Market Insights: Consumer Confidence Up, Inflation Down

Milestone Wealth Management Ltd. - Jul 28, 2023

Macroeconomic and Market Developments:

- North American markets were mixed this week. In Canada, the S&P/TSX Composite Index was down 0.14%. In the U.S., the Dow Jones Industrial Average was up 0.66% and the S&P 500 Index rose 1.01%.

- The Canadian dollar decreased slightly this week, closing at 75.54 cents vs. 75.63 cents USD last Friday.

- Oil prices were positive this week. U.S. West Texas crude closed at US$80.61 vs. US$76.94 last Friday, and the Western Canadian Select price closed at US$65.02 vs US$62.92 last Friday.

- The price of gold declined this week, closing at US$1,958 vs. US$1,961 last Friday.

- Here are some earnings highlights this week on companies within Milestone mandates:

- Microsoft (MSFT) shares declined after posting tepid quarterly sales growth and forecasting a continued slowdown in its Azure cloud-services business, overshadowing optimism about customer interest in new AI-powered products. While overall results topped analysts’ projections, Azure revenue growth slipped to 27% from 31% in the previous quarter.

- Google’s parent Alphabet Inc. (GOOGL) reported second-quarter revenue that exceeded analysts’ expectations, boosted by advertising on the company’s flagship search business. The stock reacted positively with strong gains this week. Alphabet’s sales, excluding partner payouts, were $62 billion in the quarter compared to analysts’ projection of $60.2 billion. Search advertising performed well, generating $42.6 billion, compared with analysts’ average estimate of $42.2 billion.

- TC Energy Corp. (TRP) agreed to sell a 40% stake in its Columbia Gas Transmission and Columbia Gulf Transmission systems for C$5.2 billion to be held in a joint venture with Global Infrastructure Partners (GIP). TC Energy will continue to operate the systems, focusing on maximizing value through safe operations, reliability of service and operational excellence, the company said in a statement Monday. In other news, TC Energy Corp. announced its intention to split into two separate companies by spinning off its crude oil pipelines business. The transaction is expected to be complete by the end of 2024 pending shareholder and regulator approval.

- Canadian National Railway (CNR) missed earnings estimates and cut its outlook for 2023 because of weakening demand for consumer goods and other products. CNR now expects earnings will be flat or slightly down this year compared with a 2022 forecast. Revenue from intermodal shipments plunged 26% from a year earlier, more than offsetting gains in other categories such as grain, fertilizer and automotive. Weather was another factor with wildfires and high temperatures causing disruptions.

- Loblaw Companies (L) reported a strong second-quarter performance, with a profit available to common shareholders of $508 million, marking a 31.3% increase from the same period last year. The profit amounted to $1.58 per diluted share, compared to $1.16 per diluted share in the same quarter last year. The company's revenue for the quarter reached $13.7 billion, up from $12.8 billion in the previous year.

- Monthly GDP for Canada (May) was announced today and came in at 0.3% month-over-month, just slightly below consensus. However, April’s GDP reading was revised up from flat to 0.1%. The year-over year rate is now at 1.9%, up from 1.7% the prior month.

- On Wednesday, the U.S. Federal Reserve (Fed) raised interest rates by 25 bps. The decision was unanimous and brings the target range for the Fed’s benchmark federal funds rate to 5.25% to 5.5%, the highest level since 2001. Before Wednesday’s decision, investors saw a second increase as less certain, in part because of data on consumer prices showing inflation receding sharply last month. However, Fed officials appear to have left the door open for all options.

- In other U.S. economic news, the PCE Deflator, a key measure of prices for goods and services and the U.S. Fed’s preferred inflation gauge, fell to 3.0% year-over-year and the lowest rate in over two years.

Weekly Diversion:

Check out this video: Hopefully your day is going better than these people

Charts of the Week:

This year started off with relatively weak economic conditions and most economists predicting a recession as early as June. Flashforward to July, and we see a much different picture. Recessions are a natural part of economic cycles and are inevitable; however, with improvements in employment, corporate earnings, inflation, and consumer confidence, the looming recession appears to be off the table, at least for now.

This week, a widely followed sentiment report from The Conference Board showed that U.S. consumer confidence reached a two-year high. Although there has been a lot of negative economic news, with employment numbers remaining strong, year-over-year headline inflation rate decreasing significantly from 9% a year ago to 3% today, and the U.S. stock market in a renewed cyclical bull market, it’s difficult to fault this confidence. Consumer confidence hitting a new two-year high is a common occurrence as the first chart below illustrates. However, if you filter this out for periods when sentiment hit a two-year high for the first time in at least a year (like present), we are left with 9 occurrences since 1967, as shown in the second chart. In this case, there was never an instance when the economy was close to being on the verge of a recession, and more than half occurred early in the cycle rather than late. An interesting note we wanted to draw attention to (large red shaded areas on the chart) is the similarity between the occurrence in the early 1980s and today. Like the current period, back then there was a sharp drop and subsequent sharp rebound in confidence, followed by another decline that failed to make a lower low.

Source: Bespoke Investment Group

Source: Bespoke Investment Group

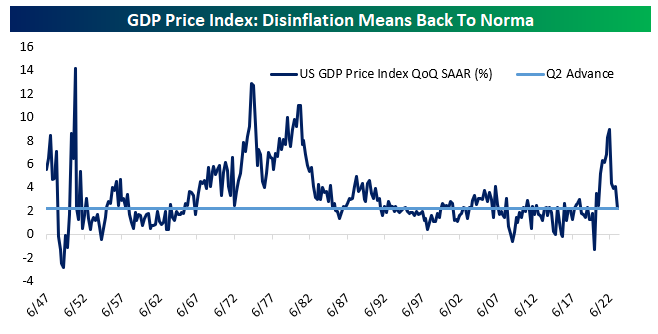

As we mentioned, there has also been good news on the inflationary front with U.S. headline inflation dropping to its lowest level in over two years since March 2021. This has been dropping steadily since last June, but we wanted to your draw attention to another inflation indicator, the U.S. GDP Price Index. This index measures price changes for consumer goods and services, and also measures price changes for goods and services purchased by businesses, governments, and foreigners. However, unlike the CPI, this one excludes imports. The GDP Price Index has seen an even more rapid drop compared to other inflation measures. As the following chart illustrates, the index peaked in the second quarter of 2022 at a 9% quarter-over-quarter annualized pace. This week it fell back to 2.2%, which is a historically normal pace of inflation and slightly lower than the 2.3% average since 1990. Although the U.S. Federal Reserve is more concerned with core consumer inflation (excludes food and energy) when deciding on fiscal policy (remains over 4%), GDP price and headline CPI disinflation is providing consumers with some faith that inflation is starting to curb. For Canadians, GDP price disinflation in the U.S. also offers some reason for optimism as the U.S. remains our largest trade partner.

Source: Bespoke Investment Group

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Refinitiv, Forbes, Econoday

©2023 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed