Market Insights: Rate Decisions and Looking Forward to 2024

Milestone Wealth Management Ltd. - Dec 15, 2023

Macroeconomic and Market Developments:

- North American markets were positive this week. In Canada, the S&P/TSX Composite Index rose 0.93%. The Dow Jones Industrial Average increased 2.92% and the S&P 500 Index advanced 2.49% for a strong week in the U.S.

- The Canadian dollar rallied this week, closing at 74.78 cents vs 73.60 cents USD last Friday.

- Oil prices were up this week. U.S. West Texas crude closed at US$71.69 vs US$71.64 and the Western Canadian Select price closed at US$52.83 vs US$49.84 last Friday.

- The price of gold also climbed this week, closing at US$2,019 vs US$2,003 last Friday.

- The U.S. central bank met this week and elected to hold rates steady at a range of 5.25% - 5.50%. The release stated: “Recent indicators suggest that growth of economic activity has slowed from its strong pace in the third quarter. Job gains have moderated since earlier in the year but remain strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated. The U.S. banking system is sound and resilient. Tighter financial and credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation.” The markets rallied, taking this as a message that the Fed has perhaps eased back on its tightening bias.

- U.S. inflation data was released this week. The Consumer Price Index (CPI) rose 0.1% in November and is up 3.1% from a year ago. The Core CPI, excluding food and energy, rose 0.3% in November and 4.0% from a year ago. Also, The Producer Price Index (PPI) which measures wholesale prices was flat in November. From a year ago, the headline PPI was up 0.9%, while the Core PPI was up 2.0%.

- Another week, another mega oil deal. Occidental Petroleum (OXY) has agreed to acquire Texas shale driller CrownRock LP in a cash-and-stock deal valued at approximately $12 billion. CrownRock, a large oil producer in the Permian Basin, has operations that compliment assets Occidental acquired through its massive 2019 takeover of Anadarko.

- The government of Panama has officially instructed Canadian copper miner First Quantum Minerals (FM) to cease all operations at its $10 billion Cobre copper mine. First Quantum’s stock price has dropped over 70% in the last few months as the future of its Panama mine has been called into question.

- Rogers Communications (RCI.b) has announced the sale of all its shares in Cogeco (CGO) to the Caisse de dépôt, Québec’s pension, for $829 million. This move is aimed at reducing Rogers' debt leverage ratio.

- Pembina Pipeline (PPL) announced it has entered into an agreement to acquire Enbridge's (ENB) interests in Alliance, Aux Sable and NRGreen for an aggregate purchase price of ~$3.1 billion. The cash portion of the acquisition will be funded through a combination of a $1.1 billion stock offering, amounts drawn under Pembina's existing credit facilities, and cash on hand.

Weekly Diversion:

Check out this video: Dear Christine: A Letter from Canada

Charts of the Week:

