Market Insights: Peak Analyst Disparity

Milestone Wealth Management Ltd. - Jul 14, 2023

Macroeconomic and Market Developments:

- North American markets were positive this week. In Canada, the S&P/TSX Composite Index was up 2.17%. In the U.S., the Dow Jones Industrial Average bounced 2.29% and the S&P 500 Index advanced 2.42%.

- The Canadian dollar increased this week, closing at 75.66 cents vs 75.34 USD cents last Friday.

- Oil prices were up this week. U.S. West Texas crude closed at US$75.42 vs US$73.86 last Friday, and the Western Canadian Select price closed at US$63.40 vs US$62.37 last Friday.

- The price of gold was also positive this week, closing at US$1,955 vs US$1,925 last Friday.

- All eyes were on the Bank of Canada this week as the Canadian central bank increased its bank rate by 0.25% to 5.0% as expected by most economists. As per the press release, the central bank said “Global inflation is easing, with lower energy prices and a decline in goods price inflation. However, robust demand and tight labour markets are causing persistent inflationary pressures in services.”

- TransAlta (TA) has reached an agreement to buy all the shares of TransAlta Renewables (RNW) that it doesn’t already own for $13.00/share, 18.3% above the last trading price. TransAlta believes that the combined company will share a common strategic path to achieve its clean electricity growth objectives and be more competitive as a single, streamlined, publicly-listed entity.

- Laurentian Bank (LB) has put itself up for sale and announced that it has been in talks with multiple potential acquirers since late June. Laurentian, based in Montreal, is Canada’s eight largest bank with a market cap of roughly $1.4 billion.

- U.S. inflation came in below expectations for June, with the Consumer Price Index (CPI) coming in at 3.0% from June 2022 to June 2023. The Core CPI, excluding the volatile sectors of food and energy, was 4.8% from a year ago, with declines in used vehicle and airline prices helping to bring inflation down.

- Earnings season has kicked off in North America, with the spotlight on U.S. bank earnings on Friday:

- JP Morgan Chase (JPM) reported record revenue and crushed estimates with earnings of $4.37/share vs $4.00/share estimated on revenue of $42.4 billion vs $38.96 billion estimated.

- Wells Fargo (WFC) also beat estimates with quarterly earnings of $1.25/share vs $1.16/share expected on revenue of $20.53 billion vs $20.12 billion expected.

- Citigroup (C) slightly beat earnings estimates as well, although the stock still dropped on Friday. The bank came in with earnings of $1.33/share vs $1.30/share forecast on revenue of $19.44 billion vs $19.29 billion forecast.

Weekly Diversion:

Check out this video: Squirrel setting up its own crime scene

Charts of the Week:

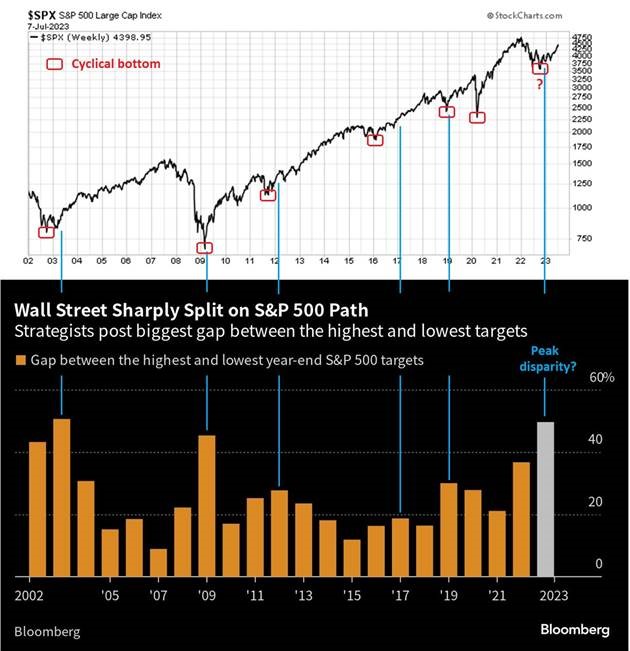

Many forecasters were caught flat-footed by how the first half of 2023 unfolded in equity markets and this seems to have rattled their faith in what the rest of the year will bring. Heading into 2023, there were a few predictions that seemed to dominate many strategists’ annual outlooks. A global recession was imminent, bonds would outperform equities that re-test bear-market lows, central banks would soon be able to stop the aggressive rate hikes that made 2022 such a negative year for markets, and as growth stumbled, there’d be more pain for risky assets. However, that bearish outlook was wrong-footed as stocks rallied even as the Central Banks continued to ratchet up their target interest rates in the face of stubbornly elevated inflation. The “Year of the Bond” that so many predicted has fizzled, and at the end of last week, U.S. Treasuries had nearly wiped out their small gain for the year as long-term yields tested new highs and the economy remains surprisingly resilient in the face of the Fed’s tightening monetary policy.

As a result, forecasters have rarely disagreed more about where markets are headed next. According to Bloomberg compiled data, there’s a 50% difference between the most bullish outlook from firm Fundstrat, which sees the S&P 500 Index rising nearly 10% more this year to 4,825, and the most bearish call from firm Piper Sandler which sees the S&P 500 falling 27% to 3,225. This mid-year gap in forecasts hasn’t been that wide in two decades. From a contrarian point of view, the persisting pessimism can be framed as a good sign for risk assets, since it suggests that unspent buying power could push stocks higher when it’s plowed back into the market and the bears finally give in. That’s what has happened so far this year, with defensively positioned investors under pressure to chase gains.

As the next two charts illustrate, past periods of peak disparity have proven beneficial for the S&P 500 as this sort of disparity among analysts has historically been observed after a major cyclical low. In the first chart, the red boxes highlight cyclical bottoms for the S&P 500 since 2002 and the blue lines connecting both charts show where the peak levels of disparity between positive and negative market outlooks have occurred. As you can see, these blue lines mostly line up not long after these cyclical bottoms and were followed by major rallies. This could bode well for forward-looking returns and perhaps continue to surprise the naysayers.

Source: The Chart Report, StockCharts.com, Bloomberg

Sources: CNBC.com, Globe and Mail, Financial Post, Bloomberg, Thomson Reuters, Refinitiv, The Chart Report, StockCharts.com

©2023 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed