Market Insights: Streak of Negative Stock Market Expectations Ends

Milestone Wealth Management Ltd. - Jun 30, 2023

Macroeconomic and Market Developments:

- North American markets were positive this week. In Canada, the S&P/TSX Composite Index rose 3.80%. In the U.S., the Dow Jones Industrial Average increased 2.02% and the S&P 500 Index rallied 2.35%.

- The Canadian dollar declined this week, closing at 75.52 cents vs 75.87 cents last Friday.

- Oil prices were up this week. U.S. West Texas crude closed at US$70.64 vs US$69.45 last Friday, and the Western Canadian Select price closed at US$59.34 vs US$58.18 last Friday.

- The price of gold pulled back this week, closing at US$1,919 vs US$1,922 last Friday.

- Last weekend, Putin faced the most significant challenges to his decades-long reign in power over the weekend following a revolt by Yevgeny Prigozhin and the Wagner Group, a private military group that has been fighting alongside the Russian army in Ukraine. The “March for Justice” was short-lived, after Belarus helped broker a deal between Putin and the rebels, which will see Prigozhin exiled to Belarus.

- The inflation rate in Canada continued to fall with the year-over-year Consumer Price Index (CPI) dropping to 3.4% in May. The slowdown in May inflation was driven by lower gasoline and energy prices, while mortgage interest costs and grocery prices remained elevated.

- IBM announced the acquisition of software company Apptio from private equity firm Vista Equity Partners for $4.6 billion. Apptio sells online services that help companies manage their information-technology budgets, forecasting and analysis.

- Thomson Reuters (TRI) has agreed to acquire Casetext, a California-based provider of technology for legal professionals, for $650 million in cash. Casetext's key products include CoCounsel, an AI legal assistant that launched earlier this year that is powered by GPT-4.

- Brookfield Reinsurance, a subsidiary of Canadian investment firm Brookfield, has made a ~$4.3 billion takeover bid for American Equity Investment Life (AEL). The offer price of US$55.00/share represents a ~$35% premium to the previous day’s closing price.

- An inflation measure that's closely watched by the Federal Reserve slowed in May due to falling energy prices. On a monthly basis, prices ticked up 0.1% following a 0.4% increase the prior month, according to the personal consumption expenditures price (PCE) index. The year-over-year PCE Price Index is now up 3.8% vs. 4.3% last month, while the core PCE is up 4.6% year-over-year, a slight decline from the 4.7% the prior month.

- The Supreme Court on Friday struck down President Joe Biden’s student loan forgiveness plan, denying tens of millions of Americans the chance to get up to $20,000 of their debt erased. The high court said the president didn’t have the authority to cancel such a large amount of consumer debt without authorization from Congress.

- Canadian monthly GDP for April came in at 0.0%, under the 0.2% consensus, and is now up 1.7% year-over-year, no change from last month.

Weekly Diversion:

Check out this video: This girl is impressive!

Charts of the Week:

Since January 2022, the monthly report on investor confidence from The Conference Board in the U.S. has shown a larger percentage of investors expecting lower stock prices than higher. That all changed with the release of the latest June U.S. Consumer Confidence Survey, which ended the streak of net negative investor sentiment readings at 17 months. This is the second longest streak behind the 18 months experienced during and coming out of the 2008 Financial Crisis. In fact, since 1987, there have only been three other periods where the net readings on the part of investors were negative for nine months or more as we can see below.

Source: Bespoke Investment Group

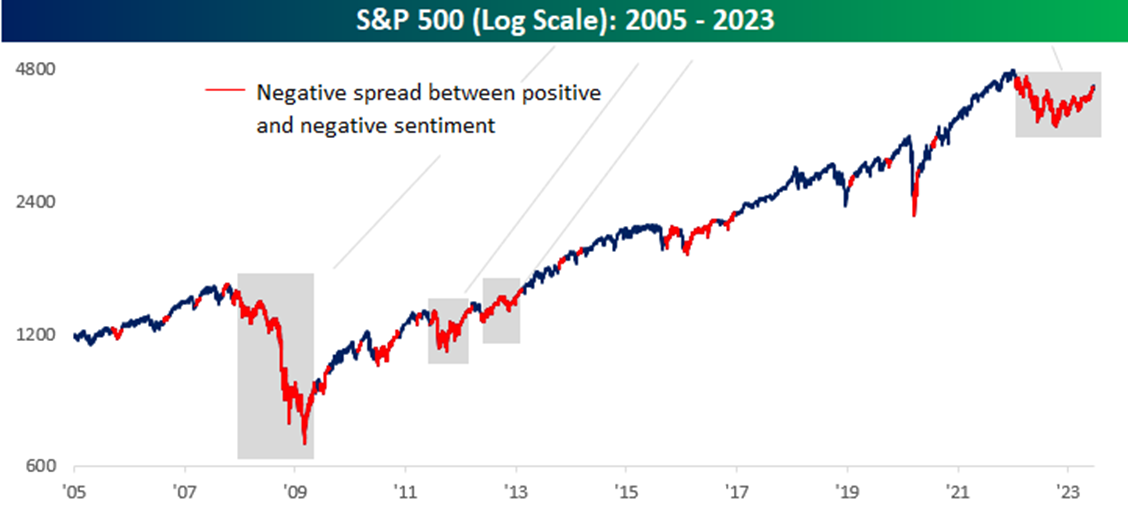

The next chart of the S&P 500 Index illustrates every period where there was a negative spread between bullish and bearish sentiment in red, and the three streaks of nine or more months are shaded in gray. In the year after each of the two nine-month streaks, the S&P 500 rallied 10.9% and 19.0%, respectively, and coming out of the record 18-month streak, the S&P 500 rallied even more.

Source: Bespoke Investment Group

Looking specifically at the record streak coming out of the Financial Crisis, while the S&P 500 had already rallied 29% off its lows before consumers finally started to turn net bullish on the stock market, in the year following the end of that streak, the S&P 500 rallied an additional 35%. We acknowledge that this is a limited sample but following the end of past extended streaks of negative investor sentiment, there appears to have been a good degree of pent-up demand once those streaks ended.

Source: Bespoke Investment Group

It may also be interesting to note that July has been a strong month of performance for the S&P 500 and especially in the past decade. As we can see from the following chart, over the last 10 years performance has been even stronger, with the S&P 500 averaging a gain of 3.27% with positive returns 90% of the time including each of the last eight years.

Source: Bespoke Investment Group

Sources: CNBC.com, Globe and Mail, Financial Post, BNN Bloomberg, Thomson Reuters, Refinitiv, Business Insider, Bespoke Investment Group, The Conference Board

©2023 Milestone Wealth Management Ltd. All rights reserved.

DISCLAIMER: Investing in equities is not guaranteed, values change frequently, and past performance is not necessarily an indicator of future performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. Opinions and estimates are written as of the date of this report and may change without notice. Any commentaries, reports or other content are provided for your information only and are not considered investment advice. Readers should not act on this information without first consulting Milestone, their investment advisor, tax advisor, financial planner or lawyer. This communication is intended for Canadian residents only and does not constitute as an offer or solicitation by anyone in any jurisdiction in which such an offer is not allowed