Market Insights: 2024 Federal Budget - New Capital Gains Taxation Rules

Milestone Wealth Management Ltd. - Apr 19, 2024

Before we get into our regular weekly comments, we would like to note that we have launched a new 10-part series on the most important financial planning concepts for business owners. Here is the first part to our series, with posts to follow on a monthly basis:

Top 10 Financial Planning Concepts for Business Owners: #1 Incorporating Your Small Business

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index fell 0.42%. In the U.S., the Dow Jones Industrial Average increased marginally by 0.01% and the S&P 500 Index shrank 3.05%.

- The Canadian dollar devalued, closing at 72.72 vs 73.59 cents USD two weeks ago.

- Oil prices were down. U.S. West Texas crude closed at US$83.14 vs US$86.69 two weeks ago.

- The price of gold rallied, closing at US$2,391 vs US$2,324 two weeks ago.

- The Bank of Canada released its monetary policy report last Wednesday, electing to hold its key interest rate at 5.0%. The central bank said it “expects the global economy to continue growing at a rate of about 3%, with inflation in most advanced economies easing gradually. The US economy has again proven stronger than anticipated, buoyed by resilient consumption and robust business and government spending.”

- Reinforcing the view that the U.S. economy continues to be stronger than anticipated, the U.S. Consumer Price Index (CPI) came in at 3.5% from March 2023 to March 2024, slightly above the 3.4% economists had forecast. The Core CPI, excluding volatile items like food and energy, was up 3.8% from a year ago.

- Meanwhile, Canada’s CPI came in at 2.9% from March 2023 to March 2024, slightly higher than the 2.8% reading in February. The increase came as gasoline prices rose 4.5% compared with a year earlier.

- Private equity manager Blackstone (BX) is buying U.S. housing firm Apartment Income REIT (AIRC), known as AIR Communities, for $10 billion in cash including debt. Blackstone will pay $39.12/share, representing a premium of about 25% to AIRC’s previous closing price.

- The Canadian government will allow 30-year amortization periods on insured mortgages for first-time homebuyers purchasing newly built homes. Finance Minister Chrystia Freeland said the change would take effect August 1. Freeland also said the government will increase the amount first-time homebuyers can withdraw from RRSPs to buy a home from $35,000 to $60,000.

- Netflix (NFLX) added 9.33 million customers in the first quarter, nearly doubling the 4.84 million average of analysts’ estimates. Those new subscribers helped the company beat forecasts for sales and earnings as well; however, investors were still disappointed, sending the stock down 9.09% on Friday.

Weekly Diversion:

Check out this video: Dog joins high school track race

Charts of the Week:

The Federal Government released the 2024 budget, and although many of the highlights have already been discussed through news releases leading up to this week, the one aspect that caught many by surprise was the increase in the capital gains inclusion rate for some.

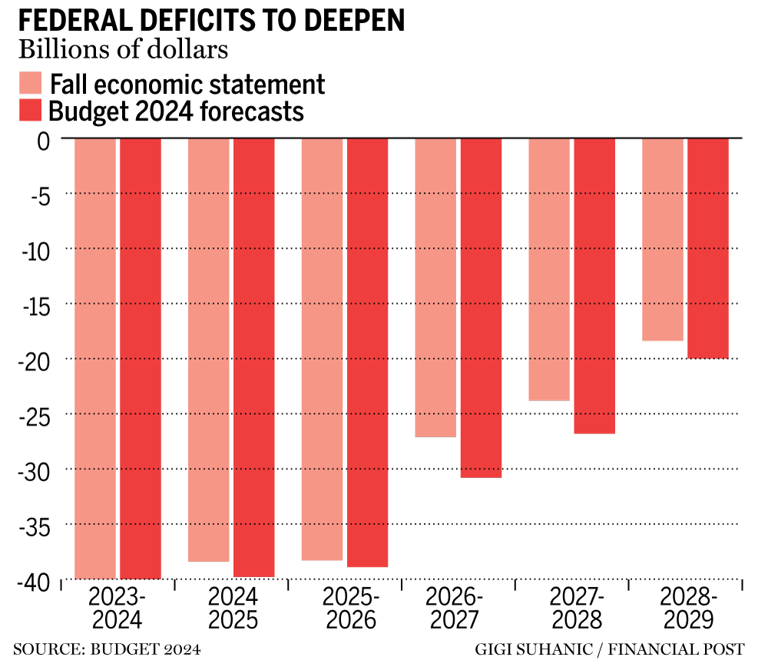

The federal deficit is scheduled to increase to just under $40 billion as illustrated in the chart below. Along with the growing deficit, the federal government announced changes to the capital gains taxes to help supplement the budgeted spending.

Source: Financial Post

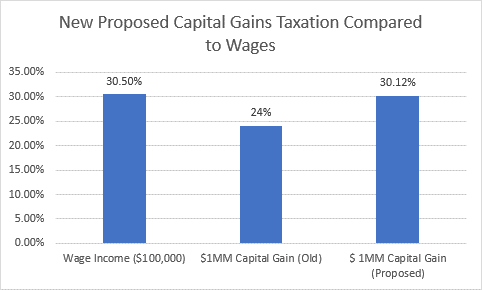

Previously, if you disposed of a capital property, excluding primary residences which are exempt from capital gains taxes, only 50% of the capital gain was included as taxable income. The budget proposes an increase in capital gains inclusion from 50% to 66.7% for gains realized on or after June 25, 2024. This higher rate only applies to corporations and trusts, as well as any capital gains above $250,000 for individual taxpayers. The example below demonstrates the difference in taxes paid on wage income of $100,000, as well as taxes paid on $1MM in capital gains under the current taxation rules, and $1MM in capital gains under the new proposed rules for an Alberta earner. The new proposed rules would bring the new capital gains tax closer to the rate paid by wage earners, in this example.

Individual taxpayers will still be able to take advantage of the 50% inclusion rate on the first $250,000 of annual capital gains realized on or after June 25, 2024. This $250,000 limit is not prorated for 2024, so all gains realized before June 25 will be subject to the 50% rate, as will the first $250,000 of gains after that date. Investors with capital losses carried forward from prior years will be able to deduct them against taxable capital gains by adjusting the value of the losses to reflect the new 66.7% inclusion rate. This ensures the full value of the losses can still be used to offset gains.

On the positive side for business owners, the budget has proposed increasing the Lifetime Capital Gains Exemption (LCGE) to $1,250,000 of eligible capital gains from the current $1,016,836. This measure would apply to dispositions that occur on or after June 25, 2024, and then will be indexed again after that. In addition, the budget introduced a new Canadian Entrepreneurs’ Incentive to reduce the rate of capital gains resulting from the disposition of qualifying shares of a corporation or by an eligible individual. This incentive would provide for a capital gains inclusion rate that is one-half the prevailing inclusion rate on up to $2 million in capital gains per individual over their lifetime. Under the new proposed two-thirds capital gains inclusion rate, this measure would result in an inclusion rate of just one-third for qualifying dispositions. This would apply in addition to the LCGE and would apply to dispositions that occur on or after January 1, 2025. It would be phased in by increments of $200,000 per year, before ultimately reaching a value of $2 million by January 1, 2034.

For more information, please feel free to visit the full budget 2024 website here or speak with your professional accountant.

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, E&Y Tax Calculator

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.