Market Insights: Uranium Demand and Nuclear Energy

Milestone Wealth Management Ltd. - Jan 26, 2024

Macroeconomic and Market Developments:

- North American markets were positive this week. In Canada, the S&P/TSX Composite Index rose 1.05%. In the U.S., the Dow Jones Industrial Average increased 0.65% and the S&P 500 Index grew 1.06%.

- The Canadian dollar declined this week, closing at 74.36 cents vs 74.46 cents USD last Friday.

- Oil prices improved this week. U.S. West Texas crude closed at US$77.95 vs US$73.79 last Friday.

- The price of gold waned this week, closing at US$2,018 vs US$2,029 last Friday.

- The Bank of Canada was in the spotlight this week. On Wednesday, the central bank announced that it is holding its overnight interest rate at 5.0% and continuing its policy of quantitative tightening. According to the press release: “Global economic growth continues to slow, with inflation easing gradually across most economies. While growth in the United States has been stronger than expected, it is anticipated to slow in 2024, with weakening consumer spending and business investment.”

- U.S. Real (above inflation) GDP increased at a 3.3% annual rate in Q4, easily beating the expected 2.0%. The largest positive contribution to Real GDP growth in Q4 came from personal consumption, while every other major component of GDP was up as well. Personal consumption, business fixed investment, and home building, combined, rose at a 2.6% annual rate in Q4.

- Also, another important U.S. data point was released Friday showing that the rate of price increases cooled as 2023 ended. The Commerce Department’s core personal consumption expenditures price index for December (Core PCE – excludes food and energy), the Federal Reserve’s preferred inflation gauge, increased 0.2% on the month and was up 2.9% on a yearly basis, down from the prior month’s 3.2% and a bit less than the 3.0% expected by economists. The 12-month rate is the lowest since March 2021 and a welcome sign for the U.S. Fed in their inflation fight.

- Sunoco LP has agreed to acquire pipeline and fuel storage company NuStar Energy LP in an all-stock deal valued at about $7.3 billion, including debt. The acquisition would extend the fuel products carried by Sunoco, one of the largest independent fuel retailers in the U.S.

- West Fraser Timber (WFG) announced that it will permanently close its sawmill in Fraser Lake, BC following an orderly wind-down. The mill closure will reduce West Fraser's Canadian lumber capacity by ~160M board feet and the company anticipates recording restructuring and impairment charges of ~$81M in Q4 of 2023.

- Netflix (NFLX) reported earnings this week showing an increase of 9 million subscribers in the fourth quarter, well surpassing expectations of 8 million and cementing the success of the company’s anti-password sharing efforts last year. Additionally, the company has acquired the exclusive rights to Raw as well as other programming from World Wrestling Entertainment, marking the streaming service’s first big move into live events. Raw will air on Netflix in the US, Canada, Latin America and other international markets beginning in January 2025, after the expiration of the WWE’s domestic deal with Comcast Corp.

- Shares of Tesla (TSLA) fell 12% Thursday after the company released a disappointing fourth-quarter earnings report and issued a stark warning on 2024 demand. The drop to about $182 per share made for Tesla stock’s worst day in over a year.

Weekly Diversion:

Check out this video of a family making incredible family photos.

Charts of the Week:

The extreme rise in the price of uranium, especially in the past year where it has doubled, can be attributed to a combination of factors including resurgent demand, supply challenges, and geopolitical risks. The increased demand for nuclear power, particularly from major economies like China, India, Japan, Europe, and the United States, has led to the need for more uranium, when ‘enriched’ into U-235 concentrations, is used as fuel for large- and small-scale nuclear power plants. This demand is being driven by several factors, including the need for a reliable and low-carbon source of power, the increasing electrification of end-uses, and the growth in global energy demand due to population growth and industrial development. Additionally, nuclear power - especially via small nuclear reactors (SMEs) - is seen to reduce greenhouse gas emissions and address climate change concerns, as it provides a powerful, stable, and consistent source of electricity without emitting greenhouse gases during operation. Furthermore, nuclear energy can contribute to energy security for some countries by reducing the dependence on fossil fuel imports.

The economic and political considerations, as well as advancements in nuclear technology, also play significant roles in driving the demand for nuclear power. The environmental benefits of nuclear power include its low carbon emissions, minimal air pollution, and small land footprint. These factors make nuclear power a significant contributor to reducing greenhouse gas emissions and addressing climate change concerns.

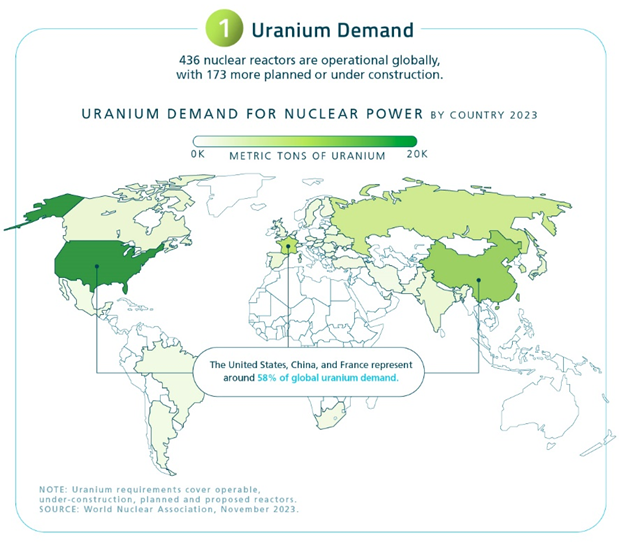

As the next chart illustrates, the demand for uranium has been dominated by China, the U.S., and France, representing 58% of the global uranium demand in 2023. This demand is only going to grow as there are currently 436 nuclear reactors operational globally with an additional 173 planned or under construction.

