Market Insights: CBOE Put/Call Ratio and Market Sentiment

Milestone Wealth Management Ltd. - Oct 13, 2023

Macroeconomic and Market Developments:

- North American markets were mixed over the past two weeks. In Canada, the S&P/TSX Composite Index decreased 0.40%. In the U.S., the Dow Jones Industrial Average rose 0.49% and the S&P 500 Index increased 0.93%.

- The Canadian dollar dropped from two weeks ago, closing at 73.19 cents vs 73.67 cents USD.

- Oil prices took a wild ride the last two weeks. U.S. West Texas crude closed at US$90.81 two weeks ago, dropped to close at $82.31 on October 4th, before rallying after the Hamas attack on Israel and the U.S. tightening sanctions on Russia, to finish this week at US$87.71. Western Canadian Select price closed at US$64.68 this week vs US$72.49 two weeks ago.

- The price of gold soared compared with two weeks earlier, closing at US$1,928 vs US$1,848 two weeks ago.

- Laurentian Bank has announced that Éric Provost has been appointed President and CEO, replacing Rania Llewellyn effective immediately. The bank also said director Michael Boychuk has been appointed chair of its board of directors, replacing Michael Mueller, who has resigned from the board. The changes come after a failed attempt to find a buyer and after the bank suffered a mainframe outage recently during a planned IT maintenance update.

- In a massive deal in the oil patch, Exxon Mobil (XOM) is buying shale rival Pioneer Natural Resources (PXD) for $253/share or $59.5 billion in an all-stock deal, Exxon’s biggest deal since its $81 billion takeover of Mobil in 1998. Exxon said its production volume in the Permian Basin would more than double to 1.3 million barrels of oil equivalent per day.

- Wholesale inflation in the U.S. rose more than expected in September, with the Producer Price Index (PPI) increasing 0.5% in the month vs estimates of a 0.3% rise, and was up 2.2% year over year. Consumer prices also rose more than expected, with the Consumer Price Index (CPI) increasing 3.7% year over year vs the 3.6% forecast, and the core CPI increasing 4.1% over the past year.

- The United States’ services sector remains in growth mode, however at a slightly slower pace. The ISM Non-Manufacturing (Services) index declined to 53.6 in September (levels above 50 indicate growth), slightly higher than the expected 53.5. The business activity index rose to 58.8 from 57.3, while the new orders index dropped to 51.8 from 57.5.

- Last Friday was jobs day, with both the U.S. and Canada blowing away expectations. In Canada, the September labour force survey showed that our economy added 64,000 jobs, more than tripling estimates. The unemployment rate held steady at 5.5% for the third straight month, compared with expectations for a slight uptick. Meanwhile, U.S. nonfarm payrolls posted a 336,000 jobs gain in September, well above the 170,000 estimate. The unemployment rate held steady at 3.8% vs expectations for a slight drop.

- After 247 years as a private company, shoe maker Birkenstock completed its IPO this week (symbol BIRK) at a price of US$46.00. The company sold US$495 million of shares to the public, however, after the first day of trading the stock dropped to finish at $40.20 and continued to fall, finishing the week at $36.38, giving the company a market value of approximately US$6.8 billion.

- U.S. banks kicked off earnings season on Friday:

- JPMorgan Chase (JPM) beat estimates with $4.33/share in quarterly earnings on revenue of $40.69 billion vs $39.63 billion expected by analysts.

- Wells Fargo (WFC) also beat expectations with $1.48/share in earnings, with revenue of $20.9 billion vs the $20.1 billion forecast.

- Citigroup (C) reported quarterly earnings of $1.63/share on revenue of $20.14 billion vs $19.31 billion expected.

Weekly Diversion:

Check out this video: Would you try this?

Charts of the Week:

The Chicago Board Options Exchange (CBOE) put/call ratio is a widely used indicator for market sentiment. It is a measurement that compares the volume of put options (bets that a stock or market will decline) to call options (bets that a stock or market will increase) traded on the CBOE. A high put/call ratio suggests that the market is overly bearish and stocks might rebound, while a low put/call ratio suggests that a market could be overexuberant and could result in a sharp fall. The significance of the CBOE put/call ratio is that it can be used to gauge the overall mood of the market and provide insight into how investors are positioning themselves. The CBOE put/call ratio can also be used as a contrarian indicator, meaning that it can be used to predict market trends by taking the opposite position of the prevailing sentiment.

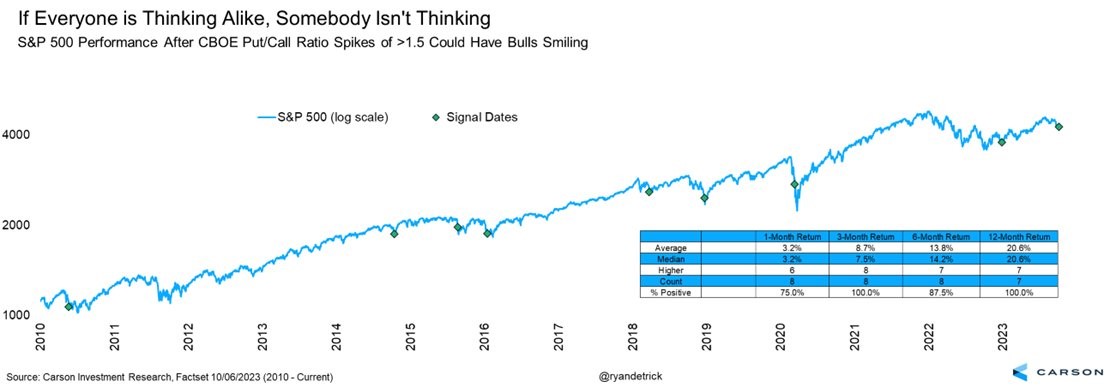

As shown in the table below, the 1.59 put/call ratio observed on October 4, 2023, was the highest spike since December 28, 2022, and just the ninth occurrence of a ratio above 1.5 since 2010. As many contrarians would expect, this high put/call ratio has been beneficial for long-term S&P 500 investors as a timing tool because a reading this high indicates that there is a high amount of pessimism in the markets and potentially ready to bottom out.

The table shows the 1-month, 3-month, 6-month, and 12-month performance of the S&P 500 after each of these prior occurrences. When we compare each of these increments to all years (1950-2022), we can see a drastic improvement in the average returns and percentage of times with positive returns. Perhaps most impressive was the longer-term performance after occurrences with a put/call ratio above 1.5 as demonstrated by the 6-month and 12-month average returns of 13.8% and 20.6% with positive returns 87.5% and 100% of the time, compared to all-time average returns of 4.4% and 8.9% with positive returns 68.7% and 72.6% of the time, respectively.

Source: Carson Investment Research via Canaccord Genuity Wealth Management

The chart below of the S&P 500 Index over time shows these signal dates (occurrences discussed in the table above) by the small green diamonds. We can see that these have typically occurred at or just before major bottoms and a significant rise in value for the S&P 500. Time will tell if the most recent signal on October 4th will follow a similar pattern.

Source: Carson Investment Research via Canaccord Genuity Wealth Management

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Refinitiv, Carson Investment Research, Canaccord Genuity Wealth Management

©2023 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.