Market Insights: Surge in the Price of Gold

Milestone Wealth Management Ltd. - Mar 08, 2024

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index rose 0.86%. In the U.S., the Dow Jones Industrial Average fell 0.93% and the S&P 500 Index declined 0.26%.

- The Canadian dollar improved this week, closing at 74.14 cents vs 73.74 cents last Friday.

- Oil prices were down this week. U.S. West Texas crude closed at US$77.85 vs US$79.78 last Friday.

- The price of gold set a record high this week, closing at US$2,177 vs US$2,083 last Friday.

- The Bank of Canada met this week, with the central bank electing to keep its overnight interest rate at 5.0% and continue its policy of quantitative tightening. According to the statement, “the Council is still concerned about risks to the outlook for inflation, particularly the persistence in underlying inflation”.

- TC Energy (formerly TransCanada) and its partner have signed a deal to sell the Portland Natural Gas Transmission System for US$1.14 billion including the assumption of US$250 million in debt to BlackRock (BLK). PNGTS is a 475-kilometre natural gas pipeline system that serves the upper New England and Atlantic Canada markets.

- The U.S. ISM Non-Manufacturing (Services) index declined to 52.6 in February, slightly below the 53.0 level forecast by economists (levels above 50 signal expansion in the economy). The business activity index increased to 57.2 and the new orders index increased to 56.1, whereas the employment index declined to 48.0, and the supplier deliveries index dropped to 48.9.

- U.S. discount airline JetBlue (JBLU) has terminated its $3.8 billion deal to acquire fellow discounter Spirit Airlines (SAVE). The decision comes after a federal judge in January blocked the merger, and experts believed it would have been difficult to attempt to reverse it.

- Employment data for February was released on Friday. In Canada, the economy added 41,000 jobs; however, the unemployment rate rose to 5.8%, increasing 0.1% from the previous month. In the U.S., Nonfarm Payrolls rose 275,000 with unemployment rising to 3.9% from 3.7% in January.

- Constellation Software (CSU) reported strong performance in the fourth quarter, primarily driven by heightened growth from acquisitions. Revenues highlighted the Toronto-based company’s financial results, rising 26% from the same period one year prior. Net income declined by 7% from the same period, due to the higher number of acquisitions dragging on earnings. Full-year results topped expectations, sustained by an active technology market, and exemplified by revenue and earnings which improved by 27% and 10%, respectively.

- Costco (COST) shares are looking to close lower after missing revenue expectations for its holiday quarter, despite reporting year-over-year sales growth and strong e-commerce gains. Comparable sales for the company increased 5.6% year over year and 4.3% in the U.S. On a positive note, more shoppers came to Costco, and spent more on their shopping trips during the quarter. Traffic increased 5.3% across the globe and 4.3% in the U.S.

Weekly Diversion:

Check out this video: Young gentleman

Charts of the Week:

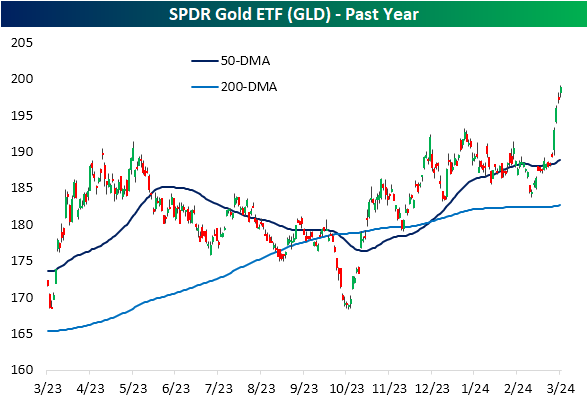

The price of gold has surged, having recently posted record prices, and closing today at USD$2,177.84. The recent rise has been driven by economic and geopolitical uncertainty, expectations of interest rate cuts, and a weaker U.S. dollar. For today’s charts of the week, we are going to observe the SPDR Gold ETF (GLD) which tracks the gold bullion market and provides insight to the overall price of gold. With the recent surge in gold prices, the ETF is up over 5% this month, reaching record highs and closing at an extremely overbought level compared to its 50-day moving average (DMA).

Source: Bespoke Investment Group

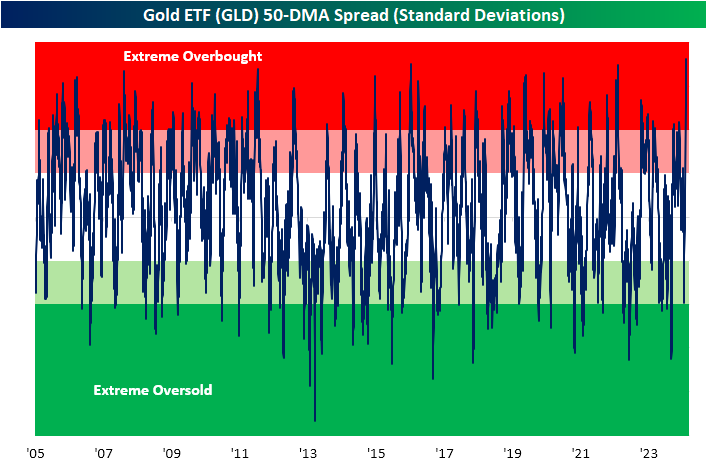

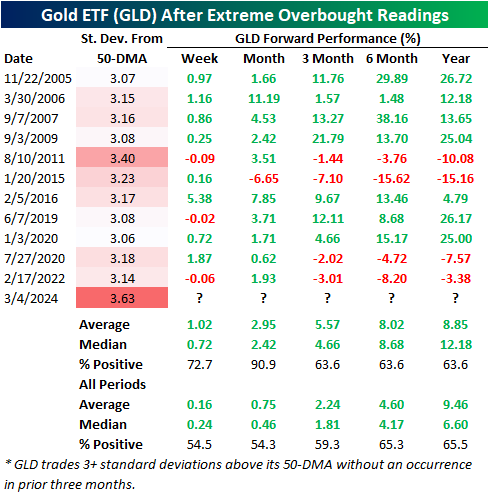

On Monday, the ETF closed 3.63 standard deviations above its 50-DMA, marking the most overbought level in its trading history, as seen the first chart below. Historically, such overbought readings have led to positive forward returns for GLD. Past instances where GLD closed at least 3 standard deviations above its 50-day without doing so in the prior three months have resulted in above-average returns from one week to six months later. Notably, and as seen in the second chart below, returns one month later have been particularly strong, averaging 2.95% compared to the all-periods average of 0.75% and with only a single decline observed after a similar instance in 2015. Returns three and six months out have also shown significant strength, averaging 5.57% and 8.02% respectively compared to all-period averages of 2.24% and 4.60%, respectively. Looking ahead one year later, performance tends to be around average.

Source: Bespoke Investment Group

The recent surge in the SPDR Gold ETF (GLD) has propelled it to its most overbought level ever, indicating a significant bullish sentiment towards gold. Despite reaching such extreme overbought levels, historical data suggests that GLD has typically performed well in the weeks and months following similar instances. This trend of historically overbought readings being associated with positive forward returns highlights the resilience and potential profitability of gold investments even amidst heightened market conditions.

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Bespoke Investment Group

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.