Market Insights: Corporate Stock Buybacks Adding Value

Milestone Wealth Management Ltd. - Dec 09, 2023

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index lost 0.59%. In the U.S., the Dow Jones Industrial Average rose slightly by 0.01% and the S&P 500 Index gained 0.21%.

- The Canadian dollar fell this week, closing at 73.60 cents vs 74.10 USD cents last Friday.

- Oil prices declined this week for the seventh consecutive week. U.S. West Texas crude closed at US$71.29 vs US$74.28 and the Western Canadian Select price closed at US$49.84 vs US$50.96 last Friday.

- The price of gold decreased this week, closing at US$2,003 vs US$2,071 last Friday.

- The Bank of Canada met this week and announced that elected to hold its benchmark interest rate steady at 5.0% for the third consecutive meeting. The central bank said, “The global economy continues to slow and inflation has eased further. In the United States, growth has been stronger than expected, led by robust consumer spending, but is likely to weaken in the months ahead as past policy rate increases work their way through the economy. Growth in the euro area has weakened and, combined with lower energy prices, this has reduced inflationary pressures. Oil prices are about $10-per-barrel lower than was assumed in the October Monetary Policy Report (MPR). Financial conditions have also eased, with long-term interest rates unwinding some of the sharp increases seen earlier in the autumn. The US dollar has weakened against most currencies, including Canada’s.”

- Standard & Poor’s announced changes to the S&P/TSX Composite Index to take effect on December 18, 2023. Additions to the index are Kelt Exploration (KEL) and New Gold (NGD), with deletions being Dye & Durham (DND), Endeavour Silver Corp (EDR), Park Lawn Corporation (PLC) and TELUS International (TIXT).

- Alaska Air Group (ALK) agreed to buy rival Hawaiian Holdings (HA) for $1.9 billion in cash and debt. The deal could provide a valuable lifeline to Hawaiian, whose stock has tumbled more than 52% this year, having been hurt by the slow return of tourism between Asia and Hawaii following the pandemic.

- The U.S. ISM Non-Manufacturing (Services) index rose to 52.7 in November (levels above 50 signal expansion), higher than the expected 52.3. The business activity index increased to 55.1 from 54.1, while the new orders index was unchanged at 55.5. The employment index rose to 50.7 from 50.2, while the supplier deliveries index increased to 49.6 from 47.5.

- Canadian National Railway (CNR) announced that it has signed and closed an agreement to acquire Iowa Northern Railway, which operates approximately 275 track miles in Iowa connecting to CN's U.S. rail network. Terms of the deal were not disclosed.

- U.S. employment numbers were released for the month of November on Friday. Nonfarm payrolls rose by a seasonally adjusted 199,000 for the month, slightly better than the 190,000 estimate and higher than the October gain of 150,000 jobs. The unemployment rate declined to 3.7%, lower than the expected 3.9% rate.

Weekly Diversion:

Check out this video: WestJet Christmas Miracle - Connecting Holiday Heroes

Charts of the Week:

November 2023 saw the biggest corporate buybacks on record based on a 4-week average. This may come as no surprise as this strategy has become more popular over the past decade, especially with large cap companies flush with cash. Stock buybacks essentially reduce the number of shares outstanding which results in the remaining shareholders participating in a higher percentage of the company’s earnings. This generally demonstrates to shareholders that large stakeholders and insiders have confidence in their own company. The buybacks can help boost the stock prices and indicate that the company possesses ample resources to do the repurchase and are ultimately favourable for existing investors. These buybacks often occur when share prices are compressed due to market conditions or as a strategy to deploy excess funds other than doing so via further dividends.

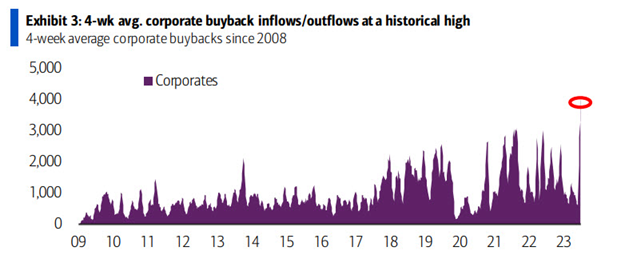

With this past November marking the largest corporate buyback month ever, let’s look at the next chart below which shows the historical 4-week average corporate buybacks since 2008. The November numbers have drastically outpaced prior months. This trend looks like it may continue into December and the new year, with Mastercard recently announcing a share buyback of $11 billion as well as Lululemon Athletica announcing a buyback of $1 billion.

Source: B of A Global Research via @zerohedge

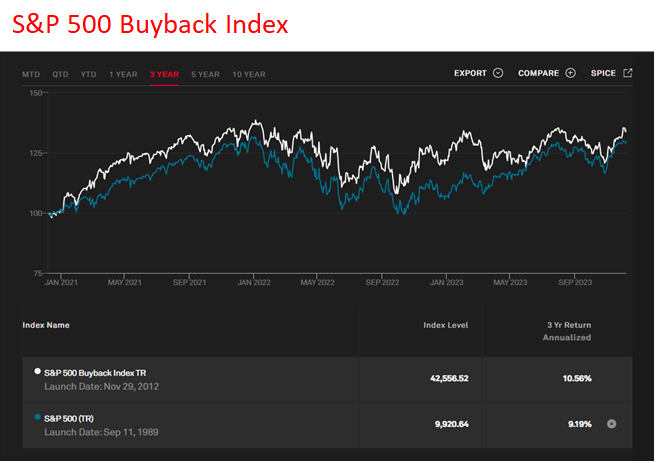

Share buybacks have been beneficial for investors over the long-term with the outperformance of the S&P 500 Buyback Index over the S&P 500 Index by an impressive 5.5% per year between 2000 and 2019. The chart below further demonstrates this outperformance when comparing the line in blue representing the S&P 500 Total Return Index to the white line representing the S&P 500 Buyback Total Return Index. As we can see over the past three years, the annualized performance of the S&P Buyback Index was 10.56% vs. the annualized performance of the S&P 500 Index at 9.19% for a 1.37%/year annualized outperformance. It is important to note that we chose to focus on timeframes that excluded the 2020 pandemic year, as this was one of the worst years for share buybacks, which comes as no surprise. In general, share buybacks have proven to provide value for investors and as a result can be a prudent investment strategy to consider.

Source: S&P Global

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Richardson Wealth, Refinitiv, B of A Global Research, @zerohedge, S&P Global, Forbes Advisor

©2023 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.