Market Insights: Record Cash on the Sidelines

Milestone Wealth Management Ltd. - Feb 09, 2024

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index was down 0.36%. In the U.S., the Dow Jones Industrial Average was up 0.04% and the S&P 500 Index jumped 1.37% to a new record closing high.

- The Canadian dollar was almost flat this week, closing at 74.28 cents vs 74.30 cents USD last Friday.

- Oil prices bounced back this week. U.S. West Texas crude closed at US$76.52 vs US$72.16 last Friday.

- The price of gold was down slightly this week, closing at US$2,025 vs US$2,037 last Friday.

- Canada has lengthened a ban on foreign home buyers for two additional years as the real estate market begins to show signs of a rebound. Prime Minister Justin Trudeau’s government acted to prohibit non-Canadians from buying residential real estate in 2022. The ban was set to expire on January 1, 2025 but that date has now been moved to January 1, 2027.

- The U.S. ISM Non-Manufacturing (Services) index rose to 53.4 in January, beating the expected 52.0 (levels above 50 signal expansion and levels below signal contraction). The new orders index increased to 55.0 from 52.8, the business activity index remained at 55.8, the employment index rose to 50.5 from 43.8, and the supplier deliveries index increased to 52.4 from 49.5.

- In December, Canada recorded its first monthly trade deficit since July, primarily attributed to increased imports of pharmaceutical products and the appreciation of the Canadian dollar. Canada reported a trade deficit of $312 million for the month, well below the expected $1 billion surplus and the $1.1 billion surplus posted in the previous month.

- Disney, Fox and Warner Bros Discovery are jointly proposing a new sports streaming offering that will feature games from the major professional leagues and college conferences. The service will offer streaming subscribers all the sports channels owned by those companies including ESPN, TNT and FS1.

- Walt Disney (DIS) reported better-than-expected Q1 earnings due to slashing costs, and increased its guidance for fiscal 2024 earnings to roughly $4.60/share which would be a 20% increase from 2023. Also, the company announced that it is taking a $1.5 billion equity stake in Epic Games, a private company that owns the massively popular game Fortnite.

- Canada’s employment numbers were released on Friday. The January Labour Force Survey showed Canada added 37,000 jobs last month, well ahead of the 15,000 predicted by economists. The unemployment rate unexpectedly declined to 5.7% from the 5.8% December reading, the first drop since December 2022.

Weekly Diversion:

Check out this video of a boy’s dream coming true.

Charts of the Week:

This week we would like to highlight the fact that U.S. investors have stockpiled a record $6.1 trillion in money market funds in search of high short-term interest rates and safety. That is an enormous amount cash on the sidelines, which has increased over 50% since 2019 and more than doubled since 2017. These funds are a low risk and highly liquid alternative to cash that hold assets like short-term U.S. Treasuries, and are similar to the High Interest Savings Account (HISA) funds we are familiar with here in Canada.

Source: Federal Reserve 12/07/2023, Bloomberg 09/21/2023, www.visualcapitalist.com

