Market Insights: Global GDP Outlook for 2024

Milestone Wealth Management Ltd. - Apr 26, 2024

Macroeconomic and Market Developments:

- North American markets were positive this week. In Canada, the S&P/TSX Composite Index rose 0.74%. In the U.S., the Dow Jones Industrial Average increased 0.67% and the S&P 500 Index rallied 2.67%.

- The Canadian dollar improved this week, closing at 73.16 cents vs 72.72 last week.

- Oil prices climbed this week. U.S. West Texas crude closed at US$83.66 vs US$83.14 last week.

- The price of gold fell this week, closing at US$2,338 vs US$2,391 last week.

- The U.S. economy is finally showing some weakness, with Real (above inflation) GDP increasing at a 1.6% annualized pace in the first quarter, well below the 2.4% estimate. Meanwhile, the personal consumption expenditures (PCE) price index, a key inflation measure for the Federal Reserve, rose 0.3% month over month and 2.8% from a year ago, up from 2.7% in the February to February timeframe.

- The recent completion of the Bitcoin halving event, which occurs approximately every four years, has reduced the mining reward from 900 Bitcoin to 450 Bitcoin per day, impacting miners' revenue. The dilutive effect of Bitcoin mining decreases with each halving, with the upcoming cycle expected to produce only 3.3% of the outstanding Bitcoin supply.

- Honda announced plans to build an electric vehicle battery plant next to its Alliston, Ontario assembly plant. It is planning to retool the facility to produce fully electric vehicles as part of a $15-billion project, including up to $5 billion in public funds, to create a supply chain in the province for the company.

- Visa (V) reported earnings that beat estimates, supported by stronger-than-anticipated credit card spending in the U.S. Net income rose by 17% to $2.51/share vs the average analyst estimate of $2.44/share.

- Facebook and Instagram parent Meta Platforms (META) released earnings after the market closed on Wednesday. The social media company beat estimates for both earnings and revenue, but provided lower future revenue guidance, sending the stock down 10.56% on Thursday as a result.

- Google and YouTube parent Alphabet (GOOG) released blowout earnings after the market close on Thursday. Earnings came in at $1.89/share vs $1.51/share expected and Alphabet announced its first ever dividend, sending the stock up 9.97% on Friday.

Weekly Diversion:

Check out this video: Emperor penguin chicks jump off a 50-foot cliff in Antarctica

Charts of the Week:

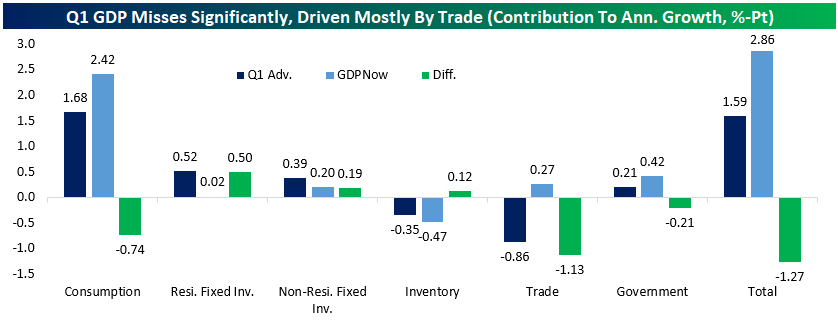

This week, the U.S. released the Q1 advanced estimate for real (after inflation) gross domestic product (GDP) data which disappointed most economists, coming in at a growth rate of just 1.59% compared to economists’ estimates ranging from 2.5% to 2.9%. In Canada, we are on a slightly different schedule compared to the U.S., with Q1 GDP data set to be released at the end of May. GDP growth is an important indicator for the overall strength of a country's economy and can be a very influential factor in central bank policy interest rates, among many other important factors like inflation and unemployment.

The following table shows some cracks forming in previously strong real GDP growth in the U.S., especially when considering the effects of trade. This focuses on the Q1 GDP advanced number in dark blue compared to the Atlanta Fed’s GDPNow numbers (a running estimate of real GDP annual growth based on available economic data for the current measured quarter) in light blue, and the difference in green. When looking at the biggest detractors from GDP, trade was the glaring category at -0.86% growth, followed by inventory coming in at -0.35% growth. In terms of what categories contributed to GDP coming in much lower than expected, again trade was the biggest difference at –1.13%, followed by consumption at –0.74%.

Source: Bespoke Investment Group

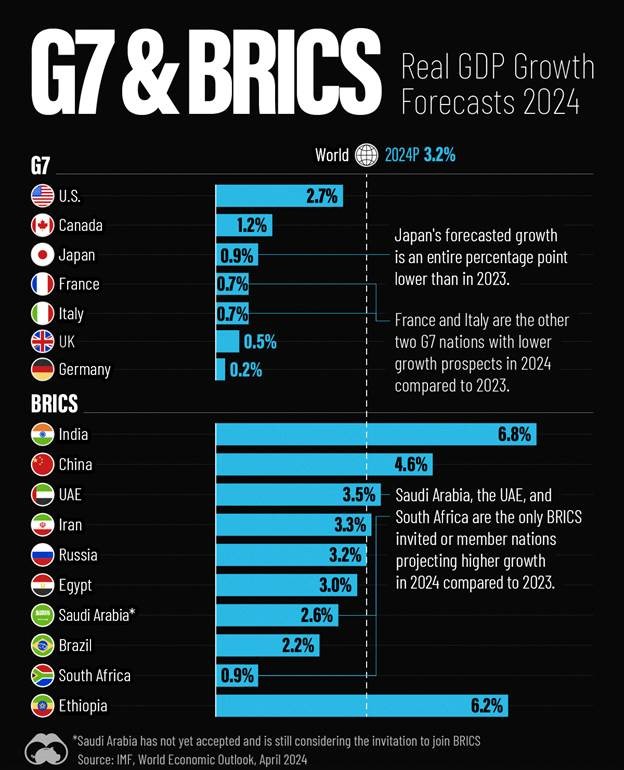

Looking out globally, the next chart highlights the projected real GDP growth forecasts of G7 and BRICS nations for 2024 according to the International Monetary Fund (IMF). It also highlights the global projected average for the world (3.2%) as represented by the dashed white line down the middle of the chart. One datapoint to note on the chart below is that it includes Saudi Arabia as a BRIC member; however, they are currently only considering the invitation to join BRICS. As we can see, for the G7 Nations, the U.S. is the clear leader with projected GDP growth at 2.7%, with Canada landing second and with less than half the projected growth of the U.S. at just 1.2%. Germany is the clear laggard with projected growth at just 0.2% for 2024, due to weak global demand and geopolitical uncertainty among other factors. Interestingly, Japan, France, and Italy are the only three G7 nations with lower 2024 projected growth rates compared to 2023. Moving on to the BRICS, the outlook for 2024 looks significantly better in comparison, especially for India with projected growth at 6.8%. The higher growth for BRICS nations is primarily due to trade within the BRICS nations and Russian sanctions by the West resulting in discounts on fuel and commodities benefiting nations like India and China. However, overall growth has shrunk for the BRICS with only Saudi Arabia, the UAE, and South Africa having higher growth projections for 2024 compared to 2023.

Source: IMF, World Economic Outlook, via Visual Capitalist

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Bespoke Investment Group, Visual Capitalist

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.