Source: The Visual Capitalist

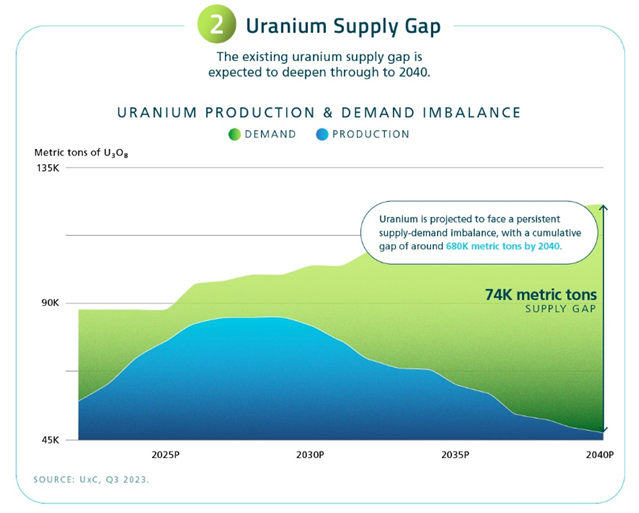

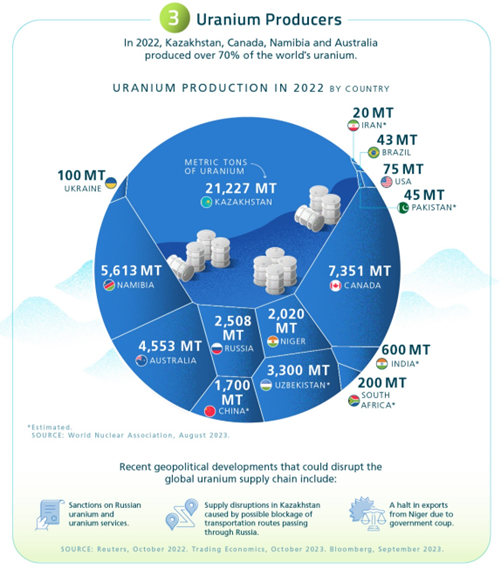

The following charts we wanted to highlight focus on the project supply gap that is expected to deepen through 2040. As we can see in the first chart, by 2040 the projected supply gap will be 74,000 metric tons of uranium with a cumulative gap of around 680,000 tons. The second chart below highlights the beneficial economic position of uranium-producing countries including Canada, which along with Kazakhstan, Namibia, and Australia, produced over 70% of the world’s uranium in 2022.

Source: The Visual Capitalist

Source: The Visual Capitalist

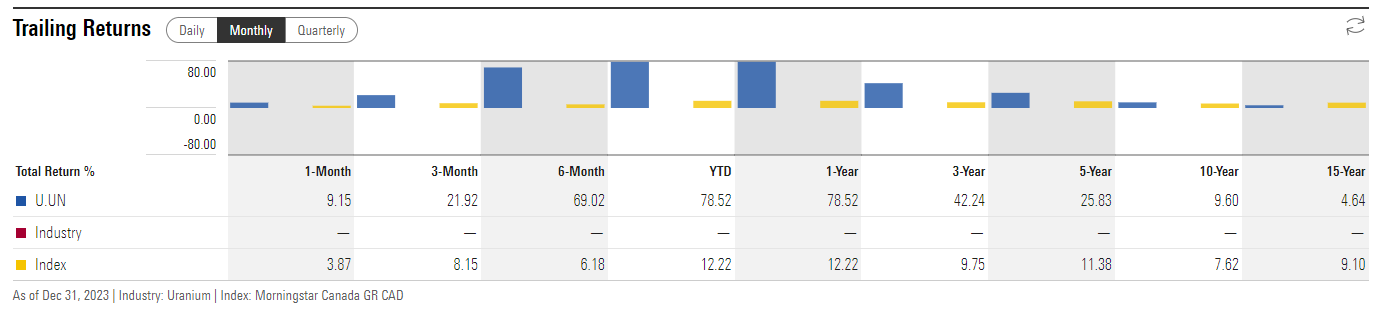

Back in mid-2021 after some thorough research, Milestone recognized the supply shortfall and the increasing demand of uranium for future and ongoing nuclear energy projects, which led to our initial purchase of Sprott Physical Uranium Trust units (formerly Uranium Participation Corp). This investment is the only vehicle in North America where you can indirectly own physical uranium, another reason for our initial investment. The next chart shows the price of Uranium over the last five years (red arrow indicates where we first bought), and the table following that shows that the performance of the Sprott investment vehicle (in blue) has been very strong, with the 2023 calendar-year return being 78.5% and the 3-year annualized compound returns at 42.4%. Based on timing, our initial investment has produced a total return of close to 200% up to this point, after taking some profits in 2022.

Source: Trading Economics

Source: Morningstar

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Refinitiv, The Visual Capitalist, Trading Economics, Morningstar

©2024 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.