Market Insights: The Return of Dr. Copper

Milestone Wealth Management Ltd. - May 17, 2024

Macroeconomic and Market Developments:

- North American markets were up this week. In Canada, the S&P/TSX Composite Index inched higher by 0.63%. In the U.S., the Dow Jones Industrial Average climbed 1.19% (finishing above 40,000 for the first time ever) and the S&P 500 Index advanced by 1.51%.

- The Canadian dollar increased this week, closing at 73.45 cents vs 73.14 cents USD last week.

- Oil prices were positive this week. U.S. West Texas crude closed at US$79.96 vs US$78.35 last week.

- The price of gold jumped this week, closing at US$2,415 vs US$2,363 last week.

- U.S. inflation as measured by the CPI rose 0.3% in April, slightly below forecasts, with the annual inflation rate coming in at 3.4%. Higher shelter and energy expenses drove the increase, while new and used vehicle prices decreased. Persistent inflation is adding uncertainty to the path of possible interest rate cuts by the Federal Reserve.

- In April, Canada's housing market saw one of the largest increases in history in listed inventory, while homebuyer demand declined, leading to a 1.7% drop in sales compared to the previous month. Despite there being more properties available, prices remained stable. High interest rates deterred some buyers, but expectations of Bank of Canada rate cuts may shift the market dynamics soon.

- Meme stocks are back in the spotlight. GameStop (GME) and AMC Entertainment (AMC) shares rocketed higher early in the week, boosted by the return of Keith Gill, aka "Roaring Kitty", to X (formerly Twitter). As a result, both GameStop and AMC announced plans to issue shares to raise capital, taking advantage of the higher stock prices to improve their balance sheets.

- Tech giants such as Alphabet (GOOGL), Meta Platforms (META), Salesforce (CRM), and Booking Holdings (BKNG) have begun paying dividends, signaling financial strength and a renewed focus on shareholder returns. Despite some reluctance from Amazon (AMZN) and Tesla (TSLA), the market increasingly favors buybacks and dividend payouts to enhance shareholder value.

- AT&T (T) and AST SpaceMobile (ASTS) are partnering to provide satellite internet to cell phones with a deal until 2030, boosting ASTS shares this week. T-Mobile has a similar agreement with SpaceX (SPACE), and Verizon (VZ) previously collaborated with Amazon's (AMZN) Project Kuiper. Apple (AAPL) has offered satellite-to-cellphone emergency services on iPhones since 2022.

- The IMF criticized the Biden administration's tariff increase on Chinese goods, cautioning against potential harm to global trade and growth. IMF officials emphasized open trade policies for the U.S. and urged collaboration with China to resolve tensions. While Biden's move aims to protect U.S. manufacturing, the IMF warns of global economic fragmentation and calls for multilateral trade dispute resolution.

Weekly Diversion:

Check out this video: New World Record Ski Jump

Charts of the Week:

