Market Insights: Valentine’s Day Indicator

Milestone Wealth Management Ltd. - Feb 16, 2024

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index rose 1.17%. In the U.S., the Dow Jones Industrial Average decreased 0.11% and the S&P 500 Index fell 0.42%.

- The Canadian dollar was down this week, closing at 74.14 cents vs 74.28 cents last Friday.

- Oil prices were positive this week. U.S. West Texas crude closed at US$79.23 vs US$76.52 last Friday.

- The price of gold waned this week, closing at US$2,013 vs US$2,025 last Friday.

- The annual inflation rate in the U.S. cooled last month. The Consumer Price Index (CPI) rose 3.1% from January 2022 to January 2023, down from 3.4% in December. Month-over-month, the CPI was up 0.3%, higher than the 0.2% expected by economists. The Core CPI, excluding volatile food and energy prices, was up 3.9% from a year ago.

- Shale producer Diamondback Energy (FANG) announced that it is buying the largest privately held oil and gas producer in the Permian Basin, Endeavor Energy Partners, in a cash-and-stock deal valued at about $26 billion, including debt. The combined company would be the third largest oil and gas producer in the region behind Exxon and Chevron.

- Restaurant Brands (QSR), owner of Tim Horton’s and Burger King, reported better than expected Q4 earnings of $0.75/share vs $0.73/share expected. Revenue came in at $1.82 billion vs $1.80 billion expected. The company also announced it is increasing its quarterly dividend by 5.5% to $0.58/share from $0.55/share.

- The continuing charge of Nvidia’s (NVDA) stock price has resulted in the company’s market value surpassing both Amazon and Alphabet in the past week. The hype surrounding AI and the resulting demand for AI chips has driven up Nvidia’s market cap to $1.794 trillion, making it the third largest company in the world, trailing only Apple and Microsoft.

- Calgary-based Cenovus Energy (CVE) released Q4 earnings of $0.39/share, the same per-share earnings as Q4 2022. Revenue for the quarter totalled $13.13 billion, down from $14.06 billion in the fourth quarter of 2022.

- Pipeline company TC Energy (TRP), formerly Transcanada, reported a Q4 profit of $1.41/share and increased its quarterly dividend to $0.96/share from $0.93/share. Revenue for the quarter totalled $4.24 billion, up from $4.04 billion in the fourth quarter of 2022.

Weekly Diversion:

Check out this video of the best and worst Super Bowl commercials.

Charts of the Week:

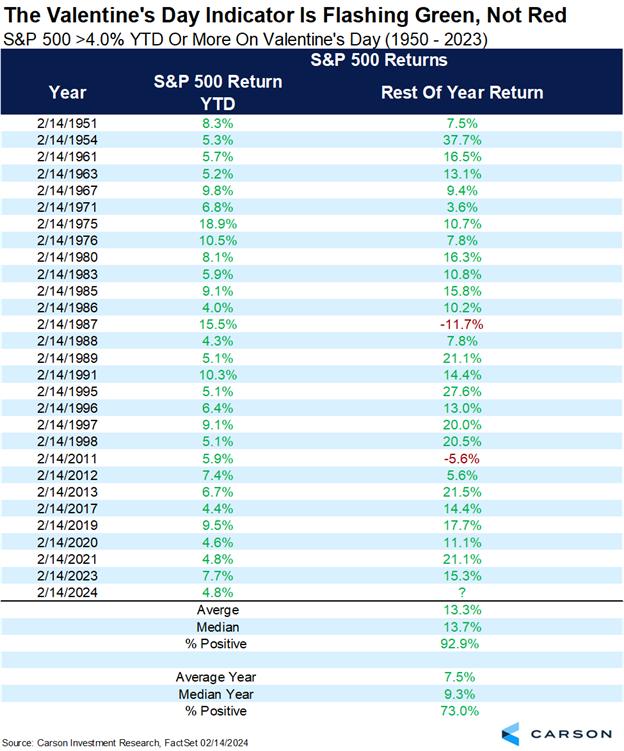

With this week’s celebration of Valentine’s Day, we wanted to draw your attention to the Valentine’s Day Indicator as a reason for further optimism. This year, we have seen a strong start to North American markets and if this indicator’s history holds, we may see these strong returns continue. As the following chart illustrates, since 1950, there have been 28 times that the S&P 500 was up by 4.0% or more on Valentine’s Day and of these 28 occurrences, 26 had positive returns for the rest of the year. At a positive rate of just under 93%, this would be impressive alone; however, the future looks brighter when we observe the average returns of 13.3% for the rest of the year compared to the all-year average of 7.5%. This indicator has also been more beneficial recently with the last six occurrences ending the year up over 10% and an average of 16.85%.

