Wealth Strategies: The Value of Financial Advice

Milestone Wealth Management Ltd. - Mar 31, 2024

The Value of Financial Advice

The value of financial advice varies widely by individual and depends on factors like income, wealth, and personal circumstances. Independent research suggests that investment selection is crucial to those paying for advice; retirees generally value asset allocation while working individuals prioritize retirement and tax planning. Assessing the value of financial advice can be challenging due to the subjective nature of its benefits, and the difficulty in quantifying aspects like peace of mind or behavioral coaching. Personalized advice can deliver significant value, with detailed studies showing that tailored financial plans can provide substantial benefits beyond just investment performance. Ultimately, whether a financial advisor’s services are valuable depends on the client’s individual circumstances, financial goals, and the alignment of philosophies between the advisor and the client. While fees will vary, the decision to work with a financial advisor should be based on whether one needs guidance in making financial decisions or managing specific financial goals.

What Financial Advisors Do

A financial advisor provides customized portfolio management by delivering comprehensive advice for planning, protection, and taxes while also helping create investment strategies, making sense of various investment options, keeping investors focused on their objectives, and monitoring portfolios during different market conditions. More specifically:

- Comprehensive Approach: A good financial advisor goes beyond managing investments to offer guidance on taxes, retirement planning, estate planning, insurance, education planning, and more. This comprehensive approach adds significant value to investors.

- Minimizing Taxes and Costs: Financial advisors can add value by minimizing taxes and costs through tax-efficient strategies, proper asset location, and emphasizing the effect of investment expenses on returns.

- Investment Strategy: Working with a financial advisor to establish an investment strategy is crucial for maintaining direction and discipline in reaching investment goals. This involves understanding goals, risk tolerance, and time horizon, with periodic reviews and adjustments.

- Investment Philosophy: Investors define their investment philosophy with their advisor, covering aspects like risk attitude, asset allocation, diversification, trading, and costs. This philosophy guides decision-making regarding the portfolio.

- Asset Allocation: Asset allocation involves distributing investments among different asset classes like cash, bonds, and stocks. It plays a vital role in determining long-term returns and balancing risk and return based on individual needs. A well-known study by Brinson, Hood, and Beebower of Vanguard found that around 90% of the variability of returns over time is derived from the asset allocation, and less than 10% of the variability of returns comes from individual security selection and market timing.

The Benefits

In a research study by David Blanchett and others for Cirano, the concept of "gamma" was introduced as a measure of how specific financial strategies can enhance retirement income. By combining five key strategies, such as using a total-wealth framework for asset allocation and employing dynamic withdrawal strategies, individuals could potentially increase retirement income by 22.6%. Notably, incorporating gamma into financial planning can significantly impact income during retirement by optimizing strategies like investment withdrawal plans and making tax-efficient allocation decisions.

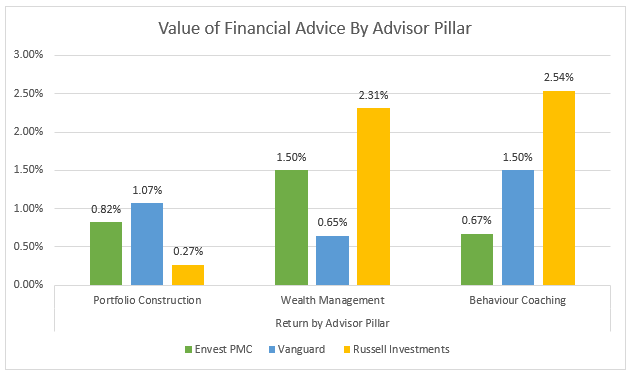

Various reputable studies show that the sources of advisor-created value can be quantified and fall within three broad categories as follows:

- Portfolio Construction: Portfolio construction focuses on asset class selection or selecting asset classes based on the client's goals and risk tolerance, investment selection or choosing investments that align with the client's portfolio, and systematic rebalancing to help control risk and enhance returns.

- Wealth Management: Wealth management focuses on financial planning which involves understanding the client's goals, risk tolerance, taxes, insurance, retirement, and estate planning.

- Behavioural Coaching: Behavioral coaching focuses on guiding clients past uncertainty to reach their financial goals by helping them change behaviors that could impede success. This coaching approach involves proactive efforts to address clients' concerns or questions in advance to enhance client outcomes.

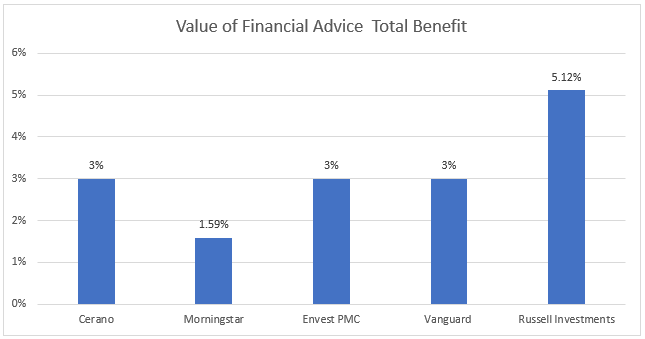

The following two charts below highlight research that was conducted by five financial industry experts. Of the five respective data sets, Envest PMC, Vanguard, and Russell Investments broke down the benefit of working with a financial advisor into the three advisor pillars. This data, along with the overall benefit provided in the research by these five experts, can be seen below. Although the quantifiable degree to which financial advice benefits range from study to study, the overall value is clear with the total benefit of financial advice ranging from 1.59% to 5.12% of added return value per year.

The value of financial advice has been shown to be significant and varies depending on individual circumstances, financial goals, and the alignment between the advisor and the client. Research indicates that personalized wealth management can provide substantial benefits beyond just investment performance, with studies showing that tailored financial plans can deliver significant value.

Sources: Russell Investments, Envestnet PMC, Morningstar, CIRANO Research, Vanguard Advisor Alpha

Disclaimer: Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.