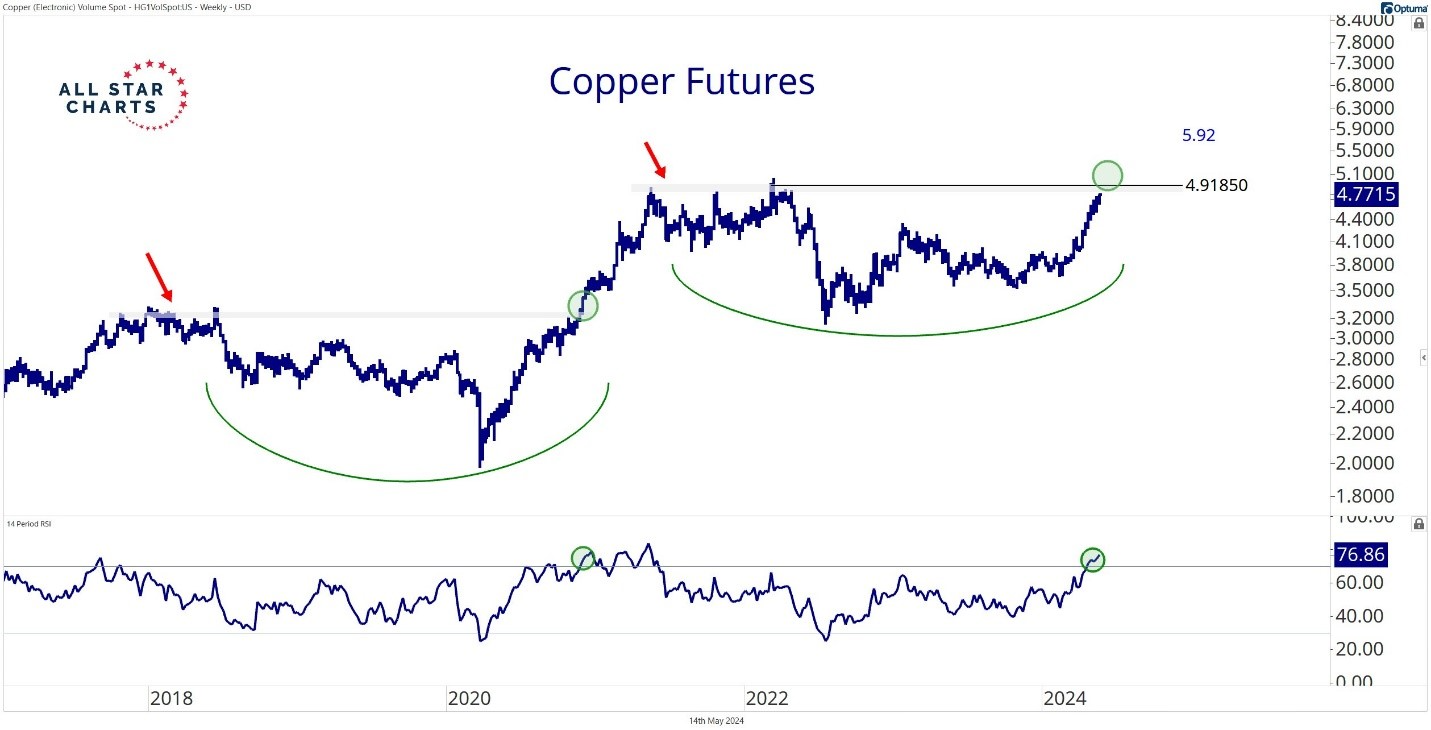

The price of copper futures broke out this week hitting an intra-day all-time high on Wednesday before closing just shy of the all-time high. Due to copper's widespread applications in most sectors of the economy - from homes and factories to electronics and power generation and transmission - demand for copper is often viewed as a reliable leading indicator of broad economic health. This demand is reflected in the market price of copper. The following chart highlights the price for copper futures this week compared to 2022 and provides a future potential technical price target of $5.92.

