Market Insights: April Seasonality & March Performance Indicators

Milestone Wealth Management Ltd. - Apr 05, 2024

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index increased 0.44%. In the U.S., the Dow Jones Industrial Average decreased 2.27% and the S&P 500 Index fell 0.95%.

- The Canadian dollar devalued this week, closing at 73.59 cents vs 73.83 cents last week.

- Oil prices were positive this week. U.S. West Texas crude closed at US$86.69 vs US$83.05 last week.

- The price of gold rallied this week, closing at US$2,324 vs US$2,229 last week.

- The U.S. manufacturing sector showed surprising strength in March, with the ISM Manufacturing index rising to 50.3 from 47.8 in the prior month (readings above 50 indicate growth). The index had fallen for 16 months in a row.

- Meanwhile, the U.S. services sector weakened somewhat, while remaining in growth territory. The ISM Non-Manufacturing (Services) index declined to 51.4 in March, below the 52.8 expected by economists.

- Canadian payments company Nuvei Corp (NVEI) has reached an agreement to be taken private by Advent International for US$34/share in cash. The takeover price represents a premium of approximately 56% over Nuvei's price of US$21.76 before rumours of a possible takeover started to circulate. Philip Fayer will continue to lead Nuvei as Chair and CEO and the company will continue to be based in Montreal.

- Schlumberger announced the acquisition of rival oilfield service provider ChampionX for $7.8 billion in an all-stock deal. The deal will bulk up Schlumberger’s portfolio as aging shale fields mean US drillers need better technology to maintain oil and gas production.

- Indigo Books & Music (IDG) has entered into an agreement to be acquired by Trilogy for $2.50/share. The agreement is 11% higher than the initially proposed takeover offer of $2.25/share.

- Employment numbers for March came out on Friday. Canada's labour market unexpectedly lost 2,200 jobs in March, pushing up the unemployment rate to 6.1%, the highest level in over two years. Conversely, the United States’ economy added 303,000 jobs, with the unemployment rate dropping to 3.8% from 3.9%.

Weekly Diversion:

Check out this video: Two-Year-Old Makes Friends With Crow Named Russell

Charts of the Week:

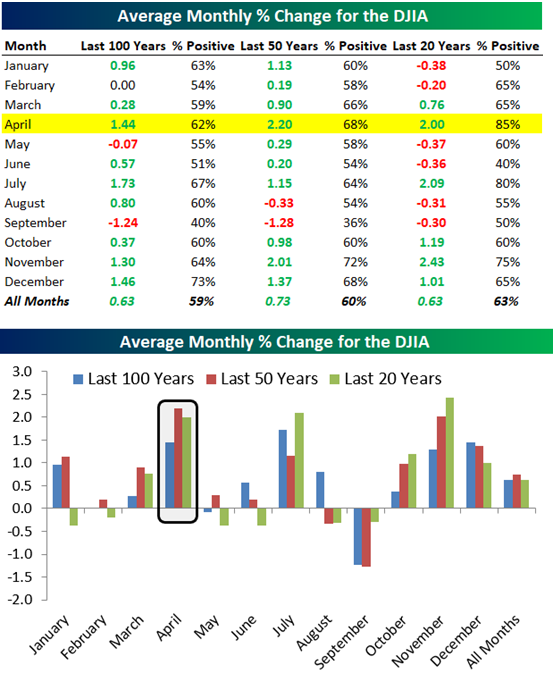

April has been a strong month for the stock market historically. Over the past 100 years, April is the third-best performing month, with average returns of 1.44%, more than doubling the average monthly return of 0.63%. Over the past 50 years, April has been the best performing month, with returns of 2.20% more than three times the average of 0.73. Even in the past 20 years, when April's performance has been more in line with the broader market, it still has the highest percentage of positive returns of any month at 85% compared to the average of 63%. The two charts below highlight this information as a table and a bar chart.

Source: Bespoke Investment Group

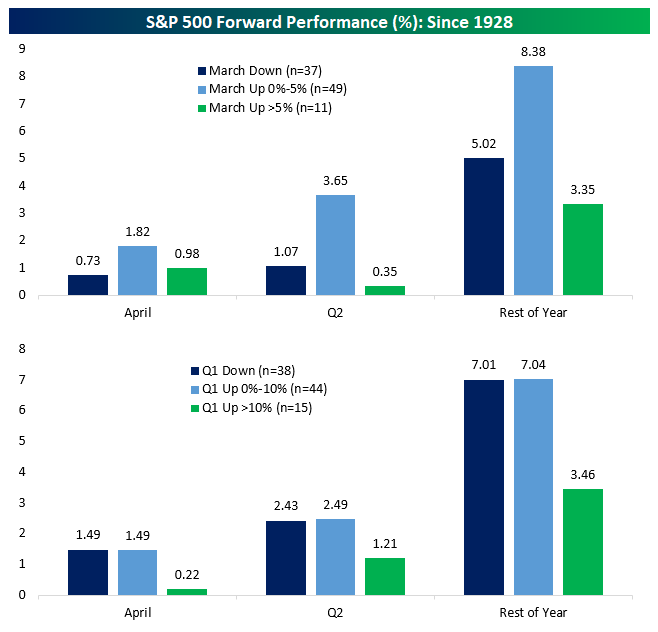

Given the performance of the S&P 500 in March, coming off an all-time high close, as well as the performance of the first quarter, we wanted to take a look at how this affects April's returns. When March sees gains of 0-5%, as was the case this year, April, the second quarter, and the rest of the year tend to see stronger than average returns. However, a very strong first quarter (up more than 10%) like we saw this year, can lead to weaker forward performance, though the difference is not dramatic. The table below highlights the difference in performance based on March performance and Q1 performance.

Source: Bespoke Investment Group

Given the volatility seen during the first week of April, it will be interesting to see if these past performance metrics remain consistent, and the rally we have seen in Q1 continues throughout the year.

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Bespoke Investment Group

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which