Market Insights: The Magnificent Seven and the Importance of Diversification

Milestone Wealth Management Ltd. - Sep 08, 2023

Macroeconomic and Market Developments:

- North American markets were negative this week. In Canada, the S&P/TSX Composite Index declined 2.29%. In the U.S., the Dow Jones Industrial Average dropped 0.75% and the S&P 500 Index contracted 1.29%.

- The Canadian dollar devalued this week, closing at 73.30 cents vs 73.55 cents last Friday.

- Oil prices were positive this week, amid reports on Tuesday that Saudi Arabia extended its 1 million barrels/day voluntary oil production cut until the end of the year. U.S. West Texas crude closed at US$87.37 vs US$85.86, and the Western Canadian Select price closed at US$69.35 vs US$67.89 last Friday.

- The price of gold decreased this week, closing at US$1,919 vs US$1,940 last Friday.

- The Bank of Canada met this week and chose to hold interest rates at the current 5.0% overnight interest rate but is maintaining its tightening bias for now. In the press release, the central bank said “The Canadian economy has entered a period of weaker growth, which is needed to relieve price pressures. Economic growth slowed sharply in the second quarter of 2023, with output contracting by 0.2% at an annualized rate.”

- Canadian pipeline company Enbridge (ENB) agreed to buy three natural gas utilities from Dominion Energy (D) for US$9.4 billion (approximately US$14 billion including debt). The deal will create North America’s largest natural gas utility platform and comes just two months after Enbridge agreed to sell a US$3.3 billion stake in a Maryland liquefied natural gas export project.

- Intact Financial (IFC) and its subsidiary RSA announced that they have reached an agreement with Direct Line Insurance Group PLC to acquire Direct Line's brokered Commercial Lines operations. The purchase price includes initial cash consideration of £520 million (C$884M), with potential for up to a further £30 million (C$51M) contingent payment under earnout provisions.

- Peyto (PEY) has agreed to buy Spanish energy company Repsol SA’s Canadian oil and gas business for $468 million in cash to expand in Alberta’s Deep Basin play. Peyto is adding natural gas and natural gas liquids production equivalent to about 23,000 bpd oil output, as well as associated pipelines and processing facilities, near its existing holdings in the area.

- This week was Canada’s turn to release jobs numbers for August. Canada’s economy added 40,000 jobs, well above the 20,000 gain that had been forecast. The unemployment rate held steady at 5.5%, and wages rose by 5.2% from a year ago, better than the 4.7% gain expected.

Weekly Diversion:

Check out this video: Jim Gaffigan discusses Newfoundland

Charts of the Week:

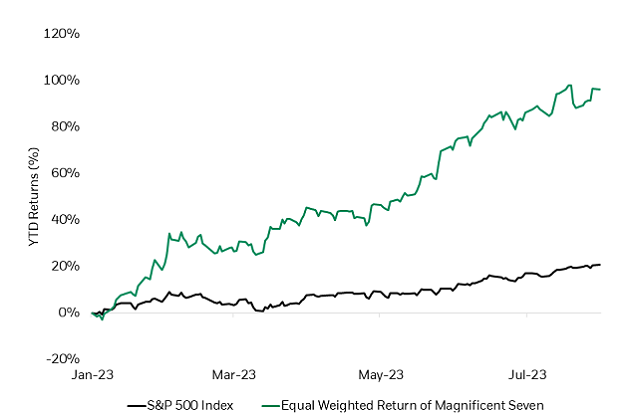

A few weeks ago, in our Charts of the Week Section, we explored the differences between the S&P 500 Index and the TSX Composite sector weightings. As we previously discussed, the S&P 500 is heavily weighted towards what the investment industry is calling the “Magnificent Seven” which is comprised of mega cap technology and communication services companies: Apple, Microsoft, Amazon, Alphabet (parent company of Google), Nvidia, Tesla, and Meta (Facebook). The chart below shows that these companies now make up approximately 28% of the S&P 500. As the second chart illustrates, they have all seen a significant rally in 2023 (after a harsh correction in 2022) due in large part to the rise of the latest artificial intelligence investment boom and its growth projections. These seven stocks have been responsible for a whopping 65% of the index’s year-to-date returns.

Source (both): Morningstar Direct via BlackRock

The heavy concentration of these seven companies within the S&P 500 makes stock selection very difficult for active managers - both systematic and fundamental - in the short-term, especially those focused on factor exposure which tend to help outperform over time. Factor exposure focuses on primary market drivers that are backed by research and past market observations with a focus on company value, quality, low size, momentum, and low volatility, and is also a tool that Milestone Wealth uses when diversifying our equity holdings. These factors provide compensation for additional risk taken above the standard market risk, a proven strategy when discovering additional sources of performance above the market. Essentially, those focused on selecting a diversified basket of stocks to invest in will explore these factors to find companies that have the potential to provide additional returns over the long term. When only a few companies are providing most of the market returns (low breadth), it is a short-term headwind for any active management style that is more diversified with lower levels of active risk and less concentration risk.

The table below shows how each of these seven stocks benefit or are affected by these underlying factors as represented by positive (benefit) and negative (impact) numbers. The numbers in this table represent something called a "z-score", which ranges from –3 to +3, and are the number of standard deviations away from the mean of a given distribution. The Magnificent Seven tend to only score consistently well in one of the five factors: quality. This factor refers to stable earnings growth, a stronger balance sheet and higher margins. Not surprisingly, they also score relatively well in momentum right now given the recent move. However, these stocks tend to score poorly in the factors of value and low size and have mixed numbers in low volatility. They have negative exposure to low size - as they are mega caps - as well as value, as they have become increasingly more expensive to buy on a historical price-to-earnings ratio. The results based on the factor of low volatility are mixed, but some of the names are heavily unfavored here as well like Nvidia and Tesla.

Source: BlackRock

Using data going back to the 1960s, the following chart shows four of the five factors (size, value, quality, and momentum) which have provided positive premiums in excess of market returns. Low volatility is the only exception as it has provided approximately the same returns as the market over long cycles, however, it has done this by taking on less risk. With the Magnificent Seven stocks only finding excess premiums in quality, these stocks are missing out on other factors over the long term.

Source: Ken French Data Library via BlackRock

This information reinforces the need for diversification and focusing on a long-term investment process, while ignoring the short-term noise due to narrow leadership. It is also important to note that only one of the top seven stocks by market cap as of December 1999 in the S&P 500 (Microsoft) is a member of the current Magnificent Seven and one of the previous top-seven (Lucent Technologies) no longer exists. We do not consider any of these stocks to be a poor investment, the opposite for some; however, we do stress the importance of diversification and not being over-concentrated to a single position, industry or sector and focusing on the key factors that have driven results over the long-term.

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Refinitiv, Wealth Professional, Seeking Alpha, Business Insider, BlackRock, CFA Institute, Morningstar

©2023 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.