Source: All Start Charts via @Ian Culley

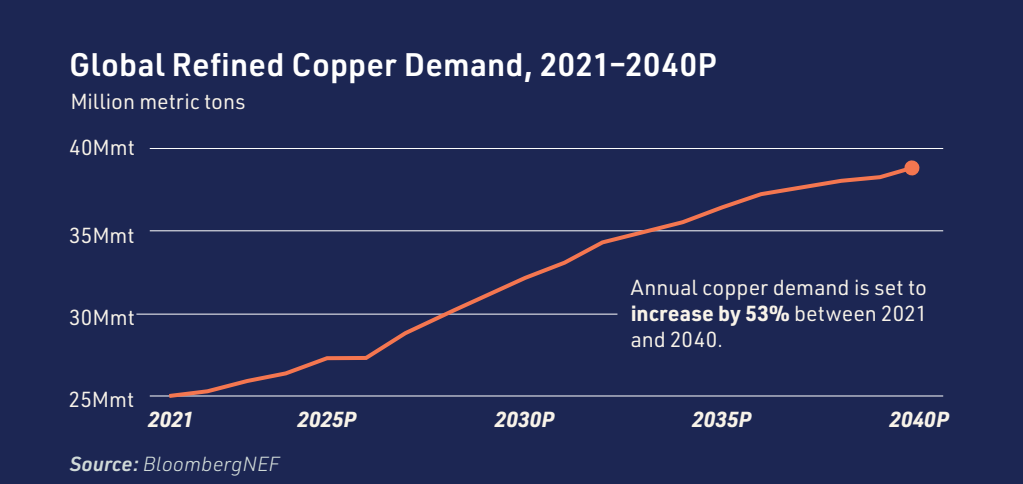

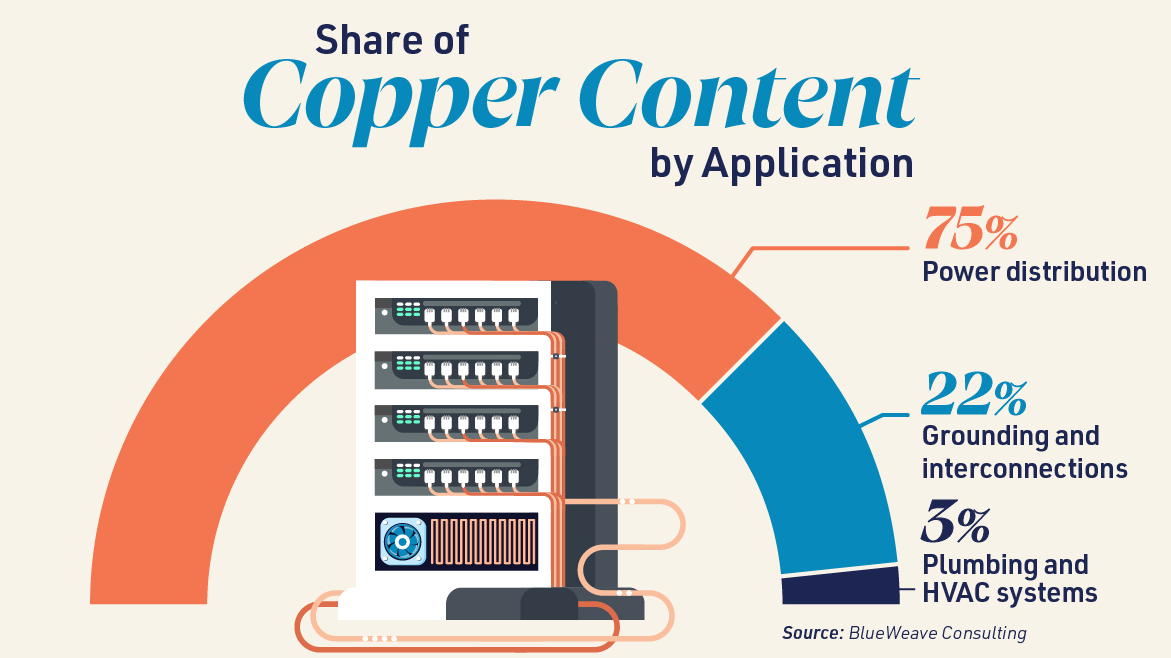

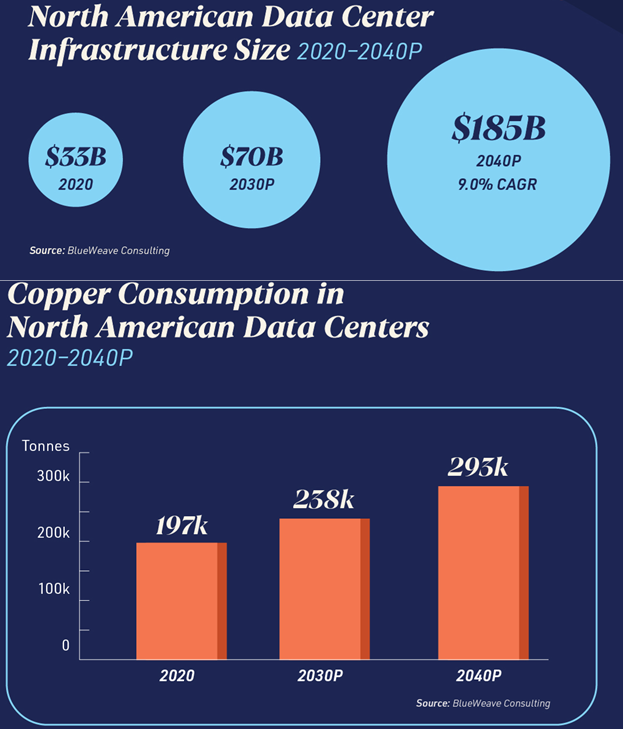

As we discussed, copper plays a vital role in critical infrastructure, and this role is expanding today as we move to a more ‘green’ and electrified society. The first chart below illustrates the growth of copper demand starting from 2021 with projected numbers through 2040. The annual demand is estimated to increase by 53% between 2021 and 2040. Another key factor, as we look to the reason for the recent spike in demand for copper, and a potential driver behind it is data centers. Data centers are computer server hubs that collect, store, and process enormous amounts of data, and require an extensive infrastructure network and power supply. With the rise in artificial intelligence (AI), more data centers will be needed to facilitate the power needed for these applications. The second chart breaks down the copper content by application in data centers. Finally, the last chart below highlights the expected North American data center infrastructure size by investment from 2020 to 2040, as well as the projected copper consumption for these data centers. As we can see, investment is expected to grow by over 460%.

Source: Copper Development Association Inc. via the Visual Capitalist

Source: Copper Development Association Inc. via the Visual Capitalist

Source: BlueWeave Consulting via the Visual Capitalist

Time will tell if Dr. Copper is able to predict another period of expansion in the global economy, but the projected growth in data centers and the move to a greener, more electrified economy will likely provide the foundation for increased demand for this critical mineral.

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, BlueWeave Consulting, Visual Capitalist, All Start Charts

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.