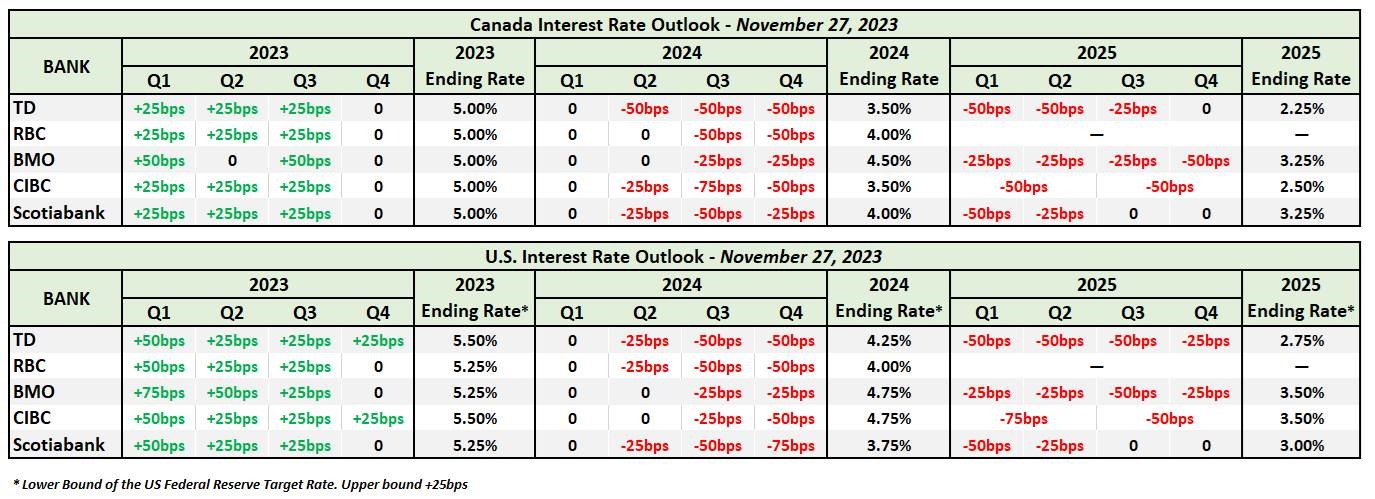

As we wrap up the week, and with only two weeks remaining in the year, we wanted to take this time to review some major rate decisions, forward rate projections, and some year-end performance data. Last week, the Bank of Canada left rates unchanged for the third consecutive meeting. This week, the U.S. Federal Reserve also announced that they were leaving rates unchanged, for the third consecutive meeting. Both rate decisions came as little surprise to economists based on current sentiment and inflation data. The table below shows Canada’s big five banks’ projections for both the Canadian and U.S. Interest Rate outlooks for 2024 and 2025. Although the timing and extent of rate changes differs between institutions, all five banks are projecting rates will begin to fall next year with many pointing to a decrease starting Q2 2024 for both the U.S. and Canada.

Source: TD Asset Management, TD Economics, RBC Economics, BMO Economics, CIBC Economics, Scotiabank Economics.

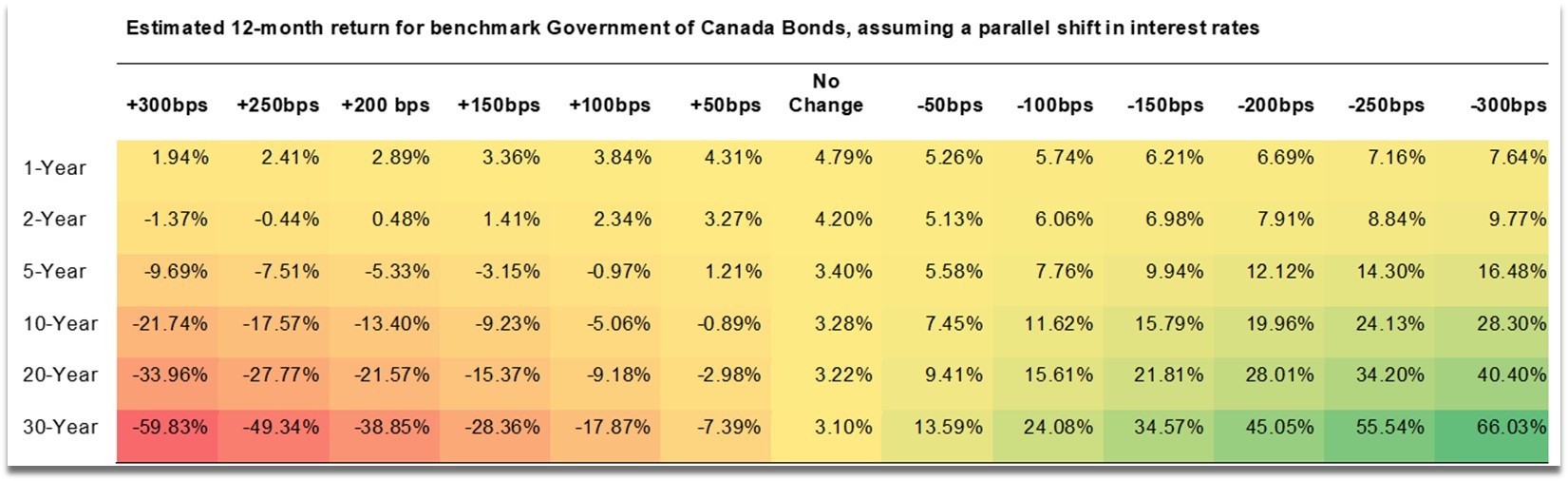

Falling Rates also represent an opportunity for fixed income holdings. The table below shows the effects of interest rate movements on current Government of Canada Bonds. It is important to note that the table highlights the potential total return for bonds in various interest rate scenarios on an estimated 12-month timeframe. As we can see, any fall in interest rates represents strong value for existing bonds.

