While major cryptocurrencies like Bitcoin saw price drops, Ether rallied significantly. This bullish run, driven by the SEC's approval of Ether ETFs, resulted in a weekly gain of 22.57% - its best performance since 2021. Although the price of Ether saw a decline today after the SEC approval, this positive outcome could indicate a major turning point for Ether, with the potential for continued growth as ETF launches become a reality.

Source: Google Finance

Finally, we wanted to take the opportunity to point out to our investors that for many of our mandates, we added significantly to our Ether Capital Corp. investment (a corporation that solely owns Ether) back in April 2023 as noted in the next chart and have seen substantial returns since that point. In addition to the recent spike in the price of Ether, there was a big announcement from the company we own in early May, that they will be converting to an ETF. This resulted in a significant price increase in our position due to the narrowing of the trading price discount to net equity. For more information on this upcoming transaction, please contact your Milestone Portfolio Manager.

Source: TradingView

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Bespoke Investment Group

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.