Market Insights: Canadian Interest Rate Expectations

Milestone Wealth Management Ltd. - Sep 15, 2023

Macroeconomic and Market Developments:

- North American markets were mixed this week, with Canada getting a big lift from oil and gas. In Canada, the S&P/TSX Composite Index was strong this week, up 2.65%. In the U.S., the Dow Jones Industrial Average increased slightly by 0.12% and the S&P 500 Index decreased slightly by 0.16%.

- The Canadian dollar jumped this week, closing at 73.92 vs 73.30 cents USD last Friday.

- Oil prices were positive this week, with WTI finally recapturing the $90 level. U.S. West Texas crude closed at US$91.12 vs US$87.37, and the Western Canadian Select price closed at US$72.25 vs US$69.35 last Friday.

- The price of gold was slightly positive this week, closing at US$1,923 vs US$1,919 last Friday.

- U.S. inflation data came in hotter than expected with the Consumer Price Index (CPI) rising 3.7% from a year ago and 0.6% month over month. Energy prices fed much of gain, rising 5.6% on the month, an increase that included a 10.6% surge in gasoline. The core CPI, excluding volatile items, increased 0.3% on the month and 4.3% for the year. Also, the U.S. Producer Price Index (PPI) rose 0.7% in August and 1.6% from a year ago. The Core PPI rose 0.2% in August and 2.2% year over year.

- Apple (AAPL) held its product launch day on Tuesday this week. The company announced the iPhone 15 and iPhone 15 Plus, now with USB-C charging, starting at US$799. It also unveiled the iPhone 15 Pro and Pro Max, starting at US$999. Another key announcement was the new Apple Watch, made with 95% titanium and with 72 hours of battery life, as well as updated AirPods with USB-C charging.

- Canadian copper producer First Quantum Minerals (FM) reached an wage deal with union leaders in Panama, averting a strike at its flagship Cobre Panama mine. The agreement also alleviates some uncertainties at a mine that has been the target of protesters calling on lawmakers to reject a new tax arrangement brokered between the government and the company six months ago.

- Laurentian Bank (LB) announced it has completed its strategic review without finding a suitable buyer. The company has concluded that the best path forward to drive shareholder value is to embark on an accelerated evolution of its current strategic plan with an increased focus on efficiency and simplification.

- J.M. Smucker (SJM), best known for its jellies, is buying Twinkie maker Hostess Brands (TWNK) for $5.6 billion, or $34.25/share. Hostess shareholders will receive $30.00 in cash and .03002 of a Smucker’s share for each Hostess share owned. Smucker will also assume Hostess’ roughly $900 million in debt when the deal closes.

- Chip design company Arm Holdings completed its IPO on the NASDAQ index (symbol ARM) on Thursday. The IPO was priced at US$51.00/share and finished the first day of trading at US$63.59/share, valuing the company at approximately US$68 billion. Japanese company SoftBank Group will retain roughly 90% ownership in Arm.

Weekly Diversion:

Check out this video of a cute dog-otter.

Charts of the Week:

Last week, the Bank of Canada elected to hold their policy rate at 5% which came as a relief for those with larger credit balances, and especially those looking to renew mortgages. A few weeks ago, we reviewed some of the main data points that the Bank of Canada considers when making these rate decisions and pointed to some easing in these metrics. The Bank of Canada was clear that they will continue to review inflation data, employment data, and GDP data among other metrics when making future rate decisions but in this week’s market update, we wanted to explore future rate expectations as many investors and consumers have been wondering when they can expect rates to start to fall. Our first hint will come at the Bank of Canada’s next rate announcement on October 25th.

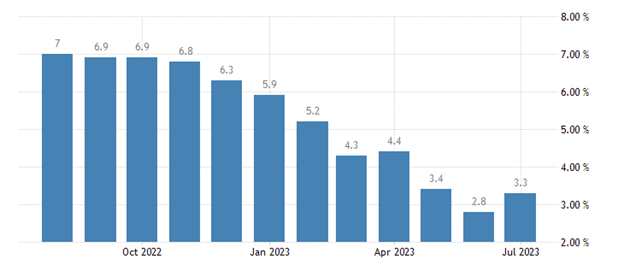

The first chart below illustrates the Bank of Canada’s policy interest rate announcements since April 13, 2022. We can see the steady rise in rates in an attempt to reduce sky high inflation that has been affecting affordability. The second chart shows Canadian inflationary numbers as represented by year-over-year Consumer Price Index (CPI) increases by month, with August’s CPI data to be released next week on Tuesday. We can conclude from this that rising central bank rates have helped in reducing inflation almost every month with a couple of exceptions (April and July). The year-over-year look back starts to become more difficult now as the high 2022 inflationary data starts to roll off (the U.S. August numbers showed a re-acceleration), so it will be interesting to see how inflation plays out over the coming months.

