Market Insights: Important Canadian Economic Data Updates

Milestone Wealth Management Ltd. - Sep 01, 2023

Macroeconomic and Market Developments:

- North American markets were positive this week. In Canada, the S&P/TSX Composite Index rose 3.58%. In the U.S., the Dow Jones Industrial Average increased 1.43% and the S&P 500 Index rallied 2.50%.

- The Canadian dollar improved this week, closing at 73.55 cents vs 73.50 cents last Friday.

- Oil prices were favourable this week, with WTI at its highest level since November 2022. U.S. West Texas crude closed at US$85.86 vs US$80.05, and the Western Canadian Select price closed at US$67.89 vs US$60.52 last Friday.

- The price of gold was up this week, closing at US$1,940 vs US$1,913 last Friday.

- The federal government posted a budget surplus of $3.62 billion for the first three months of its 2023 - 24 fiscal year, compared with a surplus of $10.20 billion in the same period a year earlier. Revenues increased to $110.58 billion from $107.88 billion a year ago, however expenses also increased to $93.81 billion from $87.03 billion. Meanwhile, the Alberta government is forecasting a $2.4 billion surplus by the end of the fiscal year despite challenges such as lower oil prices and significant spending on wildfires, which have consumed nearly $1 billion this fiscal year.

- Private equity firm Veritas Capital is considering a potential takeover offer for BlackBerry (BB). Talks are in the early stages, however other potential suitors have expressed interest in acquiring either all or parts of BlackBerry as well.

- Big bank earnings continued this week in Canada with Bank of Montreal, Scotiabank and CIBC reporting:

- On Tuesday, Bank of Montreal (BMO) disappointed investors with earnings of $2.78/share vs $3.13/share expected, on revenue of $8.07 billion vs $8.04 billion expected and a much bigger than expected provision for credit losses of $492 million vs $379.6 million expected.

- Also on Tuesday, Bank of Nova Scotia (BNS) reported earnings of $1.73/share vs $1.74/share predicted, on revenue of $8.09 billion vs $8.16 billion expected, and a provision for credit losses of $819 million, up from $412 million a year ago.

- On Thursday, CIBC (CM) reported lower than expected earnings of $1.52/share vs $1.68/share expected, on revenue of $5.85 billion vs $5.80 billion expected, with a provision for credit losses of $736 million, an increase from $243 million for this quarter last year.

- Grayscale Investments, which manages the world’s biggest crypto fund, won an appeal against the SEC on Tuesday, paving the way for the investment manager to convert the Grayscale Bitcoin Trust into an ETF. A spot bitcoin ETF would be traded through a traditional stock exchange, although the bitcoin would be held by a brokerage. Conversely, cryptocurrency ETFs have been available in Canada since 2021.

- A court ordered Canada’s competition body to pay millions to Rogers Communications (RCI.b), saying the country’s antitrust czar engaged in “unreasonable behavior” in its legal challenge of the company’s takeover of rival Shaw. The tribunal, which is Canada’s merger court, ordered the commissioner to pay approximately $13 million to Rogers and Shaw in legal fees and costs.

- U.S. employment numbers were released on Friday. Nonfarm payrolls grew by a seasonally adjusted 187,000 for the month, above the estimate for 170,000. However, the unemployment rate increased to 3.8% as the labor force participation rate rose to 62.8%, the highest since February 2020.

Weekly Diversion:

Check out this video: Farewell to a Legend

Charts of the Week:

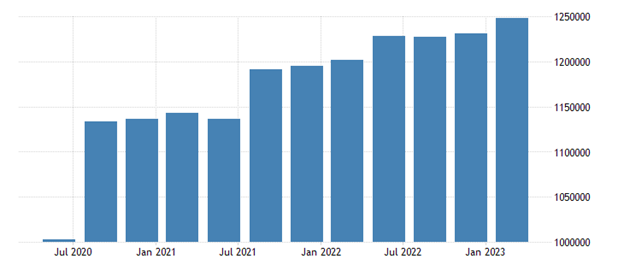

Today, Statistics Canada released 2nd quarter GDP data which showed a weakening in the Canadian economy, shrinking at a -0.2% annualized pace. The Bank of Canada had estimated an annualized growth of 1.5% for Q2 just last month. The chart below highlights GPD growth numbers for the past four quarters and as we can see, Q2 2023 was the weakest reading reported. This is negative news for the Canadian economy; however, this does present some reprieve for the Bank of Canada and future rate decisions. Many Canadians have been facing heightened interest rates, raising affordability concerns for larger debts, such as mortgages. Today’s GDP data was the last of the economic factors to be reported that the Bank of Canada uses for rate decisions, with the next rate announcement coming next Wednesday, September 6th.

Source: Trading Economics via Statistics Canada

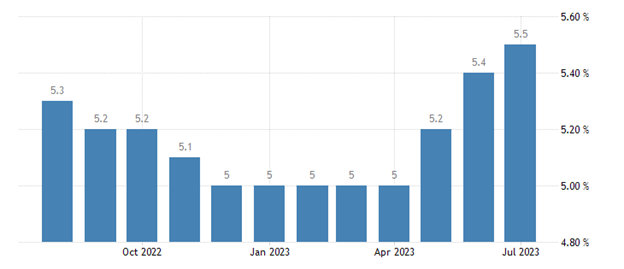

Since the last rate increase on July 12th, economic signals that the Bank of Canada tracks have been mixed. Inflation accelerated to 3.3% YoY in July after slowing to within the bank’s control range (1% to 3%) in June, showing that some underlying measures - such as food costs - remain sticky. The first chart below shows Canadian Inflation Data MoM for the past year. The second chart below shows consumer spending did increase in Q2; however, Statistics Canada did note that consumer spending per-capita decreased by 0.7%. Finally, July unemployment data showed a MoM increase to 5.5%, with 6,400 jobs unexpectedly lost. The third chart below shows MoM unemployment data, displaying a steady rise in unemployment since April 2023.

Source: Trading Economics via Statistics Canada

Weakening economic factors such as employment, consumer spending, and GDP are not ideal indicators for a healthy economy. However, in the high inflation cycle the economy currently finds itself, the Bank of Canada has been using this data to base decisions on rate increases in an attempt to cool spending and reduce price growth for goods and services. A cooling in these metrics shows the increase in rates have had the desired impact with many economists predicting, for now, that the Bank of Canada will likely leave rates unchanged pending future economic data.

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Refinitiv, Wealth Professional, Seeking Alpha, Business Insider, Trading Economics, Statistics Canada

©2023 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed.