Market Insights: Growing Optimism

Milestone Wealth Management Ltd. - Mar 29, 2024

Macroeconomic and Market Developments:

- North American markets were positive this week. In Canada, the S&P/TSX Composite Index rose 0.83%. In the U.S., the Dow Jones Industrial Average increased 0.84% and the S&P 500 Index gained 0.39%.

- The Canadian dollar rallied this week, closing at 73.83 cents vs 73.50 USD cents last Friday.

- Oil prices were up significantly this week. U.S. West Texas crude closed at US$83.05 vs US$80.86 last Friday.

- The price of gold soared this week, closing at US$2,229 vs US$2,165 last Friday, to new all-time highs.

- The shipping industry suffered a major blow this week when the 10,000 container-capacity vessel Dali collided with Baltimore’s Francis Scott Key Bridge, shutting down ship traffic. The Port of Baltimore is the 11th largest port in the United States and the top port for autos, with an average of 207 calls a month and roughly $80 billion of goods last year.

- The U.S. economy grew at a 3.4% annualized rate in the fourth quarter of 2023, higher than the original estimate. In Canada, Statistics Canada reported that the Canadian economy grew by 0.6% in January and estimated growth of 0.4% for February, both numbers indicating strong growth for Q1 2024.

- In light of ongoing safety issues, Boeing (BA) CEO Dave Calhoun will step down at the end of 2024, and Larry Kellner, chairman of the board, and Stan Deal, CEO of the commercial airplane unit, are stepping down effective immediately. Boeing executives have faced increasing scrutiny from regulators and customers over quality control problems.

- Enbridge (ENB) has entered into an agreement with WhiteWater/I Squared Capital and MPLX LP to form a joint venture that will develop, construct, own, and operate natural gas pipeline and storage assets connecting Permian Basin natural gas supply to growing LNG and US Gulf Coast demand. The deal is expected to close in Q2 of 2024.

- Canadian luxury parka maker Canada Goose (GOOS) announced that it is laying off 17% of its global corporate workforce, roughly 900 jobs. Unseasonably warm temperatures pushed back the start of the usual parka buying season, contributing to a difficult winter for the company.

- Trump Media’s merger with the shell company Digital World Acquisition Corp was completed Monday. Trump Media & Technology Group started trading on Tuesday on the NASDAQ market with the symbol DJT.

Weekly Diversion:

Check out this video: WestJet Takes Safety Seriously

Charts of the Week:

The S&P 500 has seen consistently positive returns so far this year and as of today’s close, is currently up 10.79% YTD. This consistency has created a lot of optimism for investors, as expectations for future performance continue to rise. Today’s close has also marked an important milestone, with five straight months of 1%+ gains.

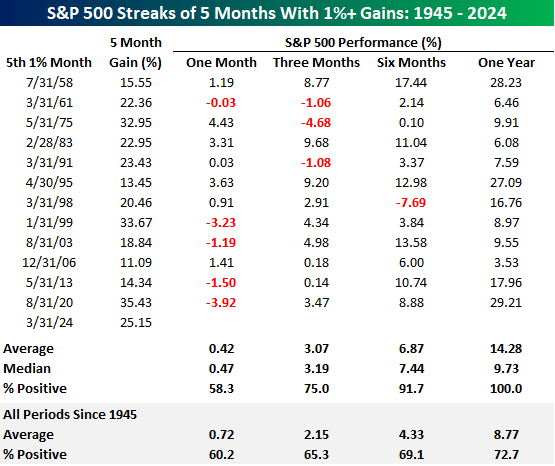

There have been 12 prior instances of 5-month streaks with 1%+ gains since 1945 and the future performance after these accomplishments have been impressive. As the first table illustrates, one month after the streak, the average return of 0.42% are lower than the all-periods average of 0.72%. However, things turn more positive when we look to longer terms. Three months after the streak, the average return was 3.07% with positive returns 75% of the time, far exceeding the all-periods average of 2.15% with positive returns 65.3% of the time. Moving even further out, six months after the streak, the return averaged 6.87% with a positivity rate of 91.7% again compared to all-periods averaging a return of 4.33% and positivity rate at 69.1%. Finally, and most impressively, we can see one year after the streak, the average return was 14.28% with positive returns 100% of time compared to the all-periods average of 8.77% and just a 72.7% positivity rate.

Source: Bespoke Investment Group

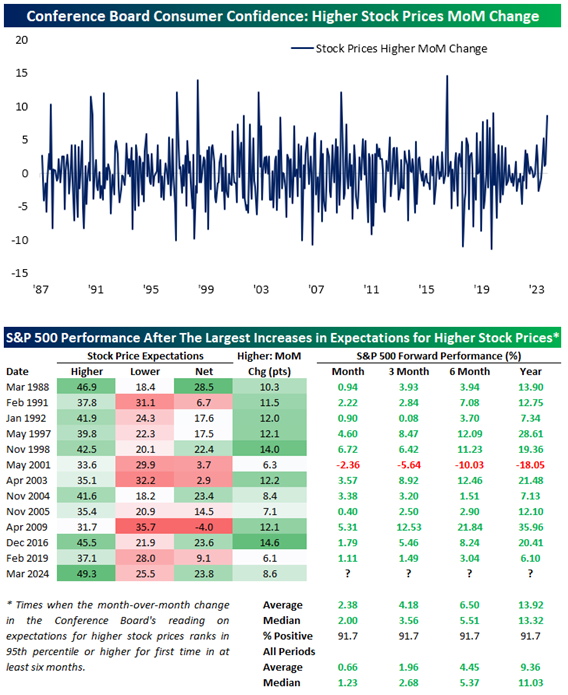

Consumer expectations for higher stock prices have reached elevated levels, with the recent month-over-month increase ranking in the top 5% of all months on record, according to the U.S. Conference Board survey. Such large increases in stock price expectations were more common in the late 1980s and early 2000s but have been less frequent since the 2010s. The first chart below highlights the month-over-month change in the reading going back to 1987. The last table shows times when the month-over-month increase in the expectation for higher stock prices has ranked in the 95th percentile or better. As we can see these big short-term jumps in sentiment have been followed by consistently positive performance of the S&P 500 over the following one-, three-, six-, and twelve-month periods, with the index rising all but one time (in May 2001). The average returns during these periods have also far outpaced the averages for all-periods with the one-month average at 2.38% compared to all-periods at 0.66%, the three-month average at 4.18% compared to all-periods at 1.96%, the six-month average at 6.50% compared to all-periods at 4.4%, and the one-year average at 13.92% compared to all-periods at 9.36%.

Source: Bespoke Investment Group

Looking back, the consistency of positive month-over-month returns of the S&P 500 has been a significant benefit to the future performance of the market, resulting in greater optimism for future returns. One may think that markets which become overbought are not for buying, but history has shown that this type of optimism can also have a positive effect on markets. Strong, or even overbought, markets tend to last longer than most would think.

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Bespoke Investment Group