Market Insights: The Role of Private Assets

Milestone Wealth Management Ltd. - Mar 15, 2024

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index rose 0.51%. In the U.S., the Dow Jones Industrial Average dropped slightly by 0.02% and the S&P 500 Index decline 0.13%.

- The Canadian dollar devalued this week, closing at 73.85 cents vs 74.14 cents last Friday.

- Oil prices were positive this week. U.S. West Texas crude closed at US$81.04 vs US$77.85 last Friday.

- The price of gold pulled back this week, closing at US$2,157 vs US$2,177 last Friday.

- Taiwan Semiconductor Manufacturing (TWD) will be awarded over $5 billion in U.S. federal grants to build a manufacturing plant in Arizona. The grant marks a major milestone in President Biden’s efforts to nationalize the semiconductor industry, particularly in the manufacturing of chips, which is currently dominated by Eastern-Asian countries.

- Reddit is seeking to raise up to $748 million through an IPO, with plans to sell 22 million shares at a price range of $31 to $34 each, aiming for a valuation of up to $6.5 billion. Notably, about 1.76 million shares are reserved for purchase by users and moderators who created accounts before January 1, without a lockup period.

- Boeing’s (BA) rough start to the year has gotten worse, with the stock now down over 27.50% year-to-date following a criminal investigation initiated by the Justice Department into a midair blowout incident involving a 737 Max fuselage panel in January. Shares dropped by as much as 4.4% on Monday after Alaska Airlines, the operator of the aircraft, confirmed reports of the probe.

- Oracle’s (ORCL) shares surged after hours Monday following a very strong earnings report, indicating a stabilization in the growth of its cloud computing segment. Cloud revenue experienced a notable 25% increase to $5.1 billion, surpassing estimates. The company, known for its database software, aims to intensify its presence in the cloud infrastructure market to compete with major players like Amazon, Microsoft, and Google.

- The US House approved a bill demanding China's ByteDance to divest TikTok, or risk being banned. The legislation, due to TikTok being viewed as a national security threat, passed 352-65. Though purportedly not a ban, it requires ByteDance to sell TikTok in six months to remain available in the U.S., drawing concerns over First Amendment rights.

- In the US, the Producer Price Index (PPI) rose 0.6% in February, coming in well above the consensus expected +0.3%. Producer prices are up 1.6% versus a year ago. The PPI report shows core inflation (3.2% in February) was spread between goods and services, with prices for nondurable consumer goods, transportation and warehousing, and outpatient care leading the charge.

- Adobe (ADBE) shares are looking to dip after the company reported strong first-quarter earnings but provided guidance that missed market expectations. Revenue increased by 11% y/y to $5.18 billion while earnings declined by 50% to $620 million. Considering the heightened expectations, the software maker’s guidance of revenue between $5.25 billion and $5.30 billion, roughly implying 9% growth in the quarter, disappointed investors. Additionally, the company was set back by antitrust regulation when U.K. regulators blocked its $20 billion acquisition of design software startup Figma, resulting in a termination fee of $1 billion.

Weekly Diversion:

Check out this video: Top 10 Places to Visit in 2024

Charts of the Week:

Private assets can play an important role in an investment portfolio for several key reasons. They offer investors a way to extend the opportunity set and provide additional sources of diversification and returns beyond traditional public securities like stocks and bonds, with the ultimate objective of enhancing overall portfolio risk-adjusted performance. Private securities, such as private equity in the form of venture capital or leveraged buyouts, private real estate and infrastructure plays, and various forms of private credit like senior or junior direct lending, mezzanine debt and specialty finance, all have the potential to generate higher returns compared to public securities.

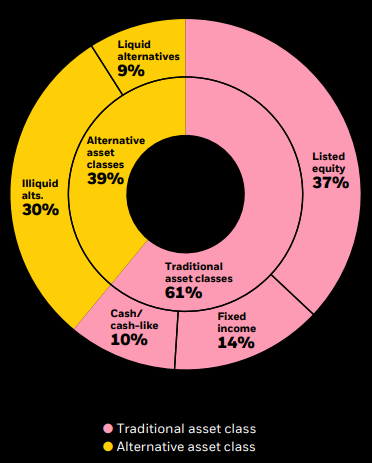

These markets often involve longer investment time horizons, allowing investors to participate in the growth of private companies over time. This long-term approach can result in significant capital appreciation and wealth accumulation. One need look no further than some of the best performing endowment funds in the world like the Yale Endowment Fund (less than 5% in domestic equities), or the Canada Pension Plan (under 25% in public equities), or even the composition of high and ultra-high net worth investors. According to the 2022-23 Blackrock Global Family Office Report, here is the average asset allocation of the correspondents of their latest survey. As you can see, a significant portion is allocated to private assets (as represented by illiquid alts. 30% in the chart).

