Wealth Strategies: Financial Planning Pitfalls

Milestone Wealth Management Ltd. - Apr 30, 2024

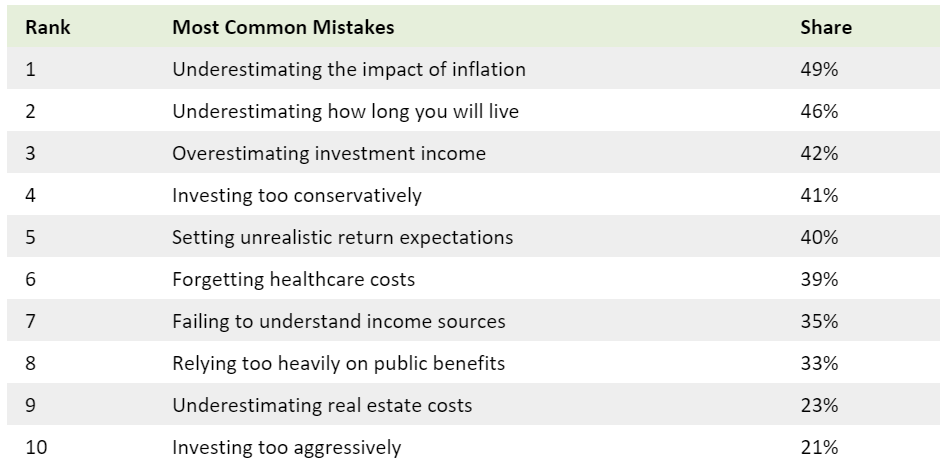

Financial Planning is an area that few manage to engage with in the most proactive or strategic manner. Based on a recent Natixis Global survey, below are the most common retirement planning mistakes:

This of course leads to the question of how one can avoid these oversights in their own financial planning process.

First and foremost, having the right financial professional on your team to address the variables above is key.

Second, use of a cutting-edge financial planning software that helps to account for many of the issues noted above leaves your financial professional free to focus more of their time and energy on shoring up remaining areas of vulnerability, as well as adjusting your plan as needed, as your life circumstances evolve.

If we zero-in on inflation, we find that a comprehensive, customized software offering such as Conquest (which we employ at Milestone) allows us to input desired assumptions such as a preferred retirement age, retirement income, home downsizing etc. and in turn incorporate inflation stress testing. This allows the client to see a range of possible outcomes that may not be as visible without the software's assistance.

Disappointing rates of return can also be a drag on the successful execution of your financial plan, if not anticipated. Here is another area where a good financial planning program can assist, via comprehensive stress testing. This technology also allows us to integrate customized portfolio options that are relevant to the client (professional investment mandates, employer-held stocks etc.) such that ROR scenarios reflect the long-term history of your portfolio.

Ensuring that your financial plan adequately provides for the span of your life is also a field in which a comprehensive stress-test, as mentioned above, is designed to assist.

And last, but certainly not least in this day and age, is the integration of AI in modern financial planning software. This can assist your financial planning professional in generating potential scenarios, both positive and negative, helping to see the effects of each, and offering creative and proactive solutions.

Given the awareness of where many people stumble in their financial planning journey, and the tools available to help in avoiding these pitfalls, it makes good sense to touch base with your trusted financial professional to find out how modern financial planning software can help to make your walk towards your financial goals a successful one.

©2024 Milestone Wealth Management Ltd. All rights reserved.

Source: Natixis

Disclaimer: Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.