Source: TD Asset Management

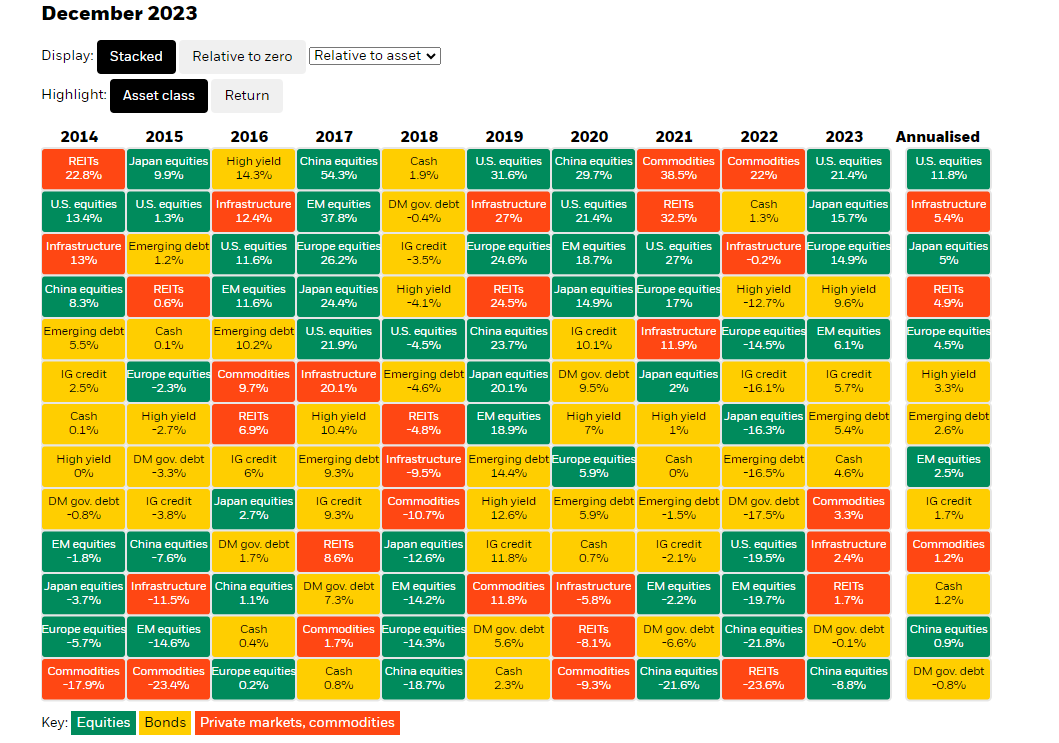

Finally, the first chart below shows the performance of different asset classes globally as of December 1, 2023, and for the past decade. The chart separates data by year and asset class for each of the past 10 years and also provides annualized rates of return over that period. As we can see, U.S. equities were the standout this past year, mostly propelled by the rise in technology and AI-related stocks. The second chart, which we found interesting, reinforces the tech-heavy U.S. stock performance when we observe that as of November 30, 2023, the “Super-7” (the large-cap tech heavy group of Meta, Tesla, Nvidia, Amazon, Alphabet, Microsoft, and Apple) now make up almost as much of the MSCI All-Country World Index (which tracks nearly 3,000 stocks in 48 countries) than Japan, UK, China, France, and Canada combined.

Source: BlackRock Investment Institute

Source: Schroders via @Duncan Lamont

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Refinitiv, TD Asset Management, TD Economics, RBC Economics, BMO Economics, CIBC Economics, Scotiabank Economics, BlackRock Investment Institute, Schroders via @Duncan Lamont

©2023 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.