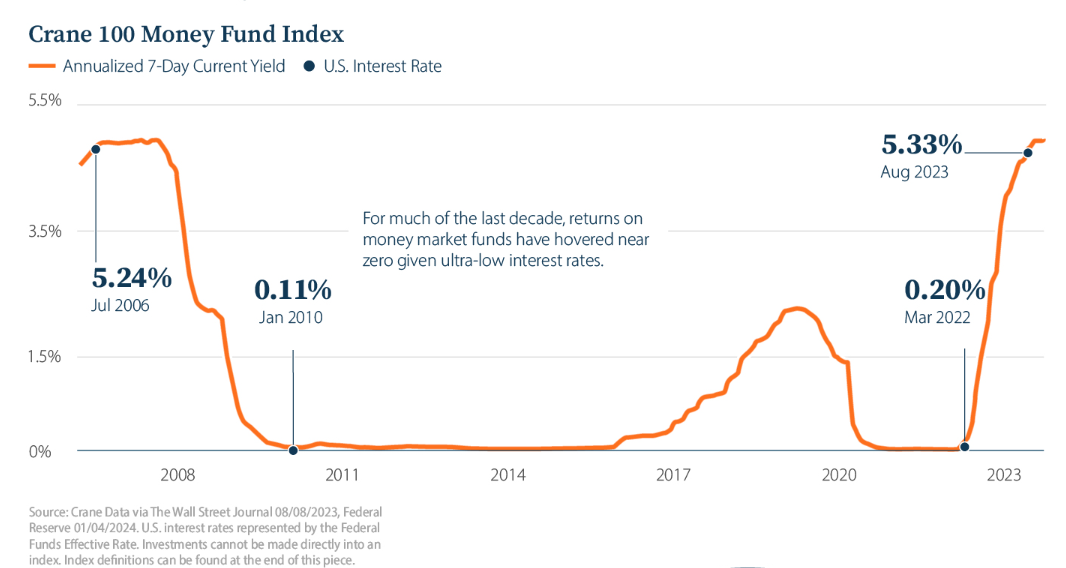

Having a large amount of excess savings may be a major source of strength for U.S. households going forward. It could also potentially act as support for equities and other risk assets if we do see slower economic growth and, as a result, interest rate declines over the coming quarters. The average yield on these funds peaked at 5.2% in August of 2023, the highest in 16 years. The next chart illustrates the steep climb in rates after a decade of near zero interest rates. However, with headline inflation (CPI) coming down to 3.4% in December, market participants today have priced in four to five rate cuts with the first one starting as early as May. If inflation continues to ease, and we see central bank rate cuts play out as currently forecasted, then the yields on these money market funds will also drop (orange line will peak and decline).

Source: Crane Data via Wall Street Journal 08/08/2023, Federal Reserve 01/04/2024, www.visualcapitalist.com

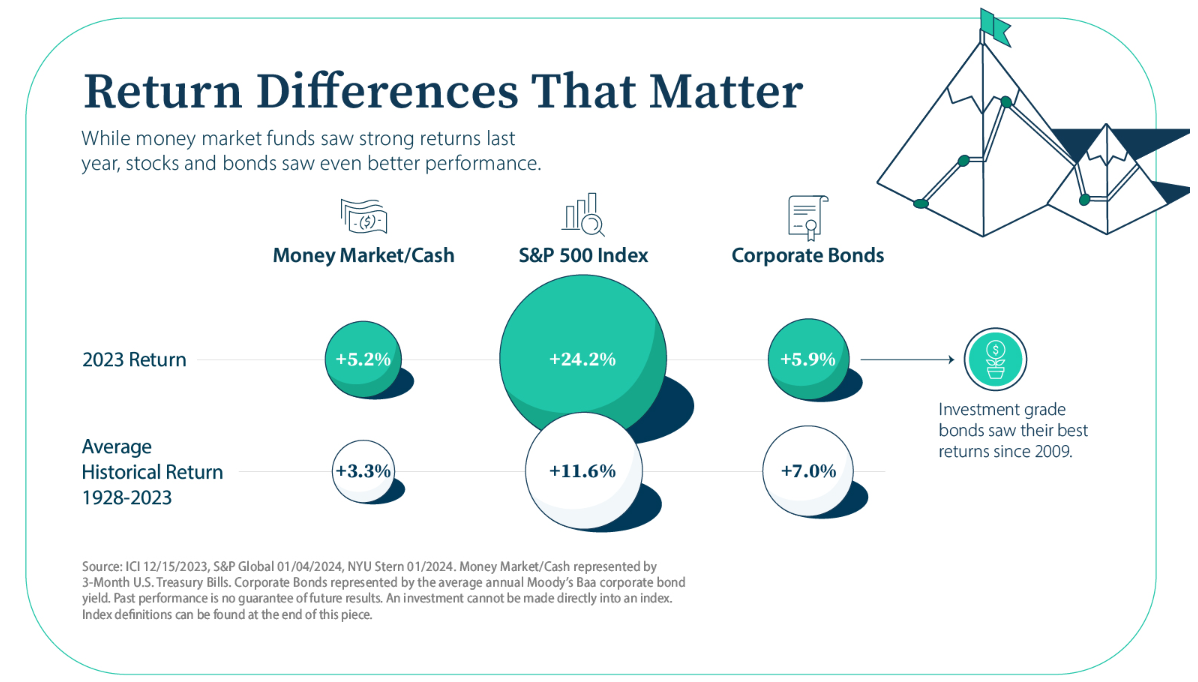

With lower yields, investors may start to shift this cash off the sidelines and back into risk assets like dividend yielding stocks, high yield corporate bonds and preferred shares, and real estate investment trusts seeking better return opportunities. This could be a strong support for further increases in equity indices, and potentially back into high dividend-paying stocks vs. high growth, no-dividend equities like some large cap tech that have been driving markets. As a result, this would provide much stronger overall breadth to U.S. equity markets and better returns for the average stock. The last chart below shows that while these money market funds (and also HISA funds here in Canada) provided nice yields last year, it still wasn’t even close to the returns seen in equities and corporate bonds. Over the short-term, these funds can be very useful to provide stability in a portfolio and access to emergency funds, but over the long-term other assets provide much better growth potential. As the current rate cycle shifts from hiking to cutting, investors would likely move money away from this record stockpile of money market funds back into high-quality equity investments.

Source: S&P Global 01/04/2024, NYU Stern 01/2024, www.visualcapitalist.com

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, U.S. Federal Reserve, S&P Global, NYU Stern, Crane Data, Wall Street Journal, Visual Capitalist

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.