Source: BlackRock Global Family Office Survey, January 2023. Numbers may not add up to 100% due to rounding

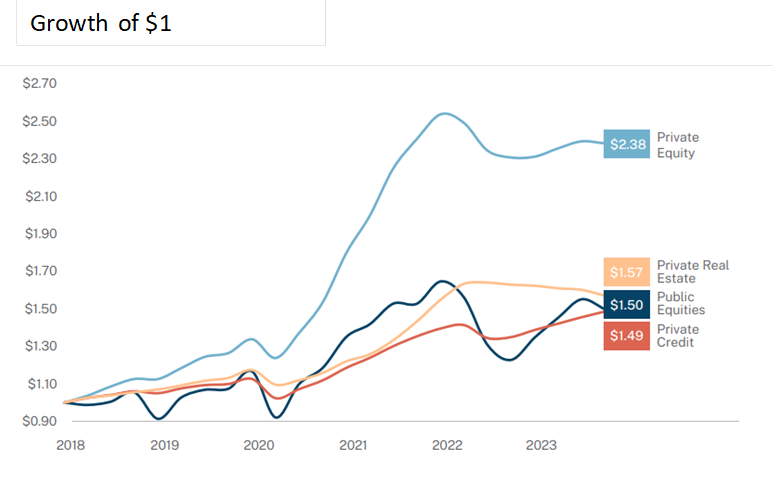

With such a high allocation by endowments, pension funds, and family offices, it is no surprise that the performance for private assets has been impressive compared to public equity. The next chart highlights $1 growth in the three primary categories of private assets (equity, real estate and credit) and the performance of public equities. As we can see, since 2018, private equities have significantly outperformed public equities. Also, we can observe private real estate outperforming public equities by a small margin and even private credit only slightly underperforming public equities. It is also important to note that each of the private asset areas were subject to much lower volatility and drawdowns.

Source: Hamilton Lane Data via Cobalt, Bloomberg

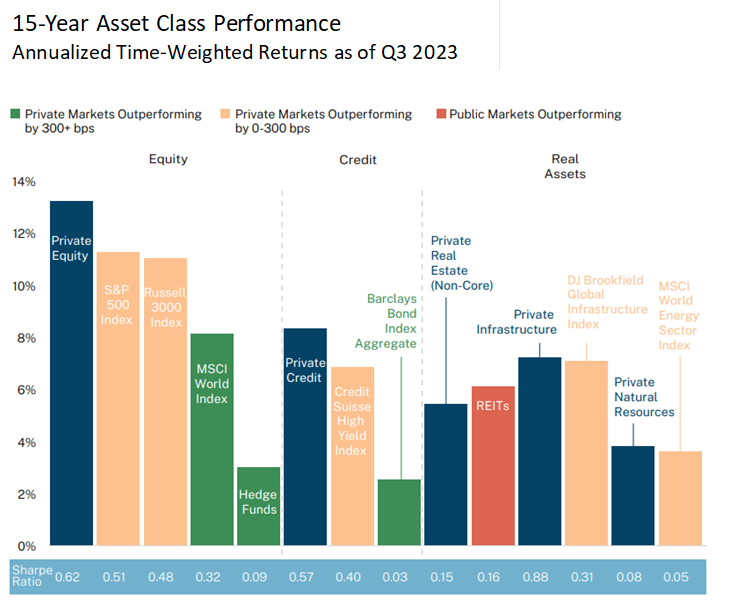

Moving to longer terms, the last chart below illustrates the performance of different private assets over the past 15 years considering annualized time-weighted return as of Q3 2023. As we can see, private markets significantly outperformed public markets with the only exception coming from public vs. private real estate investment trusts (REITs). It also notes the Sharpe Ratio for each market, which is a well-known financial metric that measures the performance of a security or portfolio relative to the risk-free rate (excess return), after adjusting for its risk (volatility). As we can see, the Sharpe Ratio is higher for each of the private assets compared to public, again except public REITs vs. private non-core real estate, indicating overall better returns for the level of risk.

Source: Hamilton Lane Data via Cobalt, Bloomberg

The importance of private assets in a portfolio lies in their ability to enhance diversification, potentially deliver higher returns with lower volatility, support long-term growth, provide access to unique investment opportunities, and enable portfolio customization based on individual investor goals and preferences.

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Hamilton Lane Data via Cobalt, Bloomberg, BlackRock, Inc.

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.