Market Insights: Government Shutdowns and the U.S. Market

Milestone Wealth Management Ltd. - Sep 29, 2023

Macroeconomic and Market Developments:

- North American markets were negative this week. In Canada, the S&P/TSX Composite Index decreased 1.21%. In the U.S., the Dow Jones Industrial Average fell 1.34% and the S&P 500 Index declined 0.74%.

- The Canadian dollar weakened this week, closing at 73.67 vs. 74.21 cents USD last Friday.

- Oil prices were up slightly this week. U.S. West Texas crude closed at US$90.81 vs. US$90.36, and the Western Canadian Select price closed at US$72.49 vs. US$71.84 last Friday.

- The price of gold was lower this week, closing at US$1,848 vs. US$1,925 last Friday.

- West Fraser Timber (WFG) is selling two pulp mills in Western Canada, along with related woodlands operations and timber holdings in Alberta, to Atlas Holdings for $120 million. The Quesnel River Pulp mill in Quesnel, British Columbia, and the Slave Lake Pulp mill in Slave Lake, Alberta, are part of this deal. These mills will be operated by Edmonton-based Millar Western Forest Products.

- The Writers Guild of America and Hollywood studios reached a tentative agreement Sunday night that sets the stage to end a strike that has been going on since May. The final contract language still needs to be firmed up with the Alliance of Motion Picture and Television Producers, which represents major studios including Amazon (AMZN), Disney (DIS), Netflix (NFLX) and Warner Bros. Discovery (WBD).

- The US Federal Trade Commission (FTC) is suing Amazon.com Inc. (AMZN) in a long-anticipated antitrust case, accusing the e-commerce giant of monopolizing online marketplace services by degrading quality for shoppers and overcharging sellers. The FTC and 17 states accused Amazon of engaging in a course of conduct to exclude rivals in online marketplace services and stifle competition. The company is also accused of illegally forcing sellers on its platform to use its logistics and delivery services in exchange for prominent placement and of punishing merchants who offer lower prices on competing sites.

- Peloton (PTON) shares closed this week up 13.29% after agreeing to a deal with Lululemon to tap its online workouts and team up on apparel. As part of the deal, Lululemon will make co-branded clothing that Peloton will sell on its website and in retail stores. Peloton’s fitness content, meanwhile, will be offered to users of the Lululemon Studio Mirror, a $995 device that lets people work out in front of a 43-inch screen, and the apparel maker’s free digital app.

- Brookfield Asset Management (BN) has entered into an $845 million partnership with Axis Energy Ventures, an Indian renewable energy company, for clean energy projects in India. The Indian government has set ambitious targets to expand green power capacity to 500 gigawatts by the end of this decade, which has attracted investments from international investors.

- The Canadian economy experienced slight growth in August with preliminary data indicating a 0.1% growth in GDP. The economy is now on track to expand at a 0.2% annualized rate in the third quarter,; weaker than the consensus estimate, and suggesting a soft patch in the economy which may come as welcomed news for the Bank of Canada when looking forward to future rate decisions.

- The core PCE price index, the Fed’s favoured measure of underlying inflation, showed the slowest monthly rise since late 2020, with a 0.1% increase in August. The overall PCE price index rose 0.4%, primarily due to higher energy costs. This low core inflation reading supports the Fed's position to hold interest rates steady at the next meeting and helps build confidence among policymakers that they are managing inflation without immediate need for further rate hikes.

Weekly Diversion:

Check this out: Cascades of red wine flood a city's streets in Portugal after huge tanks rupture

Charts of the Week:

There are currently fewer than two days left to achieve a deal that would fund the U.S. Federal Government and avoid a potential shutdown. When assessing the effects of a potential government shutdown, it is important to note that the current negotiations to keep the government funded are very different from the debt-ceiling standoff that took place in May. Unlike a debt-limit default, a shutdown does not affect the government's ability to pay its debt to bondholders, and therefore does not have a direct impact on the government’s borrowing costs or creditworthiness. In this week’s charts, we wanted to explore past government shutdowns and look at the effect these shutdowns have had on the overall U.S. economy and the S&P 500 Index. Many investors have been worrying about how a government shutdown may affect their portfolios and we hope the following will help shed some light.

Since 1976, there have been 20 government shutdowns (21 if you include the 1-day shutdown on Feb. 9, 2018). As the following chart illustrates, these past government shutdowns have had a varying effect on the S&P 500 and may indicate that they have little correlation to market performance with nine instances of negative returns, 11 instances of positive returns, and one instance where the market was closed.

Source: Vanguard

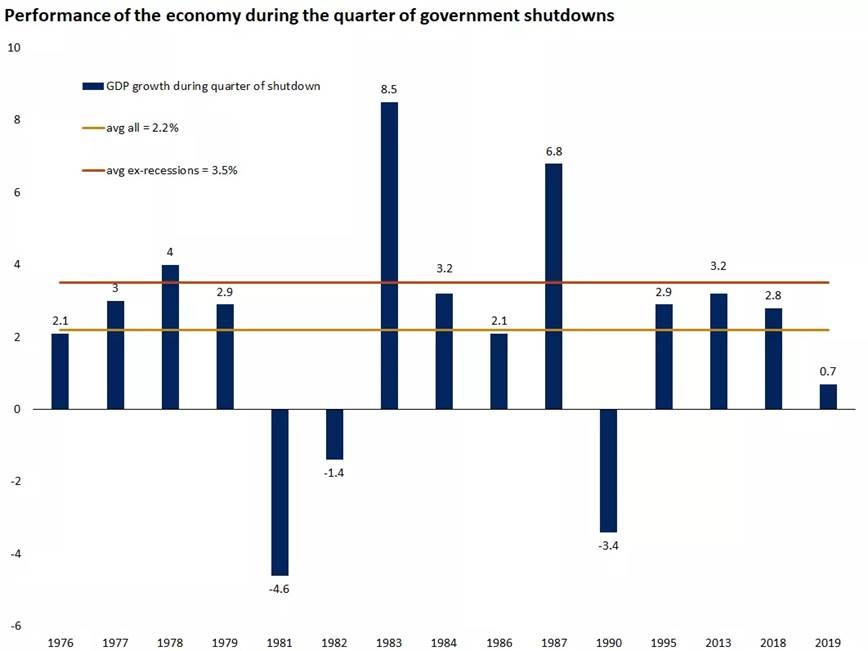

The overall economy was also little affected by these same government shutdowns. As we can see in the chart below, GDP growth during the quarter of past government shutdowns has only resulted in three instances of negative growth. The average rate of 2.2% is just under the annualized average GDP growth rate since 1990 of 2.4%, and the average excluding recessions has performed better than the annualized growth rate since 1990 (2.4%).

Source: Bloomberg, Edward Jones

Looking at equity performance after past government shutdowns, the S&P 500 Index has averaged a positive 2.6% return three months after a shutdown and averaged a positive 7.5% return six months later. Perhaps more impressively, the returns were positive 60% of the time three months after the shutdown and 70% of the time six months later. The chart below shows the returns (rounded to whole numbers) for each of the past shutdowns at different time intervals. To sum up these findings, past government shutdowns have not greatly affected the U.S. economy and equity markets on average, and little correlation can be found.

Source: Congressional Research Service, Morningstar Direct, Edward Jones

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Refinitiv, Vanguard, Edward Jones, Morningstar Direct, Congressional Research Service

©2023 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed