Market Insights: Twin Tail Winds in the High Yield Credit Market

Milestone Wealth Management Ltd. - Nov 25, 2023

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index decreased 0.36%. In the U.S., the Dow Jones Industrial Average increased 1.27% and the S&P 500 Index rose 1.00%.

- The Canadian dollar improved this week, closing at 73.33 cents vs 72.92 cents last Friday.

- Oil prices were mixed this week. U.S. West Texas crude closed at US$75.54 vs US$75.80 and the Western Canadian Select price closed at US$52.10 vs US$47.49 last Friday.

- The price of gold rallied this week, closing at US$2,000 vs US$1,980 last Friday.

- Canada’s Finance Minister Chrystia Freeland presented the federal government's fall economic statement on Tuesday. Freeland announced that the government will be putting billions into building new homes, increasing the number of construction workers, cracking down on short-term rentals and grocery competition, as well as rolling out anticipated green investment tax credits. Also announced, the federal government recorded a budgetary deficit of $8.2 billion between April and September, compared to a surplus of $1.7 billion during the same period last year.

- Canadian inflation data was released this week, with the Consumer Price Index (CPI) rising 3.1% from a year ago, down from the 3.8% pace from September 2022 to September 2023. This deceleration was primarily driven by lower gas prices, while mortgage interest costs, groceries, and rent remained the largest contributors to the overall increase.

- In a bizarre series of events, Sam Altman, CEO of OpenAI, which owns Chat GPT, was unexpectedly fired by the board last Friday. Then on Monday, Microsoft (MSFT), a huge investor in OpenAI, announced that they had hired Sam Altman to lead the company’s new in-house AI team. However, after a revolt by a majority of OpenAI employees, on Wednesday Sam Altman was brought back as CEO and several board members were removed.

- Speaking of AI, chip maker Nvidia (NVDA) reported blowout earnings after the market closed on Tuesday. Earnings came in at $4.02/share vs $3.37/share expected. The company’s revenue grew 206% year-over-year, coming in at $18.12 billion vs $16.18 billion expected.

- Statistics Canada reported Canadian Retail Sales increased 0.6% to $66.5 billion in September. Sales were up in four of nine subsectors and were led by increases at motor vehicle and parts dealers (+1.5%). However, core retail sales, excluding gas stations and car dealers, declined by 0.3% in September, indicating consumer weakness in certain discretionary purchases.

Weekly Diversion:

Check out this video: Top 50 Videos Of 2023 So Far

Charts of the Week:

In the U.S., there are currently two major factors that are benefiting high-yield credit, and if history repeats, forward returns for this asset class may provide an excellent investment opportunity. Firstly, during their last meeting on November 1st, the U.S. Federal Reserve (Fed) announced it intended to keep interest rates unchanged for a second consecutive time. The futures markets are currently pricing in close to a zero probability of a rate hike at the next meeting in December, and a high probability of a 0.75% to 1% cut by the end of 2024. Then on November 14th, the most recent U.S. inflation reading came out for October and it fell to a 3.2% year-over-year rate, down from 3.7% for the previous month and the peak of 9.1% back in June 2022. With continued easing of inflation and signs that credit conditions have tightened sufficiently, the consensus among economists is that the Fed is done its rate hiking cycle.

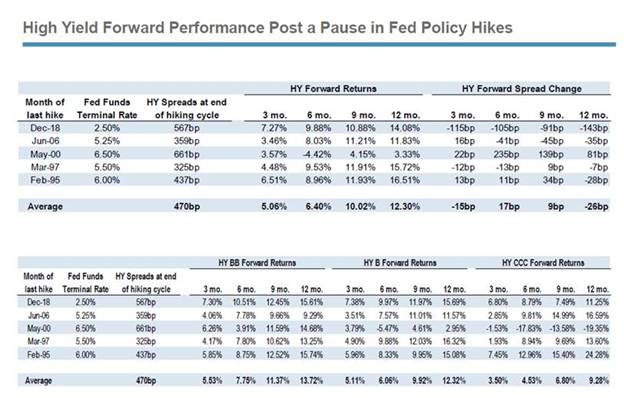

Historically, a Fed pause has been a catalyst for strong forward returns in the high yield credit space. The following table shows that since 1995, there have been five major prior instances of Fed rate hike pauses. As shown in the middle columns of the table, the average 3-, 6-, 9- and 12-month forward returns were 5.06%, 6.40%, 10.02%, and 12.30%, respectively. It is interesting to note in the second table, the higher the credit quality of high yield, the better it performed, with BB credit rating bonds outperforming B, which outperformed CCC. Therefore, sticking with the highest quality high yield credit has historically been the place to be.

Source: J.P. Morgan, Purpose Investments

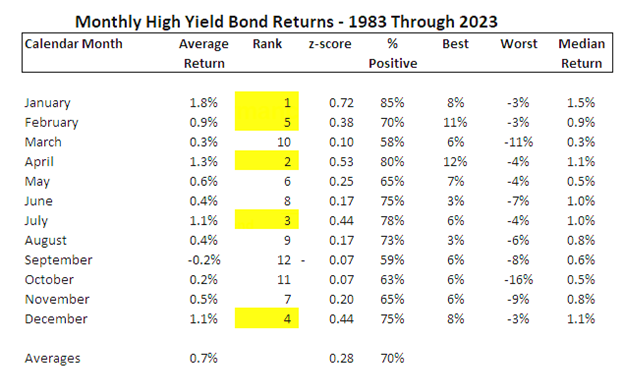

The second tail wind that is benefiting high yield credit is seasonality and the January Effect. Typically known for being impactful on equities, seasonality has also historically played a major role on high yield bond returns. The next table illustrates that the months of December through April have provided four of the five best months of the year for returns, with the average monthly returns for these months since 1983 being 1.08% and positive 73.6% of the time, both well above the full year average return of 0.7% and positive return ratio of 70%.

Source: Barclays Capital, Purpose Investments

In summary, the timing of the Fed pause combined with positive seasonality has created favourable upside potential in the high yield credit market based on historical data.

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Refinitiv, J.P. Morgan, Barclays Capital, Purpose Investments, Trading Economics

©2023 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.