Source: Carson Investment Research via @ryandetrick

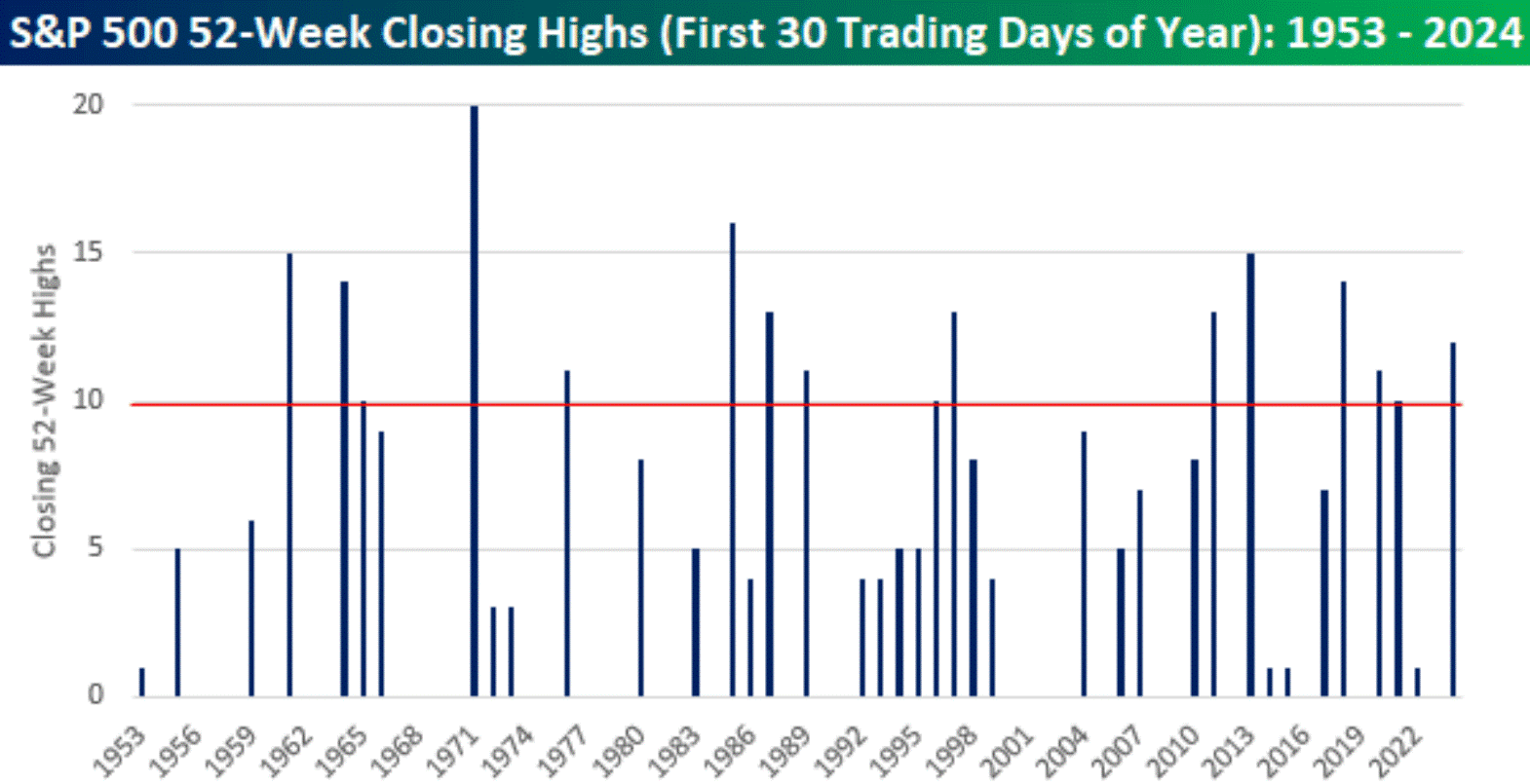

Further to the S&P 500’s performance, as we can see in the next chart below, over the first 30 trading days of the year, the index has recorded 12 closing 52-week highs which is the most since 2018. It will be interesting to see if this momentum continues throughout the remainder of the year.

Source: Bespoke Investment Group

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Bespoke Investment Group, Carson Investment Research, @ryandetrick

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.