Bank of Canada Policy Interest Rate:

Source: Bank of Canada

Source: Statistics Canada via Trading Economics

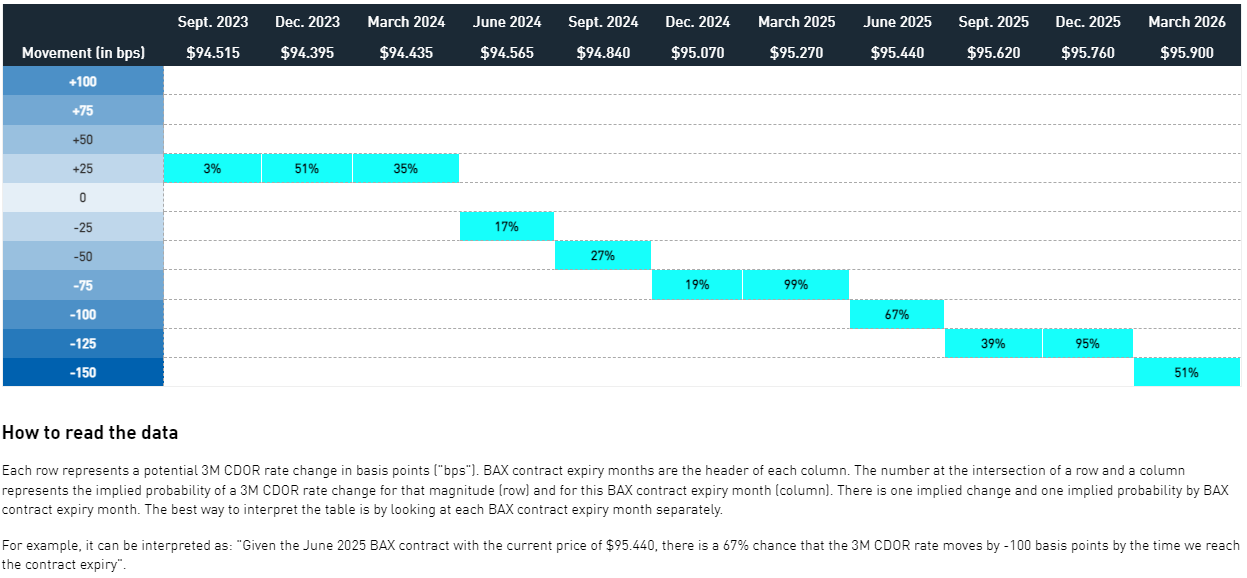

Moving to future rate expectations, we can look to the 3-Month Canadian Dollar Offered Rates (CDOR) to help predict future rate expectations. To simplify, these contracts are sold for future rate expectations and are often used by companies and large investment institutions to hedge interest rate risks. These contracts can provide analysts with a tool to help predict where interest rates will move. As we can see in the next chart, the data is organized by future quarters (expiry date of the contracts) and highlights the probability (in percentage terms) of either a rate increase or rate decrease and by how much. There is still a 51% chance that we could see another target rate increase of 0.25% in the near future (by December 2023) and 35% by March 2024. Moving further into 2024, we actually see the chance of rates declining by 0.25% at 17% probability by June 2024 and by 0.50% at 27% probability by September 2024, and a very high likelihood (99%) of rates decreasing by 0.75% by March 2025.

Source: TMX Montreal Exchange

This information does not provide a guarantee for any future changes, but it does line up with many economists' predictions that rates will start to fall next year and continue to fall into 2025. It is always important to note that this information is subject to change on a daily basis and will be dependent on future incoming data.

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Refinitiv, Statistics Canada, Trading Economics, Bank of Canada, TMX Montreal Exchange

©2023 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.